GBP/USD Price Analysis: Bulls about to show their commitments

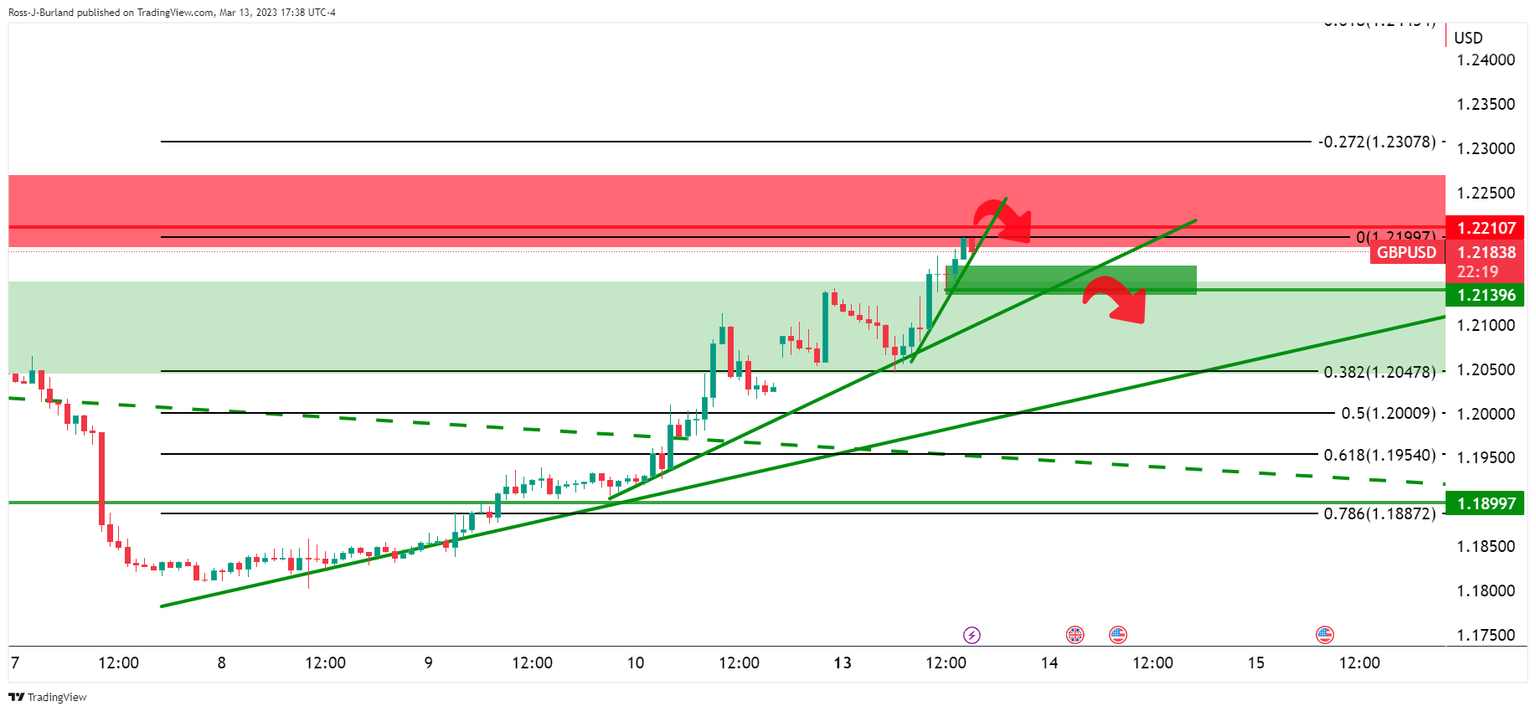

- GBP/USD´s M-formation as a reversion pattern could see price drawn to the neckline.

- GBP/USD is meeting a 78.6% Fibonacci level of the prior bullish impulse.

As per the prior analysis, GBP/USD Price Analysis: Bears seek a break of structure while price slows below 1.2200, the bears are staying the course in a drift to the downside ahead key US data today.

GBP/USD prior analysis

It was stated that the price was still very much on the front side of the trend. However, the analyses also noted that the hourly micro trendline was under some pressure while a break of the 1.2140 structure was needed to cement the bearish case for the day ahead.

GBP/USD update

The price has fallen into a key territory where demand might be expected:

The M-formation is a reversion pattern that tends to see the price drawn to the neckline. The price is also meeting a 78.6% Fibonacci level of the prior bullish impulse which may see a deceleration in the downside for the hours ahead. Resistance at the neckline near 1.2175 could see a rejection and a subsequent downside continuation to fully test the bull´s commitments in the 1.21s.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.