GBP/USD Price Analysis: Bears move in for the kill, testing key support structure

- GBP/USD bulls are under pressure following a rally in the Greenback.

- The bears are testing commitments at critical technical structures on the daily chart.

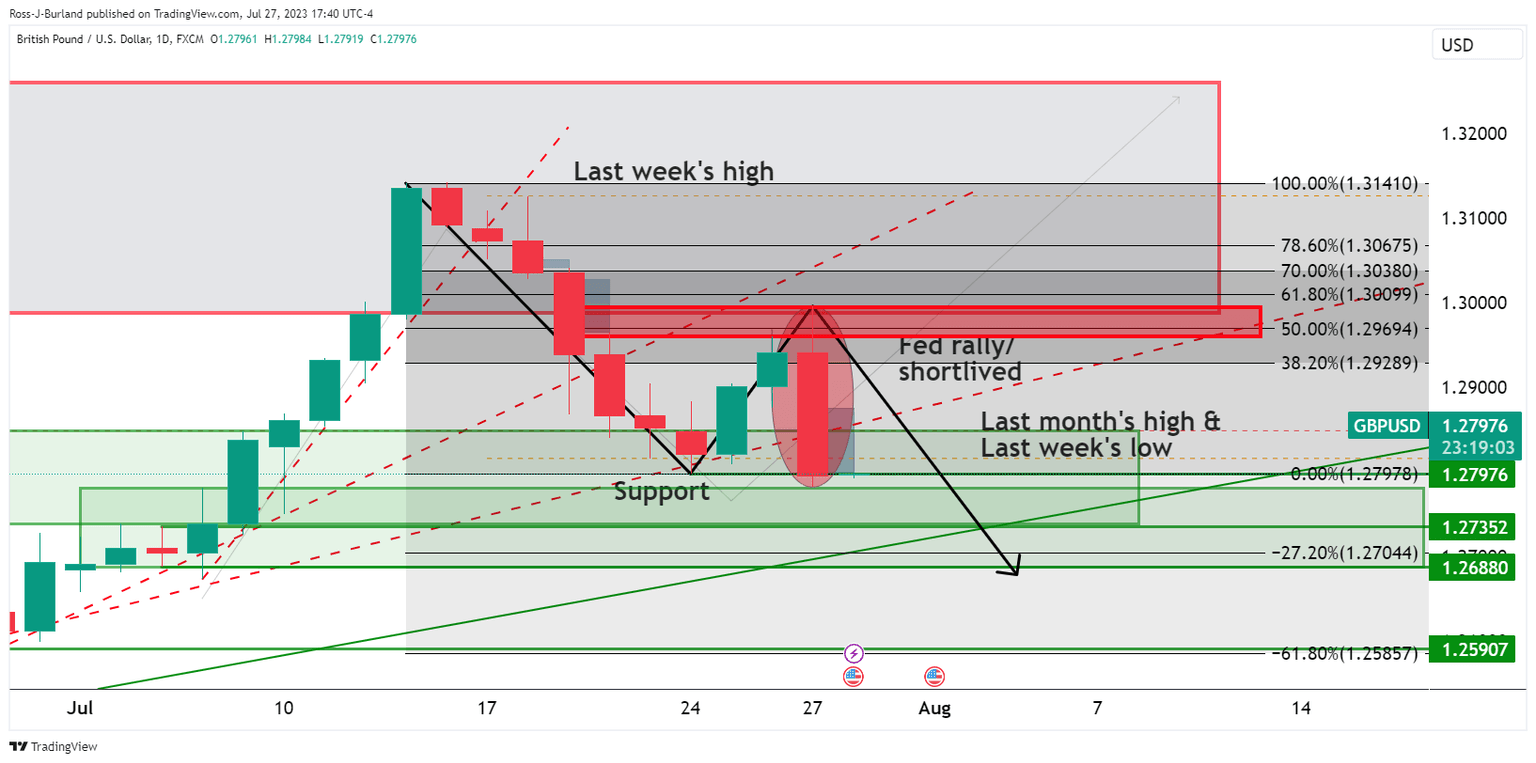

GBP/USD followed EUR/USD lower on strong US data and the European Central Babk's dovish 25bp hike. The pair dropped from 1.2995 to a low of 1.2781 while the markets reduce more hawkish Bank of England rate expectations for the August 3 interest rate meeting. This leaves the technical structure complicated and two-fold for Cable as the following illustrates:

GBP/USD technical analysis

Prior to the Thursday sell-off, Cable was rallying in line with the bullish trend on the back of the Fed's move and subsequent market take on the meeting. However, along came Thursday:

This has seen the pair drop hard into support and leaves a bearish prospect on the charts for a deeper test of the broader bullish cycle for the days ahead.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.