GBP/USD Price Analysis: Further upside hinges on 1.2310 breakout, UK inflation

- GBP/USD fades upside momentum after two-day advances, retreats of late.

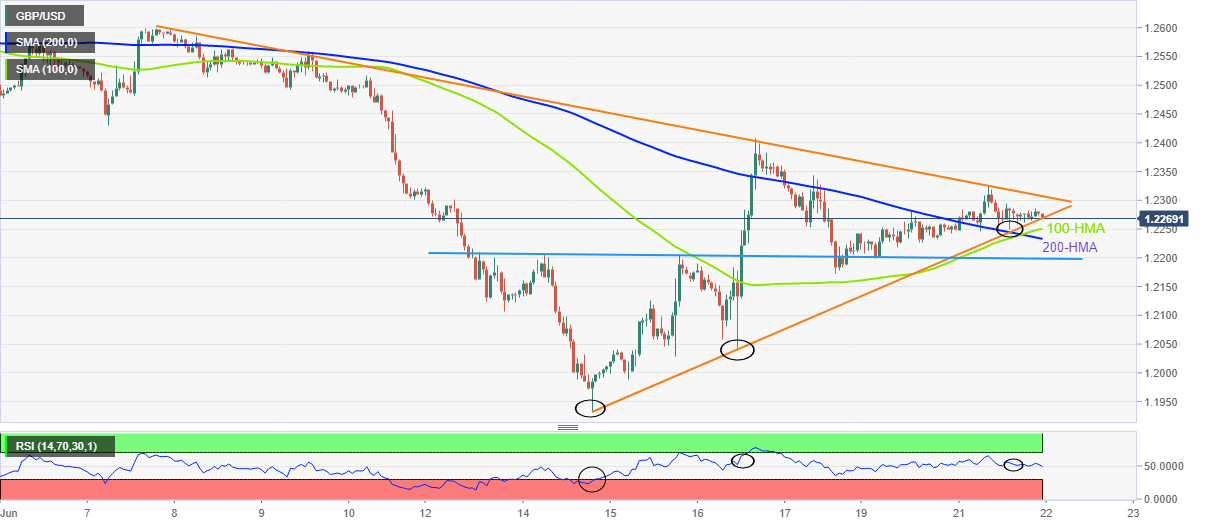

- Sustained trading beyond the key HMAs, bullish RSI formation keep buyers hopeful.

- Short-term triangle restricts immediate moves ahead of UK CPI data for May.

GBP/USD struggles to extend the weekly rebound as bulls take a breather around 1.2275 during Wednesday’s Asian session. In doing so, the cable pair funnels down to the short-term triangle break.

However, the quote’s successful trading above the 100-HMA and 200-HMA, as well as the RSI’s support to the recent higher lows on prices, keeps the pair buyers hopeful.

That said, the latest pullback remains elusive until the quote stays above the 200-HMA support of 1.2230. Before that, the stated triangle’s support line and the 100-HMA may entertain GBP/USD sellers around 1.2265 and 1.2250 respectively.

In a case where the cable pair remains weak past 1.2250, weekly horizontal support near 1.2200 and Friday’s low of 1.2172 should gain the bear’s attention.

Meanwhile, recovery moves need validation from the 1.2310 hurdle, comprising the aforementioned triangle’s resistance line.

Following that, the mid-June swing high of 1.2406 and early month bottom around 1.2430 may rest the GBP/USD pair buyers before directing the run-up towards the monthly peak of 1.2616.

It should be noted that the UK Consumer Price Index (CPI) is likely to increase to 9.1% in May from 9.0%, which in turn suggests more urgency on the part of the Bank of England (BOE) to propel rates. The same could favor the GBP/USD buyers in case of firmer data.

GBP/USD: Hourly chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.