GBP/USD whips but sees little momentum as markets digest middling Fed Powell comments

- GBP/USD tested lower, but recovered to nearly flat on the day post-Fed.

- Fed held rates steady as rate futures broadly anticipated.

- Fed Chair Powell: the Fed doesn't act until seeing more than we see now.

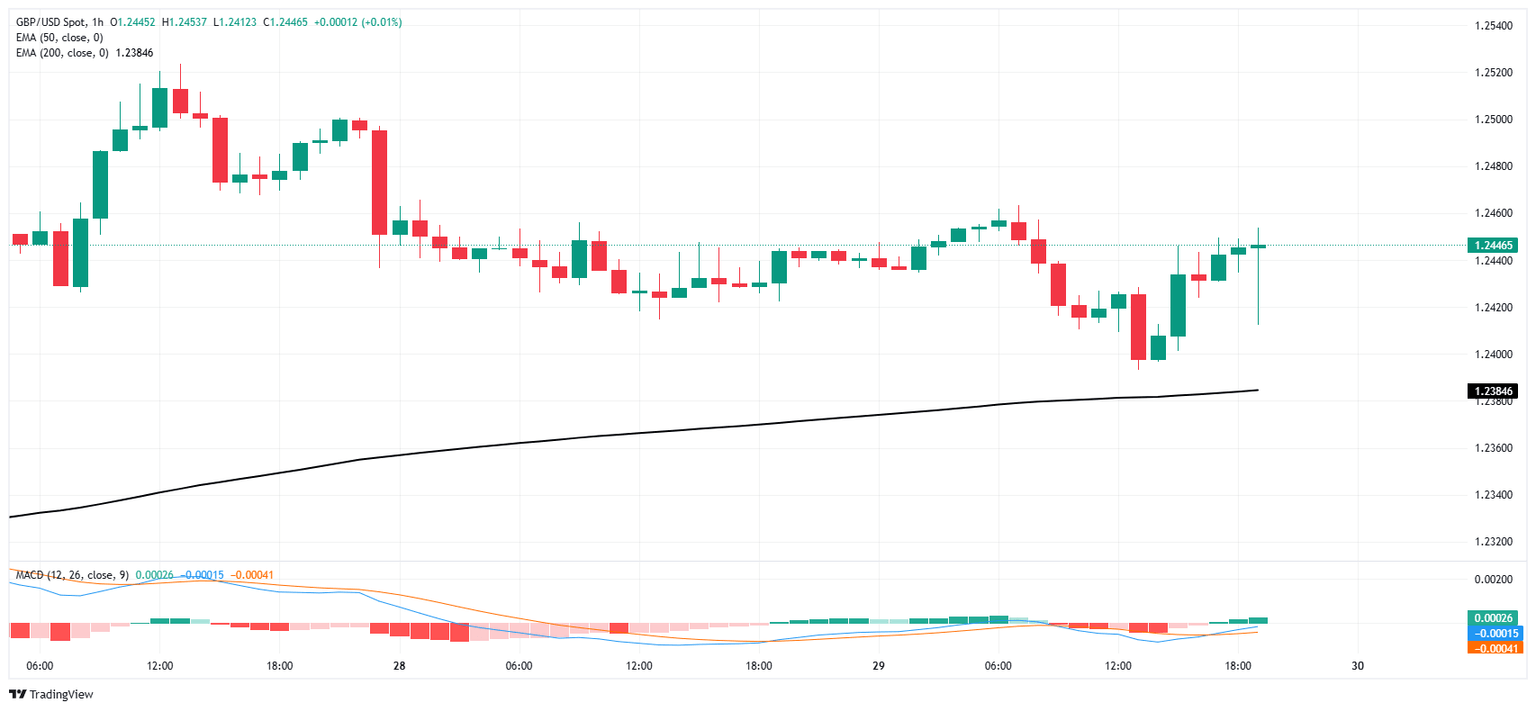

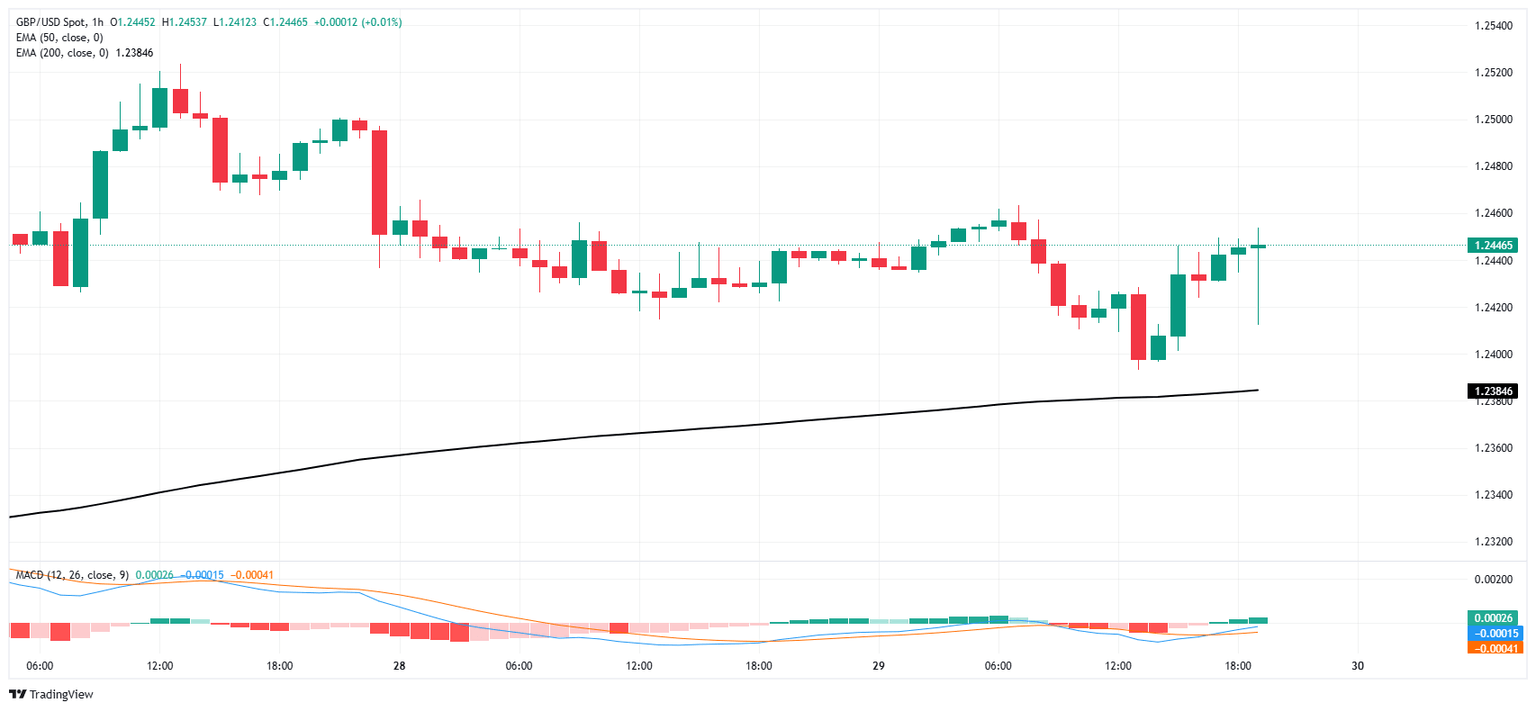

On Wednesday, GBP/USD fluctuated, dipping below 1.2420 before rising back to 1.2450 as the ongoing battle between bulls and bears resulted in less-than-noteworthy intraday volatility. The Federal Reserve (Fed) kept rates unchanged, as expected by rate futures markets, with Fed Chair Jerome Powell emphasizing their data-driven strategy for rate modifications.

Chair Powell highlighted that the Federal Open Market Committee (FOMC) is monitoring the policies enacted by US President Donald Trump closely, but he confirmed that President Trump has not communicated directly with the Fed. As an independent federal entity, the White House exerts minimal influence over the Federal Reserve's policy directions. Additionally, Powell remarked that while inflation is gradually approaching the median target levels, the current economic conditions, alongside concerns regarding President Trump’s extensive trade policies, mean the Fed is not in a hurry to alter the restrictiveness of monetary policy rates.

Furthermore, rate markets have reduced their expectations for Fed rate cuts in 2025. Based on the CME's FedWatch Tool, rate futures markets anticipate no changes in the federal funds rate until at least June.

GBP/USD one-hour chart

Economic Indicator

Fed Interest Rate Decision

The Federal Reserve (Fed) deliberates on monetary policy and makes a decision on interest rates at eight pre-scheduled meetings per year. It has two mandates: to keep inflation at 2%, and to maintain full employment. Its main tool for achieving this is by setting interest rates – both at which it lends to banks and banks lend to each other. If it decides to hike rates, the US Dollar (USD) tends to strengthen as it attracts more foreign capital inflows. If it cuts rates, it tends to weaken the USD as capital drains out to countries offering higher returns. If rates are left unchanged, attention turns to the tone of the Federal Open Market Committee (FOMC) statement, and whether it is hawkish (expectant of higher future interest rates), or dovish (expectant of lower future rates).

Read more.Last release: Wed Jan 29, 2025 19:00

Frequency: Irregular

Actual: 4.5%

Consensus: 4.5%

Previous: 4.5%

Source: Federal Reserve

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.