GBP/USD climbs as tariff relief boosts market mood, all eyes on UK CPI

- GBP supported by weaker USD as targeted tariffs ease global trade tension and lift sentiment.

- Traders brace for UK CPI and Reeves’ Spring Budget; any gilt market jitters could weigh on the Sterling.

- Fed officials cautious on inflation outlook, limiting US Dollar downside ahead of key PCE data release.

The Pound Sterling (GBP) is advancing against the US Dollar (USD) on Tuesday due to an upbeat market mood as traders are relieved of United States (US) reciprocal tariffs, which are expected to be targeted on some of the US trading partners. This weakened the Greenback as seen by GBP/USD trading at 1.2950, up 0.22%.

Sterling edges higher to 1.2950 amid calm markets, though looming inflation data and budget risks cap gains

The economic docket is empty on both sides of the Atlantic, with traders eyeing the release of United Kingdom (UK) inflation figures on Wednesday and the UK Spring Budget. The Consumer Price Index (CPI) in February is expected to dip from 3% to 2.9% YoY, while core figures are projected to cool from 3.7% to 3.6% in the twelve months to February.

The UK Chancellor of the Exchequer, Rachel Reeves, is expected to outline spending cuts and belt-tightening measures in the upcoming budget to meet the financial targets.

Francesco Pesole, currency strategist at ING, said, “There's a very fine line not to unnerve the gilt market,” which could knock confidence in the UK and weigh on the pound.

In the US, Federal Reserve (Fed) Governor Adriana Kugler stated the uptick in goods inflation is “unhelpful.” She said, “In certain subcategories, there is evidence that inflation reaccelerated in recent months,” adding that she’s paying close attention to inflation expectations.

Recently, New York Fed President John Williams stated that companies and households are experiencing heightened uncertainty about the future of the economy.

Even though both Fed policymakers struck a neutral tone, GBP/USD has failed to add to recent gains. Fears that inflation in the US could accelerate might prompt traders to buy the US Dollar due to lower chances that the Fed might reduce borrowing costs.

Ahead this week, the US economic docket will feature additional Fed speakers and the release of the Fed’s preferred inflation gauge, the Core Personal Consumption Expenditures (PCE) Price Index.

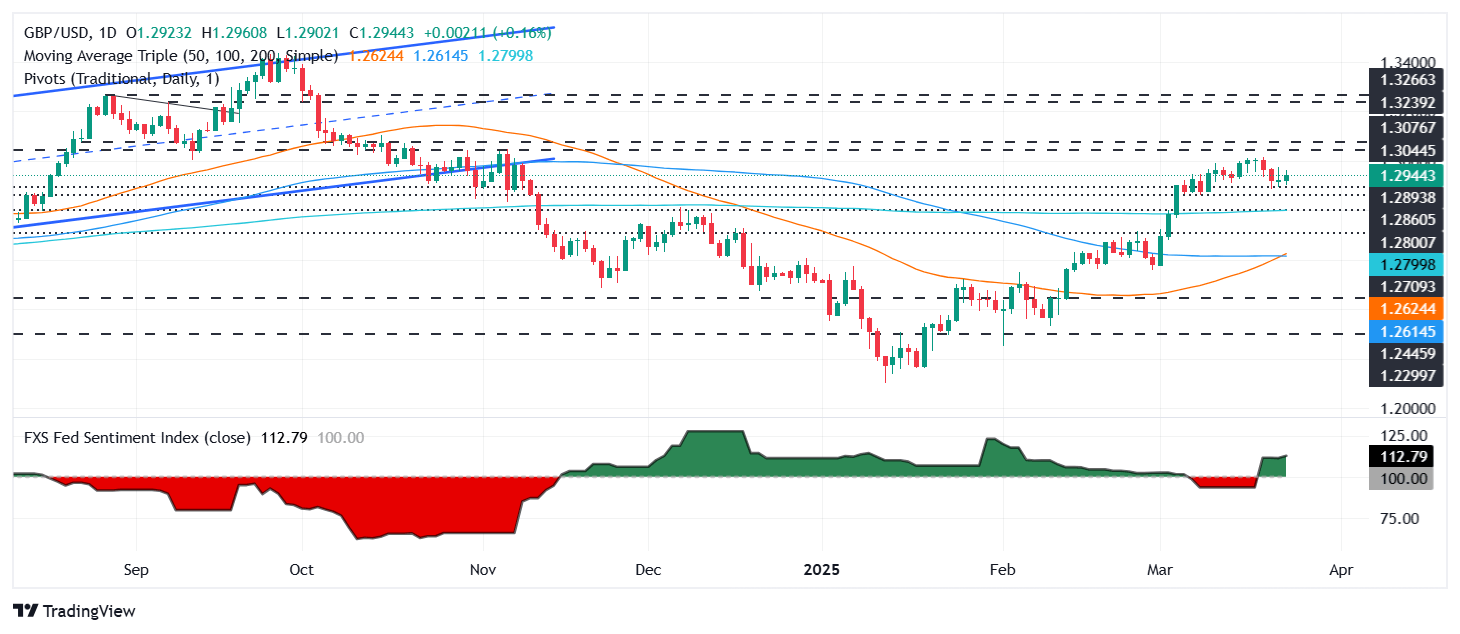

GBP/USD Price Forecast: Technical outlook

GBP/USD has been consolidating near the 1.2900–1.2950 area for the past two days, with bulls remaining unable to decisively break above the 1.3000 level. In that outcome, the pair would resume its bullish bias and challenge November’s 2024 peak at 1.3047. Conversely, if sellers drive the exchange rate below 1.2950, the first support would be the March 24 swing low of 1.2885. A breach of the latter will expose the 200-day Simple Moving Average (SMA) at 1.2799.

British Pound PRICE This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.04% | -0.22% | 0.25% | -0.36% | -0.61% | -0.10% | -0.22% | |

| EUR | -0.04% | -0.37% | -0.32% | -0.36% | -0.67% | -0.10% | -0.22% | |

| GBP | 0.22% | 0.37% | 0.47% | -0.61% | -0.33% | 0.28% | 0.04% | |

| JPY | -0.25% | 0.32% | -0.47% | -0.61% | -0.88% | -0.34% | -0.49% | |

| CAD | 0.36% | 0.36% | 0.61% | 0.61% | -0.20% | 0.26% | 0.14% | |

| AUD | 0.61% | 0.67% | 0.33% | 0.88% | 0.20% | 0.59% | 0.46% | |

| NZD | 0.10% | 0.10% | -0.28% | 0.34% | -0.26% | -0.59% | -0.05% | |

| CHF | 0.22% | 0.22% | -0.04% | 0.49% | -0.14% | -0.46% | 0.05% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.