GBP/USD Price Analysis: Hangs in the balance of NFP, breakout imminent

- GBP/USD bulls seeking a test of the daily highs but awaits NFP.

- Bears will be keen on a deeper correction on a positive NFP print.

Following the Bank of England event earlier today, GBP/USD has held onto a modest gain.

Cable rose as high as $1.3949 after the BoE decision but was unable to break the resistance needed for an upside continuation in the daily time frame.

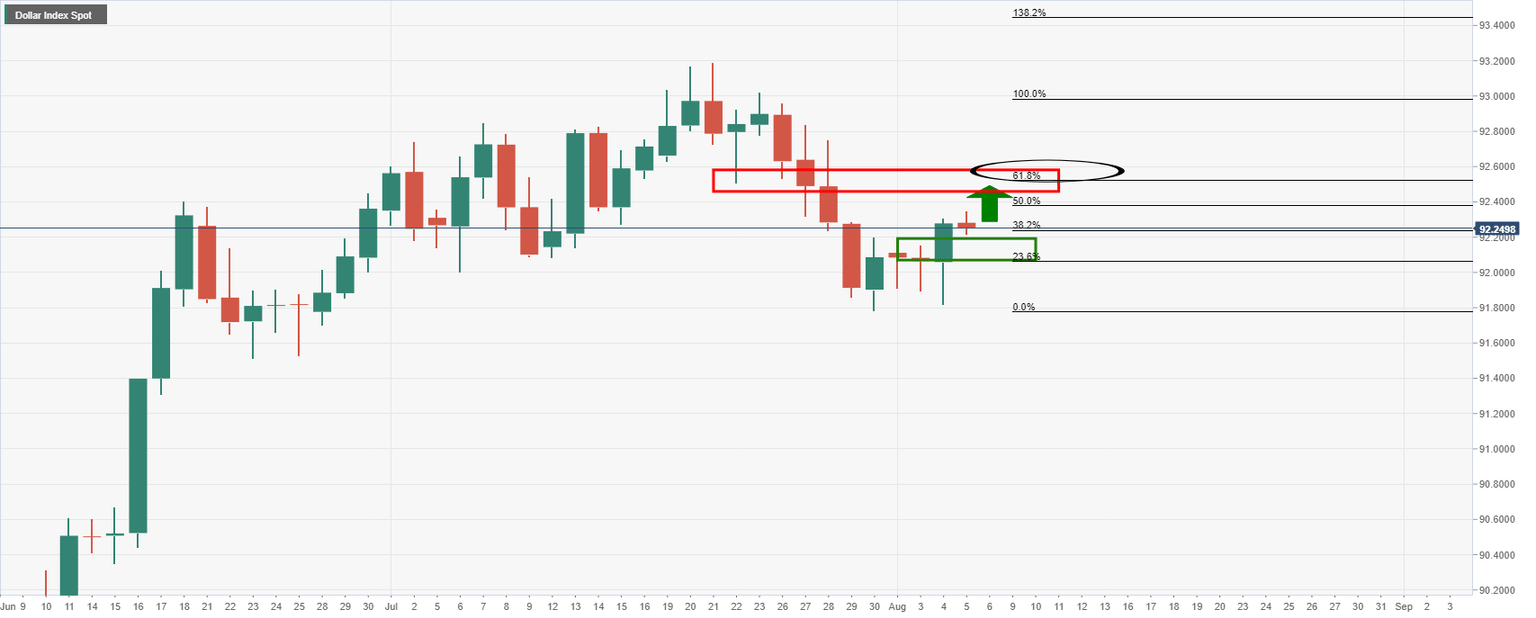

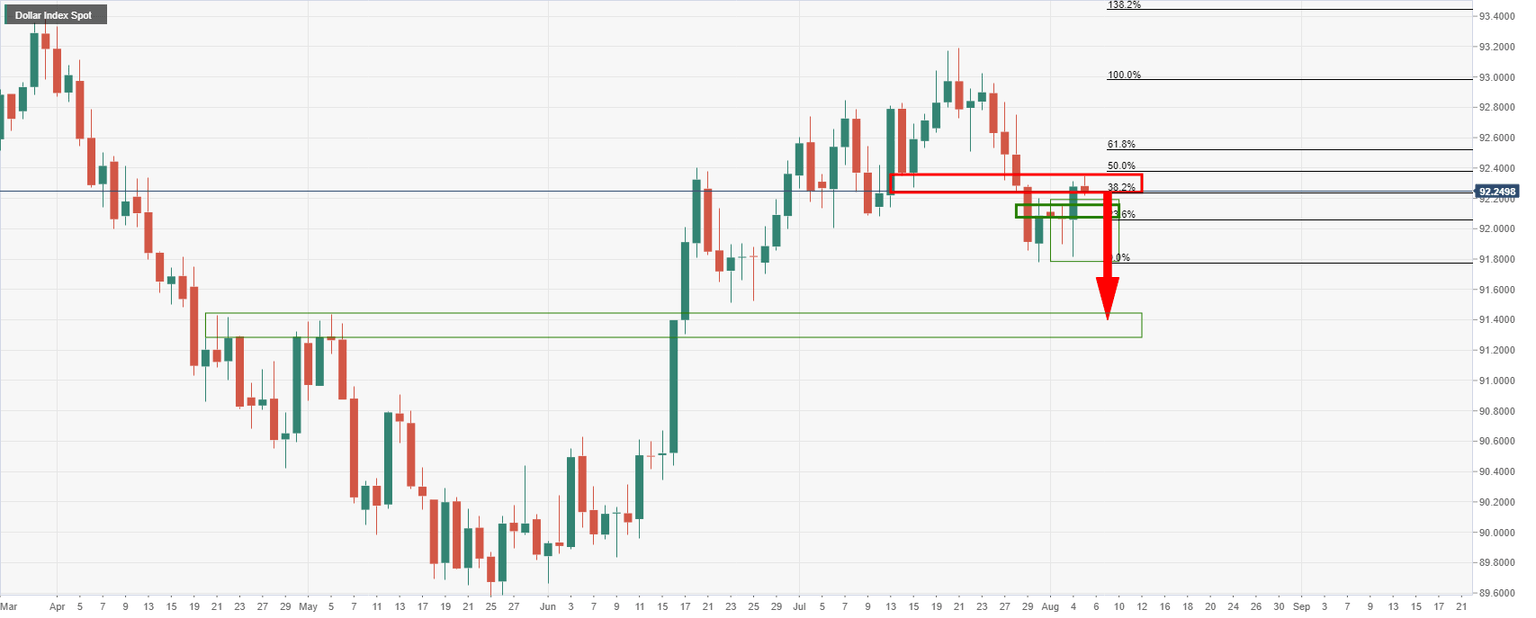

The following illustrates the market structure of both the DXY and GBP/USD.

The current trajectory in the US dollar is higher for prospects of a deeper correction into the 61.8% Fibonacci retracement level next to prior lows in the 92.50 area.

This will be depending on the outcome of Friday's Nonfarm Payrolls event. In respect of this, there is potential for a disappointment in contrast to the current hawkish narrative from the Federal Reserve.

In such an instance this would be expected to weigh heavily on the greenback and potentially send it over the cliff into the abyss to test the 90.50/40s area:

As for cable, it is on the brink of an upside breakout on the daily chart.

The price has consolidated following a slight breach of the 38.2% Fibonacci retracement level and sits in a structure that acts as support that was once resistant mid-July.

Given that, there are upside risks in this period of distribution as bulls might be attracted to buy back into uptrend at a discount following the end of month squaring/profit-taking and the probable reduction in the overall net long sterling positioning.

With that being said, there could be more distribution to come, especially on overwhelming Nonfarm Payrolls that supports the greenback.

Therefore, the downside will come into play and the W formation neckline could be a theme for weeks ahead in the 1.3780s.

Meanwhile, it is worth noting the prospects of a reverse head and shoulders:

The reverse head & shoulders is a bullish pattern on a break of neckline resistance.

With that being said, the W-formation could be brewing and any move to the upside could be in jeopardy.

M & W formations are reversion structures that have a high completion rate with price usually drawn back into the neckline of the pattern.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.