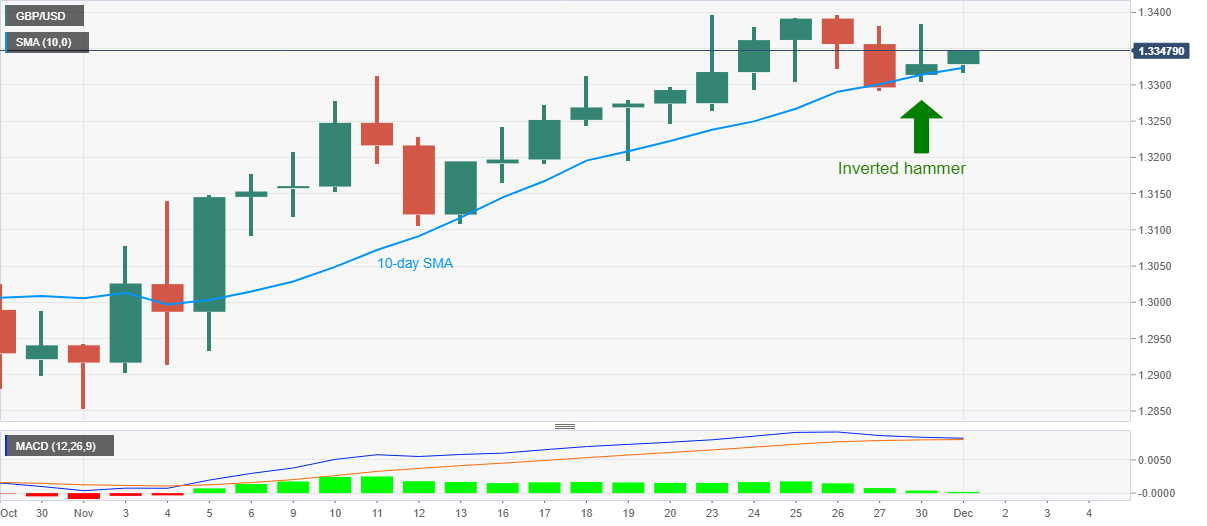

GBP/USD Price Analysis: Bulls attack 1.3350 on Monday’s inverted hammer

- GBP/USD refreshes intraday high while justifying the previous day’s bullish candlestick formation.

- MACD signals, sustained trading beyond 10-day SMA also favor buyers.

GBP/USD takes the bids near 1.3350, up 0.15% on a day, during the early Tuesday’s trading. The Cable mark another U-turn from 10-day SMA the previous day. In doing so, it flashed an inverted hammer bullish candle on the daily (D1) chart.

Not only the upside suggesting candle but bullish MACD and the pair’s ability to stay afloat beyond 10-day SMA also direct the GBP/USD buyers towards the November high near 1.3400.

Although the yearly top near 1.3485 will be next on the bulls’ radars after clearing the 1.3400 threshold, December 2019 peak near 1.3510 will be the key upside hurdle to watch afterward.

Meanwhile, a downside break of 10-day SMA, at 1.3323 now, needs validation from Friday’s low of 1.3293 for further declines towards the low of the previous pullback moves, marked during November 11-12, around 1.3110.

While the bulls have a clear runway ahead, the destination before the key hurdle isn’t too long. On the contrary, bears may seek directions from Brexit doubts to re-enter.

GBP/USD daily chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.