GBP/USD Price Analysis: Bears are moving in but 1.1800 and then 1.2000 could be over the horizon

- GBPUSD is meeting its highest levels since September 12.

- With the price on the backside of the weekly countertrend, 1.2000 is a realistic prospect.

The Pound rallied on Thursday, hitting the best level against the greenback since September 12. The moves were inspired by lower-than-expected inflation reading for the US in the day's Consumer Price Index data. CPI rose 0.4% in October to match the prior month's increase, the Labor Department said. Economists polled by Reuters had forecast the CPI would advance by 0.6%.

The markets reacted in such a manner that this might allow the Federal Reserve to ease up on aggressively hiking interest rates and this gives rise to the prospects of a prolonged offer in the US Dollar, bullish for GBP. However, there are prospects of a correction and the Dollar bulls may not be out of the game entirely:

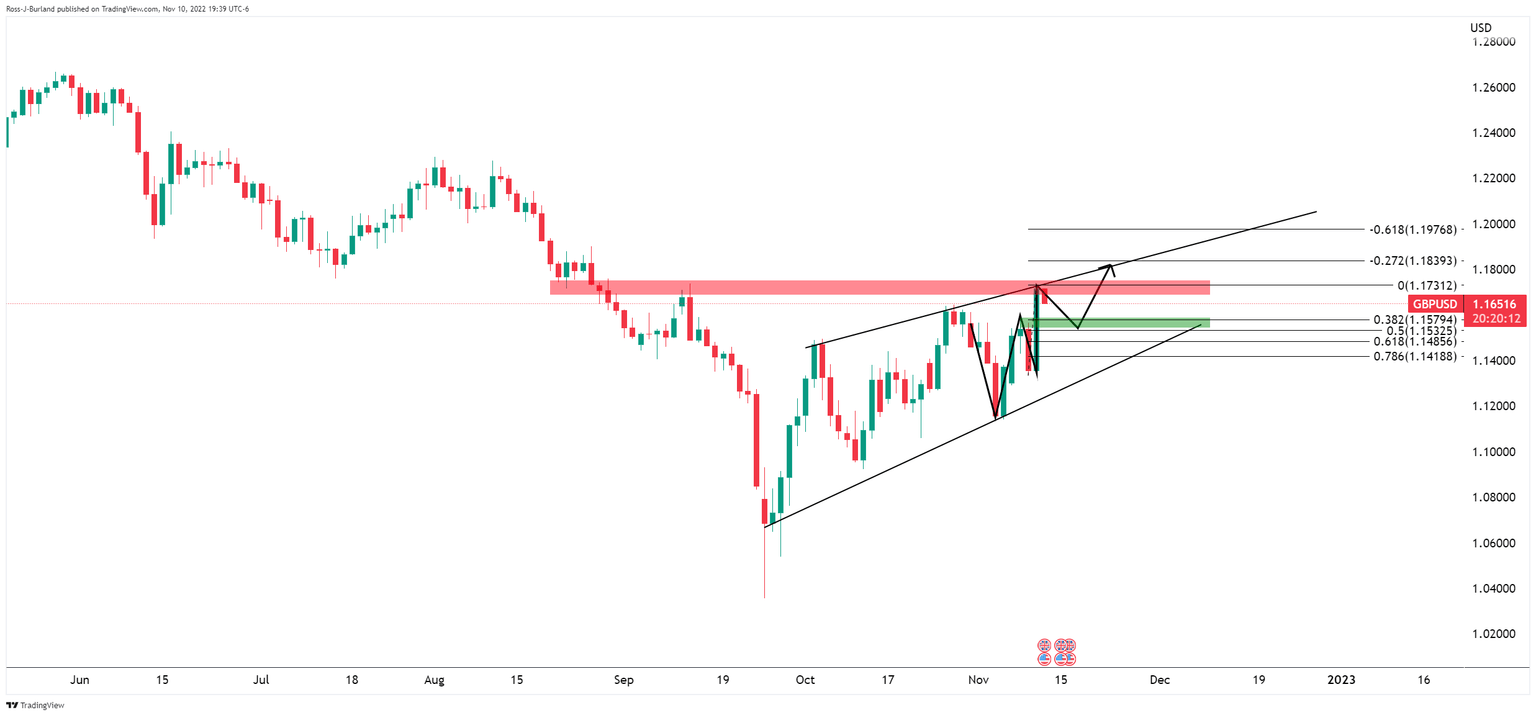

GBPUSD daily chart

If 1.1800 gives way, then 1.2000 will be on the horizon as the price moves between support and resistance within the ascending channel. The W-formation is, however, a bearish feature as the price could be drawn into the support of the neckline as it is rejected at resistance.

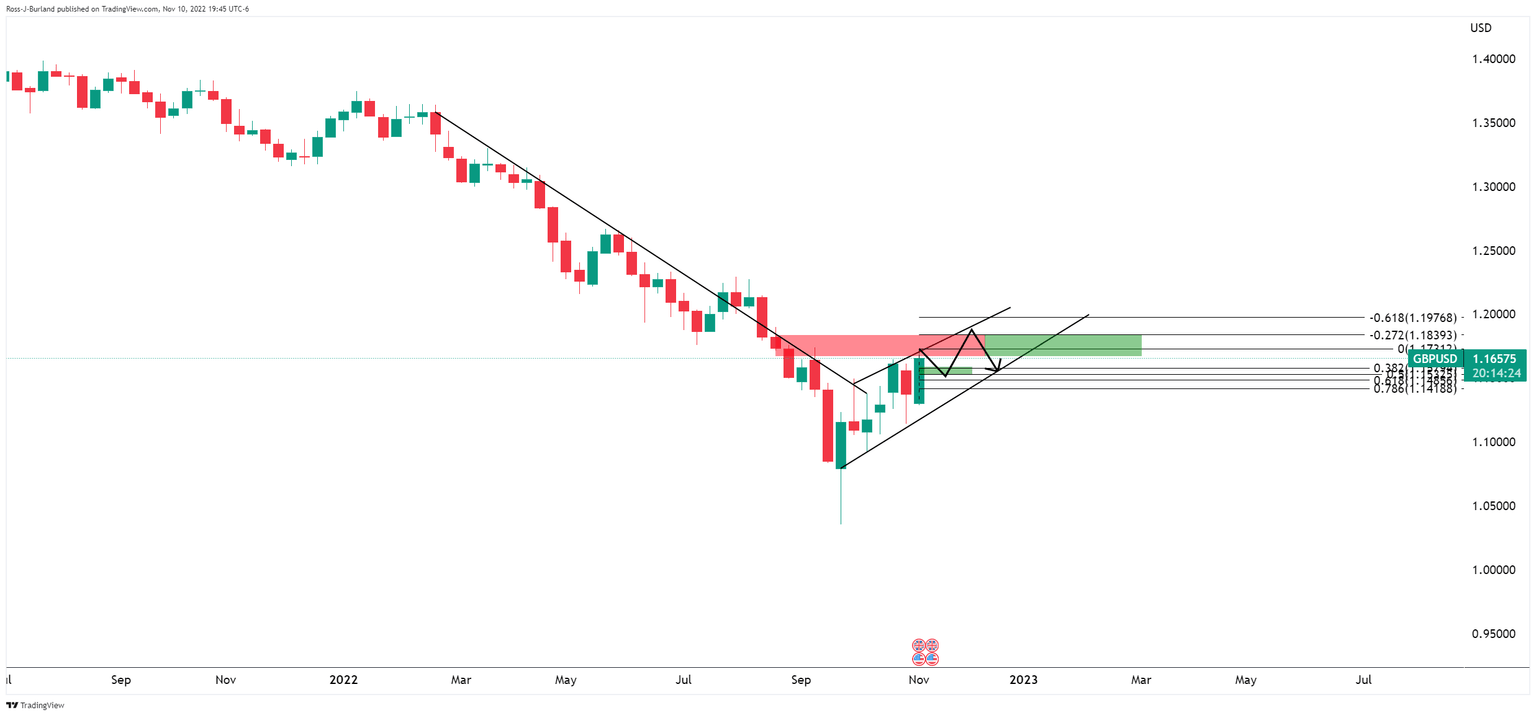

GBPUSD weekly chart

With the price on the backside of the weekly countertrend, 1.2000 is a realistic prospect.

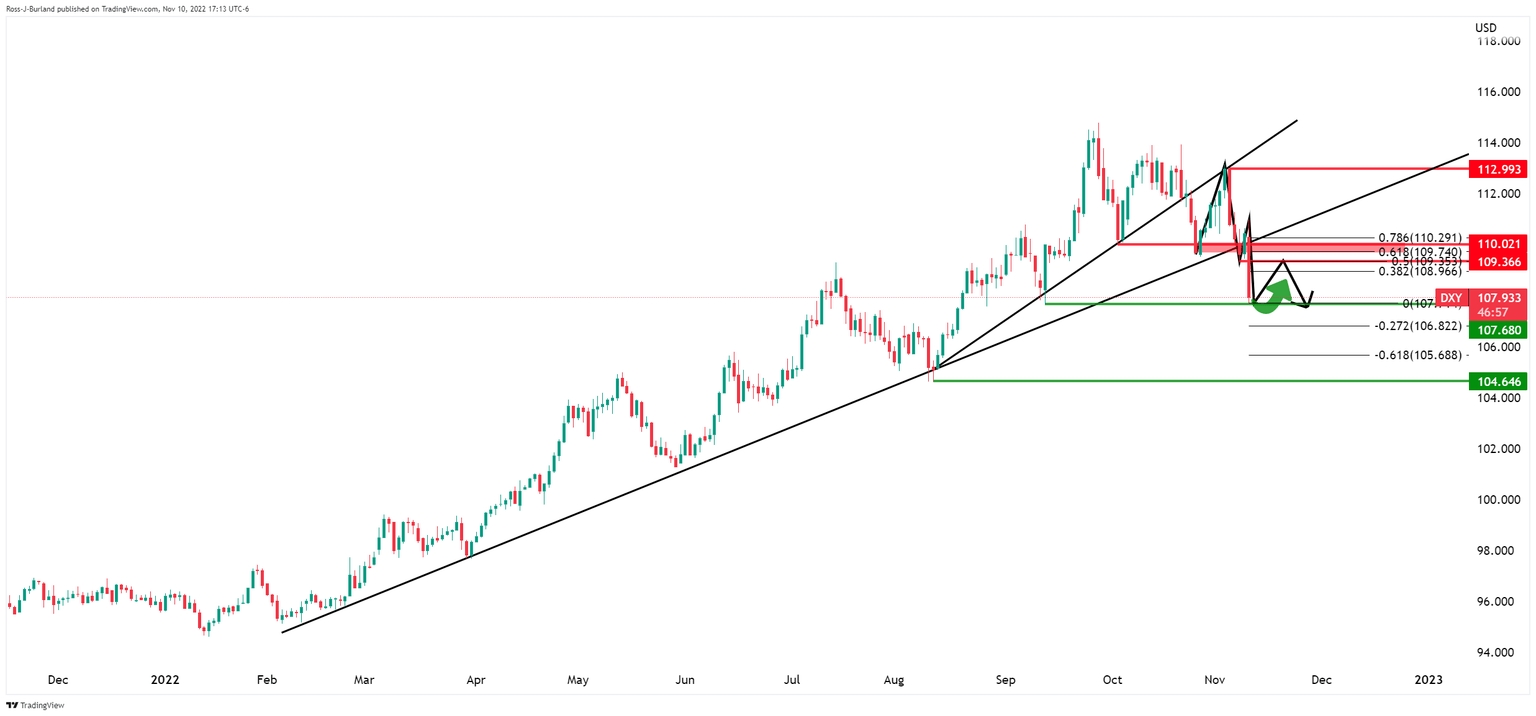

DXY technical analysis

The US Dollar has been sent into a critical support level as the following charts will illustrate:

The DXY is now well below the counter trendline and has formed an M-formation. If the support holds, then there will be prospects of a significant correction. On the other hand, if the bears dig their teeth in again, the case for 1.2000 in Cable will be active.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.