GBP/USD holds near 1.3540 as traders await Ukraine-Russia outcome, Powell speech

- GBP/USD steady as Trump–Putin ceasefire hopes offset quiet economic calendar.

- Markets await Powell’s Jackson Hole speech, FOMC minutes and US PMIs for Fed’s September outlook.

- UK CPI expected at 3.7%, keeping BoE under pressure after last meeting’s hawkish 25-bps cut.

GBP/USD steadies during the North American session, down a minimal 0.08% amid a scarce economic docket on both sides of the Atlantic. Nevertheless, market participants are optimistic due to a possible ceasefire or a peace agreement between Ukraine and Russia, following the Trump-Putin meeting on Friday and ahead of the talks between US President Donald Trump and Ukrainian President Volodymyr Zelenskyy later on Monday. The pair trades around 1.3540 at the time of writing.

Sterling steadies with geopolitics in focus; Fed and BoE policy paths remain key drivers for FX markets

Geopolitics are setting the tone at the beginning of the week, though US data, the Federal Reserve (Fed) Chair Jerome Powell's speech at Jackson Hole, and inflation figures in the UK might set the tone for the week.

In the US, traders are awaiting Powell's speech, the release of the Federal Open Market Committee (FOMC) meeting minutes, jobless claims, second-tier housing data ─ building permits, housing starts, and existing home sales ─ and S&P Global Flash PMIs.

Last week, mixed inflation figures on the consumer and producer sides triggered a reaction in the Fed funds rate futures markets. Most participants are expecting a 25-basis point (bps) rate cut at the September meeting, but some were awaiting a 50-bps cut, following a soft Consumer Price Index (CPI) reading. However, a red-hot PPI print caught those traders off guard, and market participants backpedaled. As of writing, nearly 15% of investors expect the Fed to hold rates unchanged, according the CME FedWatch Tool.

In the UK, July core CPI is expected to stay unchanged at 3.7% YoY. This exerts pressure on the Bank of England (BoE), which is balancing the need to lower inflation with the need to support a weak labor market. In the last meeting, the BoE cut rates by 25 bps in a 5-4 vote split, in what was perceived by markets as a hawkish cut, and priced in the next rate cut until February 2026.

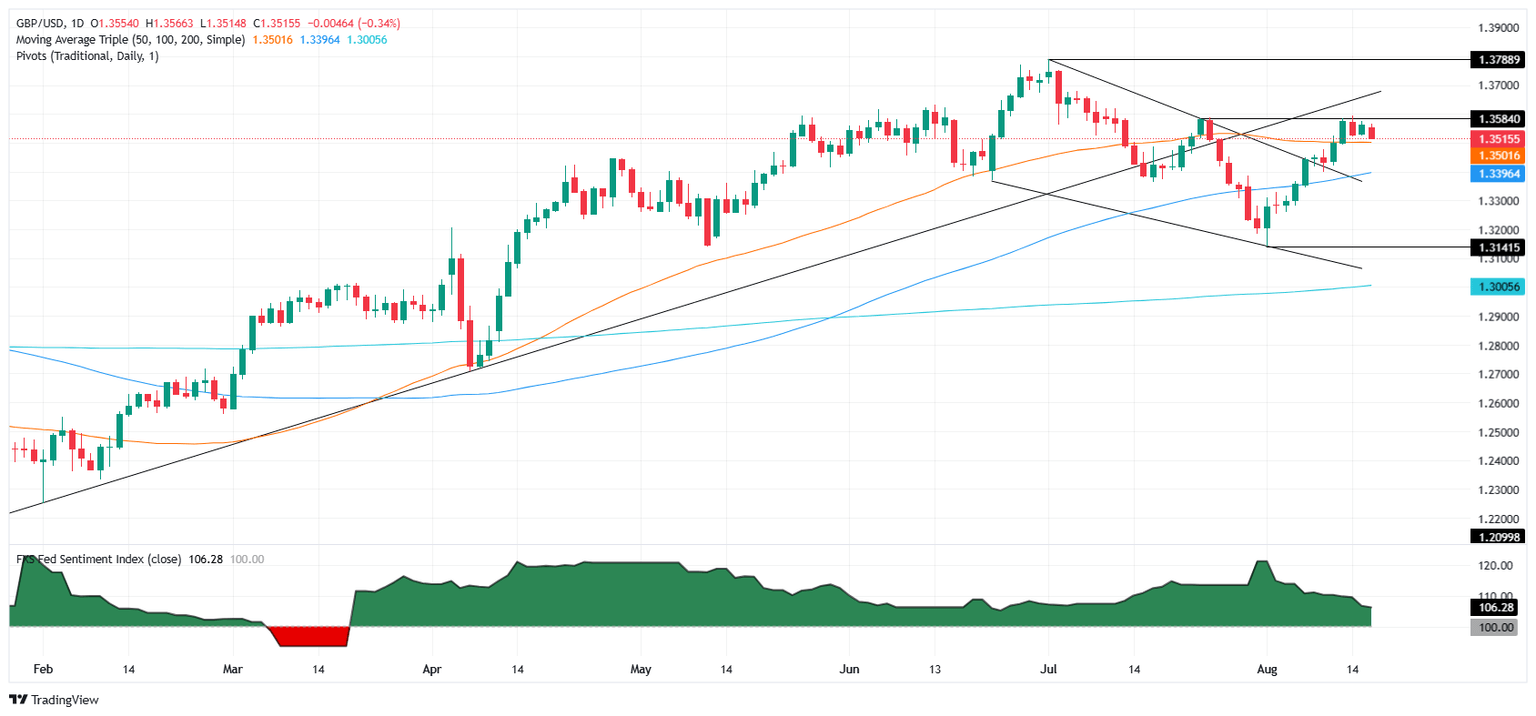

GBP/USD Price Forecast: Technical outlook

The GBP/USD uptrend resumed last week after clearing the top trendline of a falling wedge, though traders remain reluctant to climb above the 1.36 handle. The Relative Strength Index (RSI) is bullish, though losing some steam. Therefore, the pair could be set for a pullback before extending their gains.

If GBP/USD clears 1.3500, expect a test of the 50-day SMA at 1.3497, followed by the 20-day SMA at 1.3418. Once surpassed, the uptrend would be in danger, as sellers could challenge the 100-day SMA at 1.3397. Conversely, if the pair rises above 1.3600, buyers could drive spot prices towards the July 4 high at 1.3565.

British Pound PRICE This month

The table below shows the percentage change of British Pound (GBP) against listed major currencies this month. British Pound was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -2.06% | -2.29% | -1.83% | -0.17% | -0.81% | -0.18% | -0.62% | |

| EUR | 2.06% | -0.15% | 0.24% | 2.00% | 1.41% | 1.78% | 1.53% | |

| GBP | 2.29% | 0.15% | 0.44% | 2.15% | 1.56% | 2.14% | 1.70% | |

| JPY | 1.83% | -0.24% | -0.44% | 1.68% | 1.04% | 1.57% | 1.23% | |

| CAD | 0.17% | -2.00% | -2.15% | -1.68% | -0.66% | -0.00% | -0.44% | |

| AUD | 0.81% | -1.41% | -1.56% | -1.04% | 0.66% | 0.57% | 0.26% | |

| NZD | 0.18% | -1.78% | -2.14% | -1.57% | 0.00% | -0.57% | -0.33% | |

| CHF | 0.62% | -1.53% | -1.70% | -1.23% | 0.44% | -0.26% | 0.33% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.