GBP/USD Price Analysis: Flat-lines around 1.2500, near a three-month low

- GBP/USD remains flat around 1.2500, near a three-month low hit on Wednesday.

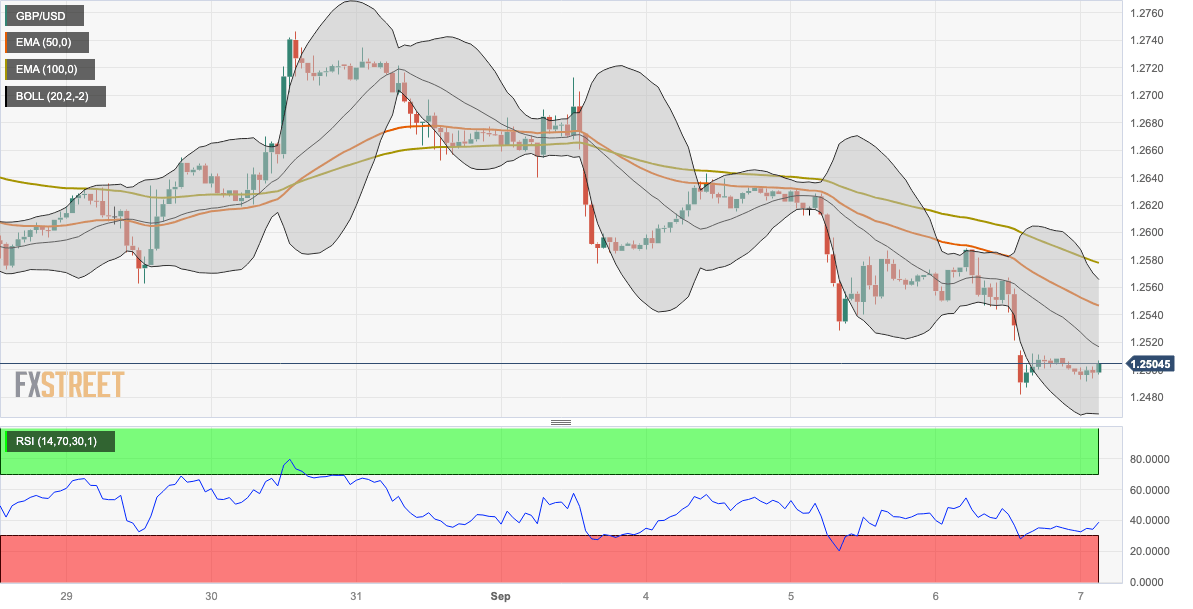

- The pair holds below the 50- and 100-hour EMAs on a one-hour chart.

- The first support level is located at 1.2465; immediate resistance level is seen at 1.2515.

The GBP/USD pair consolidates its recent losses around 1.2500 during the Asian session on Thursday. Meanwhile, the US Dollar Index (DXY), a measure of the value of USD against six other major currencies, hovers around 104.80 after retreating from the highest level since March. The strength of the Greenback is bolstered by the upbeat US ISM Services PMI, which came in better than expected and improved to a six-month high level of 54.5 in August.

On the other hand, the Pound Sterling (GBP) was weakened by Bank of England (BoE) Governor Andrew Bailey's dovish remark on Wednesday. He stated that BoE is much closer to ending its hiking cycle.

From the technical perspective, GBP/USD holds below the 50- and 100-hour Exponential Moving Averages (EMAs) with a downward slope on the one-hour chart, which means further downside looks favorable. Meanwhile, the Relative Strength Index (RSI) stands below 50, within bearish territory, suggesting that sellers are likely to retain control in the near term.

Any extended weakness below the lower limit of the Bollinger Band at 1.2465 will challenge the next contention at 1.2440 (a low of May 12) en route to 1.2390 (a low of June 6) and finally at 1.2350 (a low of May 31).

On the upside, the middle line of the Bollinger Band at 1.2515 acts as an immediate resistance level for GBP/USD. The additional upside filter is located at 1.2545 (50-hour EMA). Further north, the 1.2565-2575 zone appears a tough nut to crack for the Pound Sterling bears. The mentioned level represents the upper boundary of the Bollinger Band and the 100-hour EMA. The next barrier is seen near a psychological round mark at 1.2600.

GBP/USD one-hour chart

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.