GBP/USD Price Analysis: Poised for further downside towards 1.4000

- GBP/USD stays depressed around Monday’s low, defends 1.4050 of late.

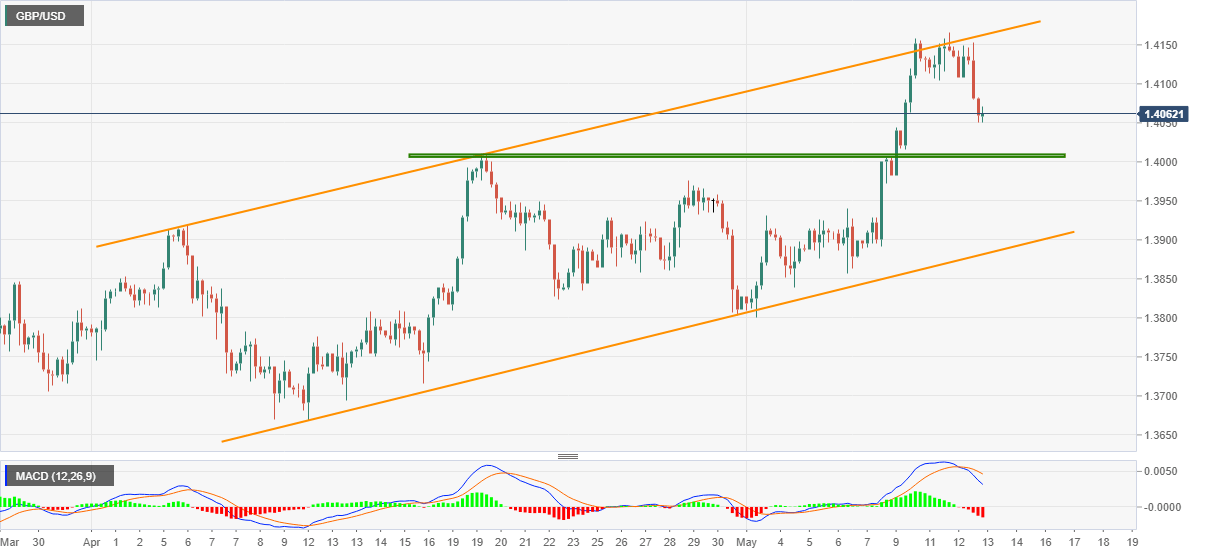

- Pullback from five-week-old ascending channel, bearish MACD favor sellers.

- Bulls remain hopeful until witnessing a downside break of 1.3880.

GBP/USD bears lick their wounds near 1.4060, up 0.08% intraday, during Thursday’s Asian session. The cable pair dropped the most in May the previous day on broad US dollar strength.

Sellers are likely to keep the reins as Wednesday’s losses pulled the GBP/USD prices back from a short-term rising channel’s resistance line, coupled with bearish MACD.

Hence, the quote’s further losses towards late April top surrounding 1.4010, quickly followed by the 1.4000 threshold, can’t be ruled out.

However, any additional downside will have to defy the bullish chart pattern by breaking 1.3880 support to the south, which in turn could immediately challenge the monthly low near the 1.3800 round figure.

Meanwhile, the 1.4100 mark guards the pair’s immediate recovery moves ahead of the stated channel’s resistance line, around 1.4165.

In a case where the GBP/USD rallied beyond 1.4165, the yearly top surrounding 1.4245 will be in the spotlight.

GBP/USD four-hour chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.