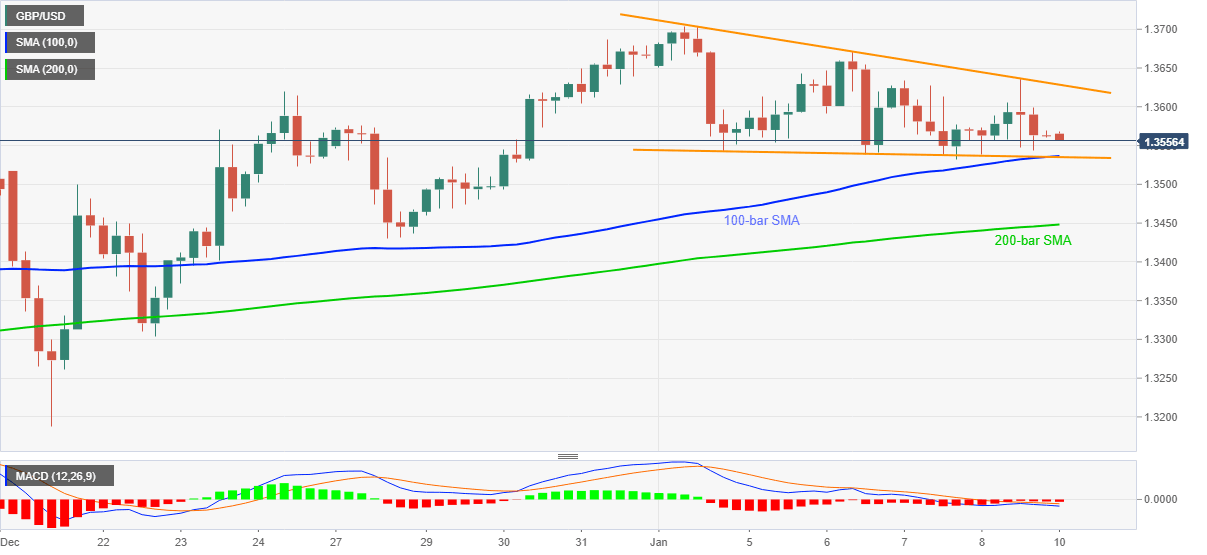

GBP/USD Price Analysis: Bears eye 1.3535 support confluence

- GBP/USD remains depressed around mid-1.3500s inside short-term descending triangle.

- Bearish MACD, virus woes in the UK keep sellers hopeful.

- 100-bar SMA, triangle’s support restrict immediate downside, buyers seek confirmation of bullish chart for fresh entries.

GBP/USD wavers around 1.3560, after declining for three consecutive days, during the early Asian session on Monday. In doing so, the cable remains inside a short-term falling triangle, a bullish chart pattern, while eyeing to re-test the formation’s support line and 100-bar SMA.

Considering the recent chatters around the coronavirus (COVID-19) woes in the UK, as well as the spread of the virus initially found in Britain, GBP/USD sellers eye further losses while following the bearish MACD.

Read: Japan says it found new coronavirus variant similar to UK strain – Bloomberg

However, a confluence of 100-bar SMA and the support line of a short-term triangle, around 1.3535, will offer a tough challenge to the GBP/USD sellers.

In a case where the sterling declines below 1.3535, the 1.3500 and the 200-bar SMA around 1.3450 will be the key to watch.

Meanwhile, the 1.3600 threshold can entertain short-term buyers before pushing them towards confirming the bullish chart pattern by an upside break of 1.3630.

Following that, GBP/USD bulls can aim for the recently flashed multi-month high near 1.3700 before eyeing the March 2018 low near 1.3715.

Also read: UK Chancellor Sunak looking to delay tax rises and end the stamp duty holiday – Times

GBP/USD four-hour chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.