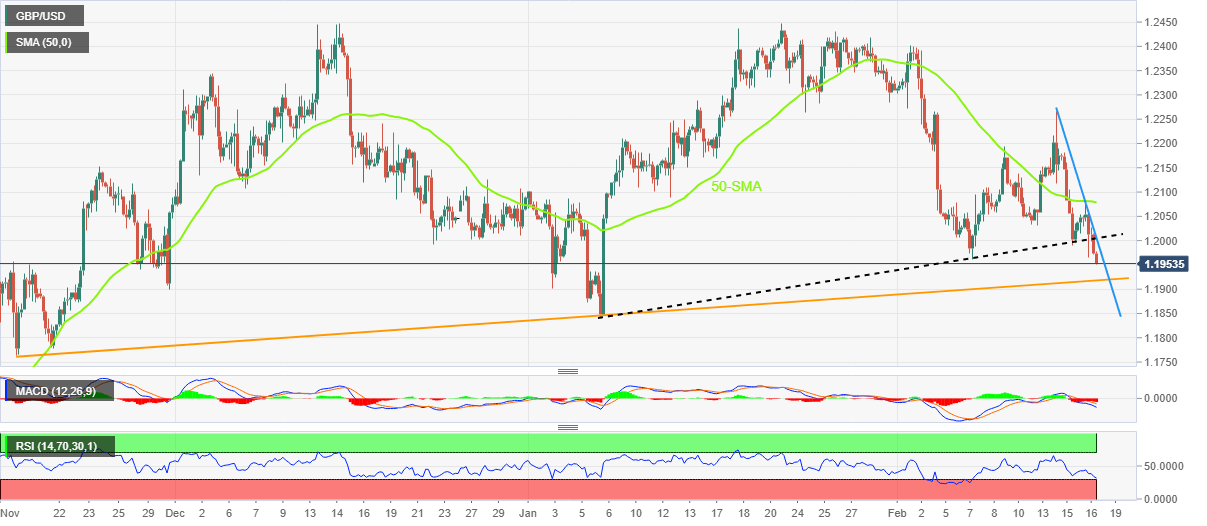

GBP/USD Price Analysis: Renews six-week low with eyes on 1.1920 support and UK Retail Sales

- GBP/USD takes offers to refresh multi-day low, drops for the third consecutive day.

- Clear downside break of six-week-old trend line, bearish MACD signals favor sellers.

- Nearly oversold RSI (14) suggests limited room towards the south.

- 50-SMA holds the key to buyer’s conviction, 1.2000 threshold guards immediate upside.

GBP/USD stands on slippery grounds as it refreshes the 1.5-month low near 1.1950 during early Friday. In doing so, the Cable pair extends the previous day’s downside break of a six-week-old ascending trend line during the three-day losing streak.

Not only the break of a multi-day-old ascending trend line but the bearish MACD signals also favor the GBP/USD sellers.

However, the RSI (14) line is near the oversold territory and suggests consolidation in the Cable price before the next leg towards the south.

As a result, an upward-sloping support line from November 17, 2022, around 1.1920 by the press time, becomes an important support to watch.

Should the GBP/USD pair remains bearish past 1.1920, the odds of witnessing a slump toward the previous monthly low of 1.1841 can’t be ruled out. It’s worth noting that the 1.1900 threshold acts as an extra filter during the anticipated fall.

Alternatively, a convergence of the previous support line from early January and the descending trend line from Tuesday, near the 1.2000 psychological magnet, appears a short-term key hurdle to watch for the GBP/USD pair buyers during a corrective bounce.

Following that the 50-SMA level surrounding 1.2080 should lure the Cable bulls.

On a different page, most of the UK data have been downbeat so far and hence pessimistic expectations from the British Retail Sales for January, up for publishing at 07:00 GMT on Friday, seem to weigh on the quote. Even so, market consensus signals -0.3% MoM figure versus -1.0% previous readings.

GBP/USD: Four-hour chart

Trend: Limited downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.