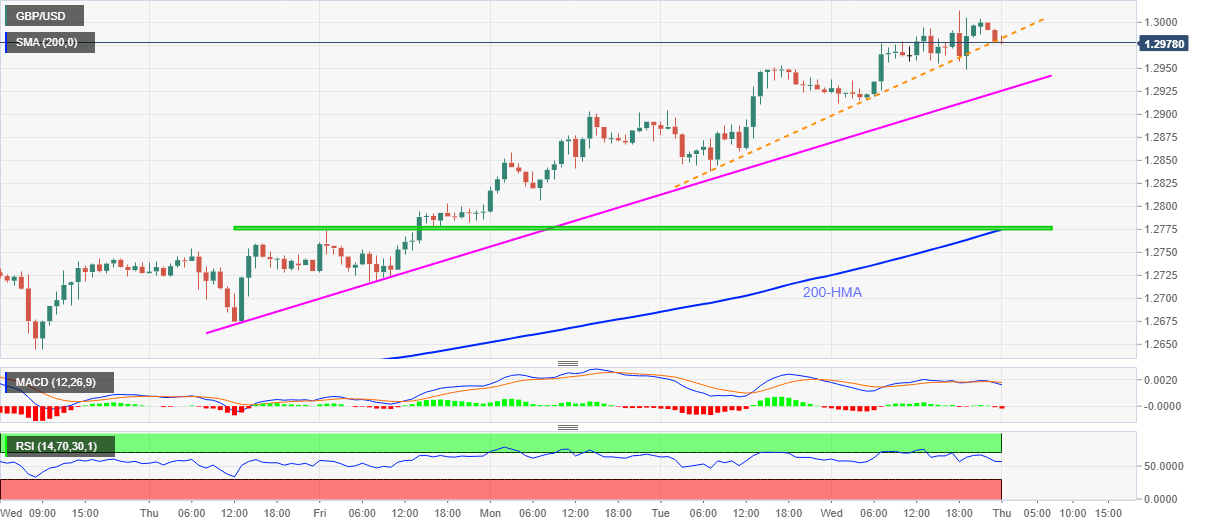

GBP/USD Price Analysis: Consolidates gains below 1.3000

- GBP/USD recedes from the highest since March 10.

- Break of two-day-old support line, MACD/RSI conditions push the sellers to take the risk.

- 1.2775/80 becomes the key support, bulls may aim for mid-February highs beyond 1.3000.

GBP/USD eases to 1.2980 during Thursday’s Asian session. In doing so, the Cable takes a U-turn from the highest since the early March while cheering the break of the immediate support line. Also suggesting further pullback is the bearish MACD signal and downward sloping RSI.

Hence, Tuesday’s high around 1.2940 gains the traders’ immediate attention ahead of an ascending support line from July 23, at 1.2925.

If at all the bears manage to break 1.2925 level, 1.2900 holds the key to the pair’s south-run towards 1.2775/80 support-zone, comprising 200-HMA and early-July 24 high.

Meanwhile, an upside clearance of 1.3000 will have to cross February 13 top near 1.3070 before attacking March month’s peak of 1.3200.

GBP/USD hourly chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.