GBP/USD Price Analysis: Remains vulnerable near monthly low, US PCE data awaited

- GBP/USD attracts fresh sellers on Friday, though the downside remains cushioned.

- Traders now seem reluctant to place aggressive directional bets ahead of the US PCE.

- The technical setup suggests that the path of least resistance remains to the downside.

The GBP/USD pair extends the overnight late pullback from the 1.2670 region and trades with a mild negative bias during the Asian session on Friday. Spot prices currently hover around the 1.2635-1.2630 area and remain well within the striking distance of the lowest level since mid-May touched on Thursday.

The British Pound (GBP) continues to be undermined by rising bets for a rate cut by the Bank of England (BoE) in August. Apart from this, some repositioning trade ahead of the crucial US inflation data lifts the US Dollar (USD) to a fresh two-month high, which, in turn, is seen as another factor exerting some downward pressure on the GBP/USD pair. That said, the uncertainty about the Federal Reserve's (Fed) rate-cut path keeps a lid on any further gains for the buck and helps limit the downside for the currency pair.

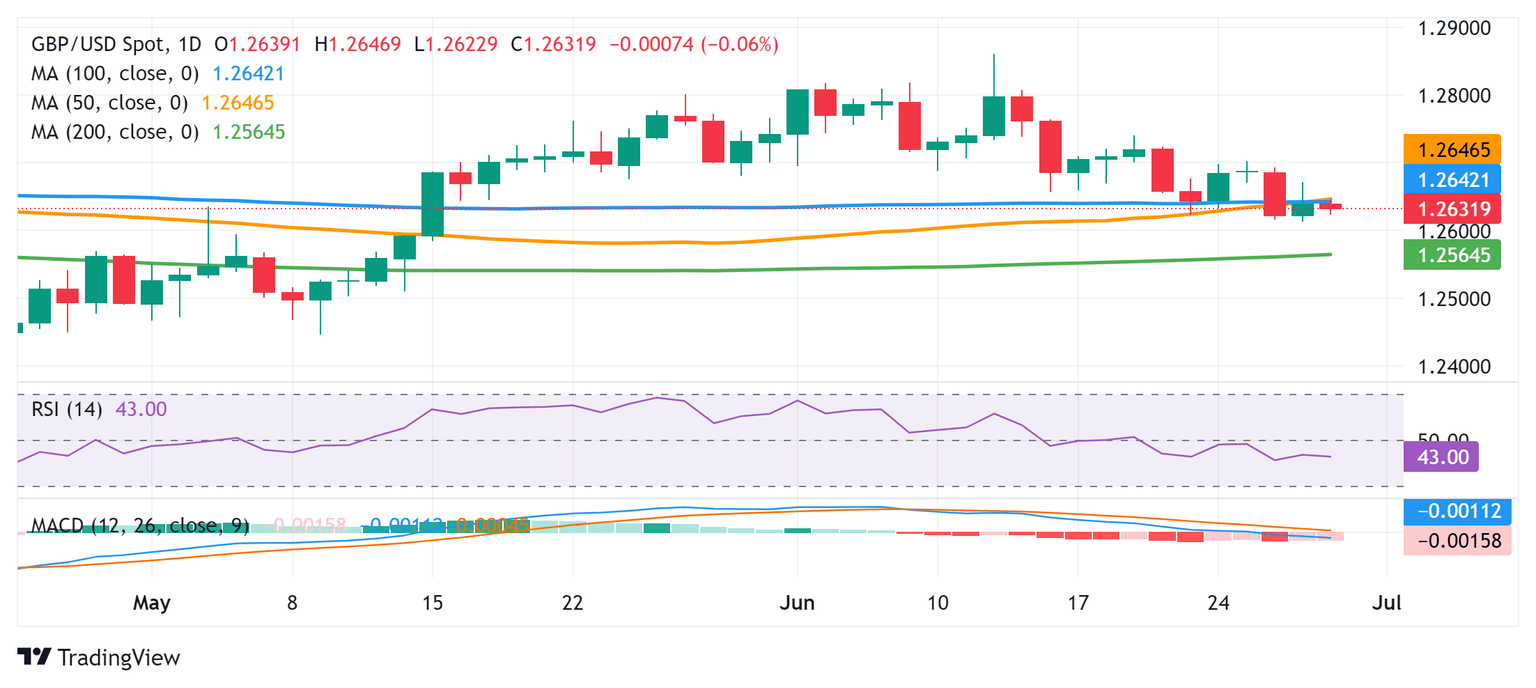

From a technical perspective, the emergence of fresh selling and acceptance below the 1.2650-1.2645 confluence – comprising 50-day and 100-day Simple Moving Averages (SMAs) – favors bearish traders. Moreover, oscillators on the daily chart have been gaining negative traction and suggest that the path of least resistance for the GBP/USD pair is to the downside. That said, any subsequent slide is likely to find some support near the weekly low, around the 1.2615-1.2610 area, ahead of the 1.2600 mark, which if broken will set the stage for deeper losses.

The GBP/USD pair might then accelerate the downfall towards challenging the very important 200-day SMA, currently pegged near the 1.2560 region en route to the 1.2500 psychological mark. The downward trajectory could extend further towards testing the May monthly swing low, around the 1.2445 area.

On the flip side, the 1.2670 area, or the overnight peak, now seems to act as an immediate hurdle ahead of the 1.2700 round-figure mark. A sustained strength beyond the latter will suggest that the recent corrective decline has run its course and lift the GBP/USD pair beyond the 1.2720-1.2725 supply zone, towards the 1.2800 mark. Bullish traders might then aim back towards challenging the multi-month top, around the 1.2860 region touched on June 12, and lift spot prices further towards the 1.2900 round-figure mark.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.