GBP/USD Price Analysis: Edges higher amid modest USD downtick, not out of the woods yet

- GBP/USD bounces off its lowest level since mid-May, albeit lacks any follow-through buying.

- The fundamental backdrop warrants some caution for bulls ahead of the key US macro data.

- The technical setup suggests that the path of least resistance for the pair is to the downside.

The GBP/USD pair attracts some buyers near the 1.2615-1.2610 area, or its lowest level since mid-May touched during the Asian session on Thursday and reverses a part of the previous day's steep decline. Spot prices currently trade around the 1.2630 area, up less than 0.10% for the day, as traders now look to the key US macro data before positioning for the next leg of directional bets.

In the meantime, the US Dollar (USD) is seen retreating from a nearly two-month high touched on Wednesday and acting as a tailwind for the GBP/USD pair. That said, elevated US Treasury bond yields, bolstered by expectations that the Federal Reserve (Fed) is in no rush to start its rate-cutting cycle, should help limit losses for the buck. Apart from this, rising bets for a rate cut by the Bank of England (BoE) in August could undermine the British Pound (GBP) and further contribute to capping the GBP/USD pair ahead of the UK general election on July 4.

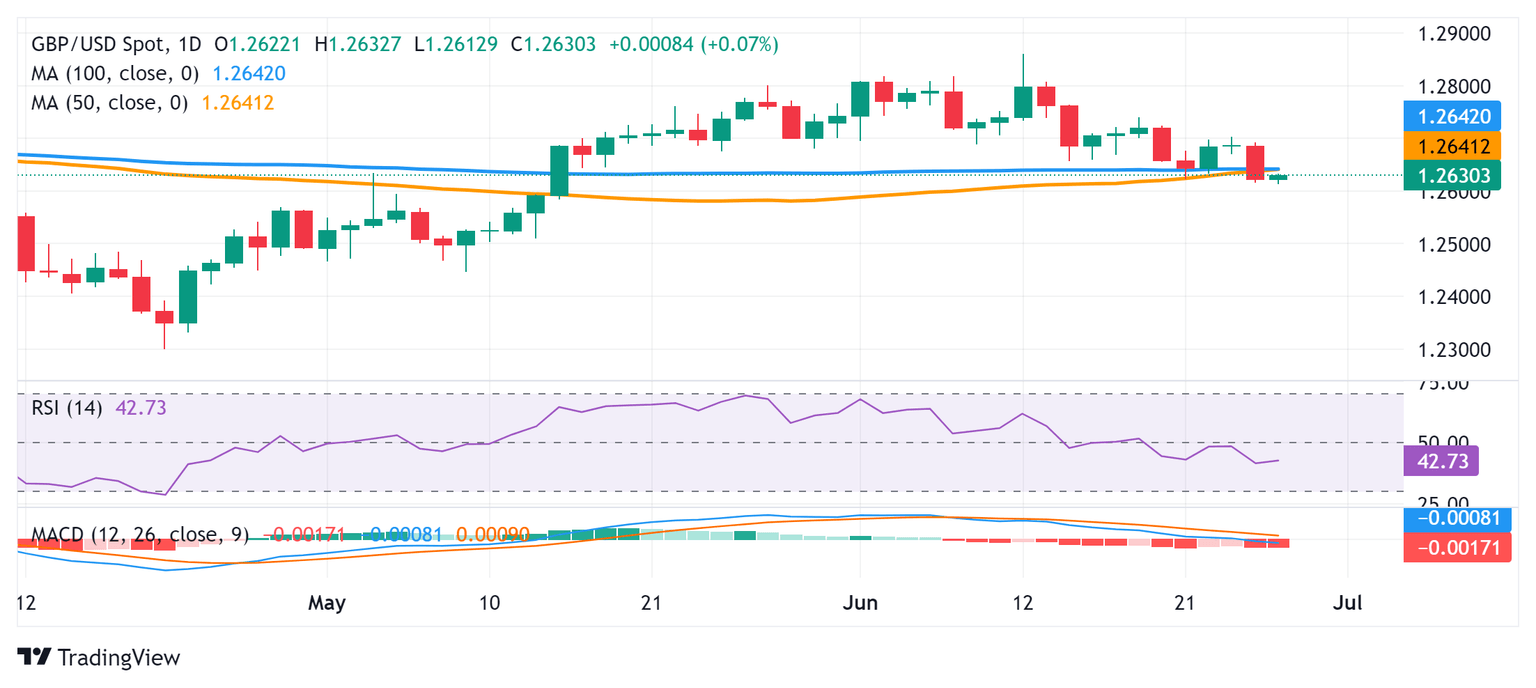

From a technical perspective, the overnight breakdown and close below the 1.2650-1.2645 confluence – comprising 50-day and 100-day Simple Moving Averages (SMAs) was seen as a fresh trigger for bearish traders. Moreover, oscillators on the daily chart have been gaining negative traction and suggest that the path of least resistance for the GBP/USD pair is to the downside. Hence, a subsequent slide below the 1.2600 round-figure mark, towards testing the next relevant support near the 1.2560-1.2555 horizontal zone, looks like a distinct possibility.

On the flip side, any positive move back above the 1.2645-1.2650 confluence support breakpoint might continue to attract fresh sellers ahead of the 1.2700 mark and remain capped. A sustained strength beyond the said handle, however, will suggest that the recent corrective decline has run its course and lift the GBP/USD pair beyond the 1.2720-1.2725 supply zone, towards the 1.2800 mark. Bulls might eventually aim to challenge the multi-month top, around the 1.2860 region touched on June 12, and lift spot prices further towards the 1.2900 round figure.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.