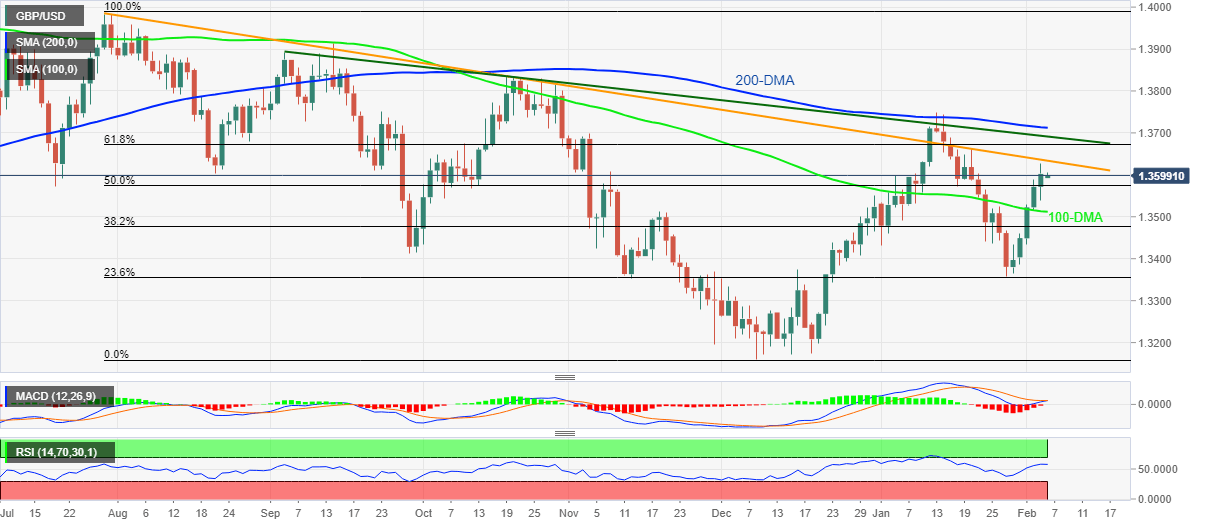

GBP/USD Price Analysis: Grinds higher around 1.3600 as bulls fear bumpy road

- GBP/USD remains sidelined at two-week top after five-day uptrend.

- MACD, RSI signal further upside but key trend lines, 200-DMA challenge bulls.

- Sellers need validation from 100-DMA, Fibonacci retracement levels can add to trading filters.

GBP/USD bulls take a breather around a fortnight high surrounding 1.3600, during the sixth positive day amid Friday’s Asian session.

In doing so, the cable pair justifies the clear upside break of the 50% Fibonacci retracement (Fibo.) of the July-December 2021 downside, as well as sustained trading beyond the 100-DMA.

Also keeping the GBP/USD buyers hopeful is the firmer RSI line, not overbought, together with the MACD line that teases bulls.

That said, the quote is up for further advances towards a descending resistance line from July, close to 1.3635, as an immediate hurdle.

Following that, the 61.8% Fibo. and a resistance line from September, respectively near 1.3670 and 1.3690, will challenge the GBP/USD upside. It’s worth noting that the 200-DMA level of 1.3712 becomes the last defense for the bears.

Alternatively, pullback moves will initially aim for the 50% Fibo. and 100-DMA, surrounding 1.3570 and 1.3510, before declining towards the latest swing low, also comprising the 23.6% Fibonacci retracement, around 1.3350.

During the pair’s moves between 1.3510 and 1.3350, September’s low near 1.3410 will act as an intermediate halt.

Overall, GBP/USD is likely to extend the recent upside but the road to the north will be a bumpy one.

GBP/USD: Daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.