GBP/USD Price Analysis: Bulls are lurking in demand area

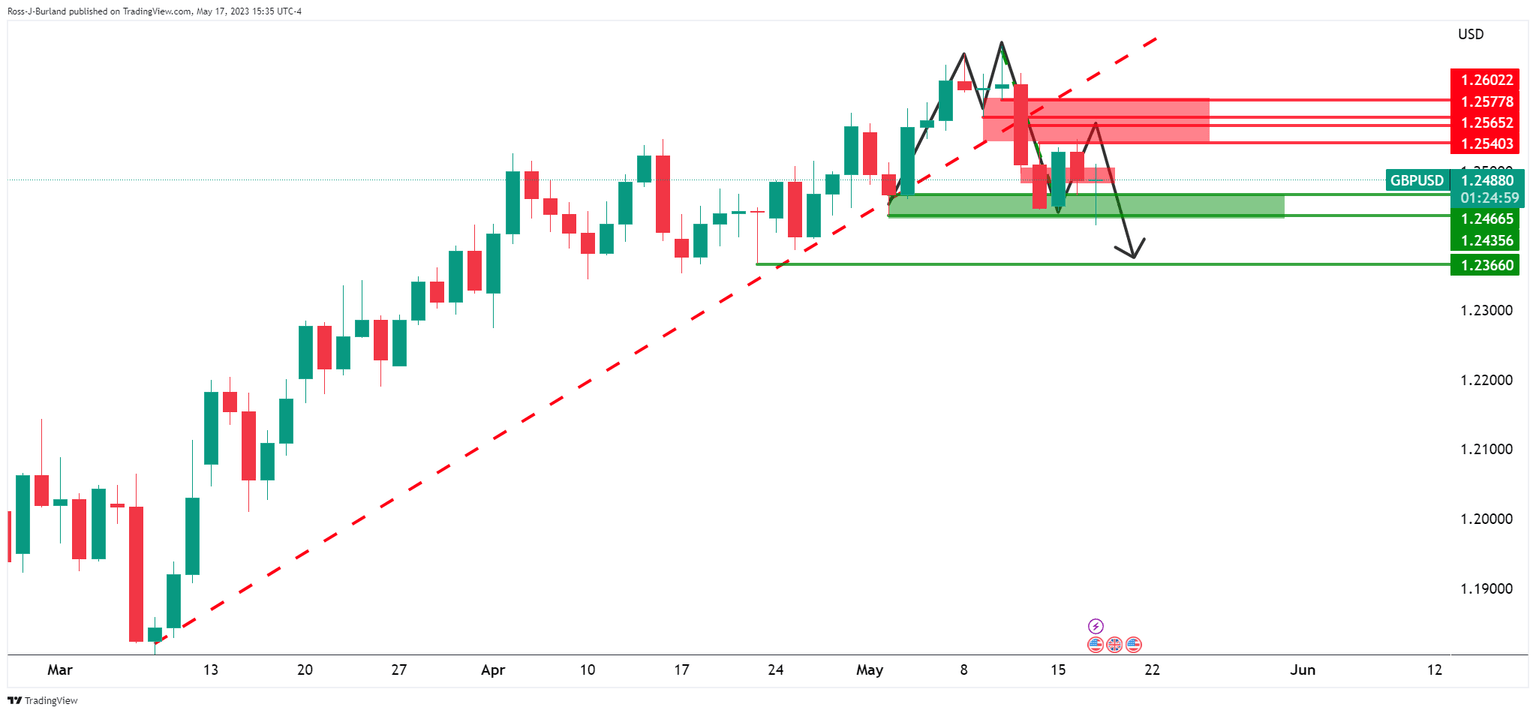

- GBP/USD slides in a meltdown from the topping pattern.

- GBP/USD could be on the verge of a correction to restest the prior area of support, 1.2420 and 1.2450 in the main.

In the prior analysis, GBP/USD Price Analysis: Bears are moving in on the risk rally, it was explained that the M-formation was explained to be a topping pattern that had formed as the potential for the final stage of the prior bullish rally:

GBP/SD prior analysis, daily chart

The price was on the backside of that trendline where traders were anticipated to trade on the short side.

GBP/USD prior analysis, H4 chart

The price has shot up to test resistance and while there are prospects of an onward continuation, the price can easily head lower as illustrated in the chart above.

GBPUSD live updates

The price is now in an area where we could now see a correction to restest the prior area of support, 1.2420 and 1.2450 in the main.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.