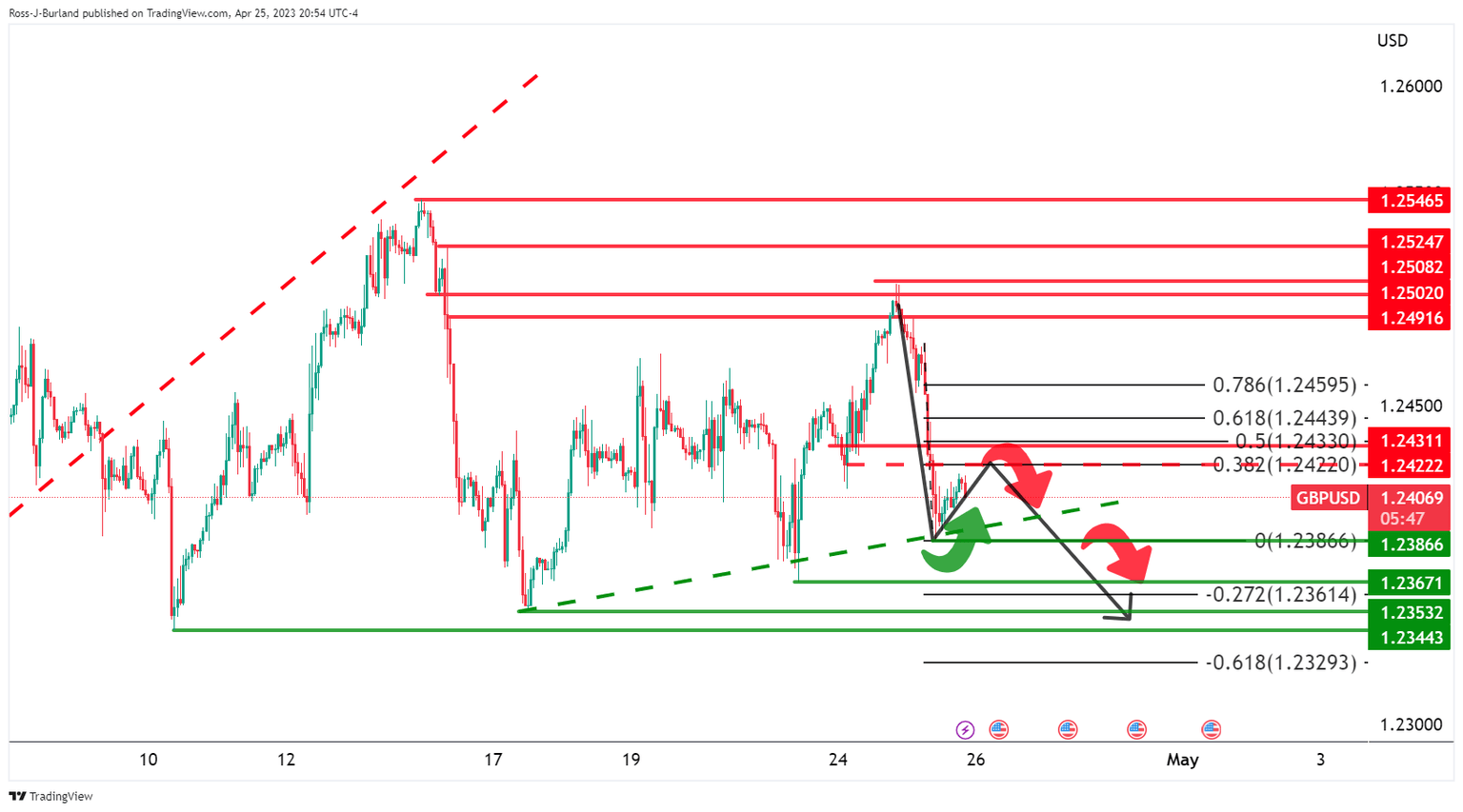

GBP/USD bears could be looking to guard the 1.2420s

- GBP/USD bears are lurking near a potential key resistance area.

- Eyes on a break of structure to the downside on renewed US Dollar strength.

GBP/USD is currently correcting towards a 38.2% Fibonacci retracement level near the 1.2420s as it takes on resistance while the Greenback gives some ground back following Tuesday´s resurgence.

Market sentiment turned risk-averse amid worries about earnings in the banking sector especially which drove the US Dollar higher. The DXY index, which measures the US dollar vs. a basket of currencies, benefitted from the related risk-off flows and touched a high of 101.949.

Plunging deposits at First Republic Bank have reignited worries over the health of the banking sector. Additionally, UBS reported a 52% slide in quarterly income as it prepared to swallow fallen rival Credit Suisse. Meanwhile, a weak consumer confidence report added to the rout in stocks on Wall Street as did the decline in Federal Reserve manufacturing data, supporting the US Dollar for its safe haven qualities.

Meanwhile, analysts at Brown Brothers Harriman explained that the Bank of England Deputy Governor Broadbent defended the bank’s policies. ´´Specifically,´´ the analysts said, ´´he said that the BOE’s QE program during the pandemic was not responsible for current high inflation shock. Broadbent noted that “QE inevitably leads to rapid growth of commercial bank deposits … and that this, in turn, inevitably leads to excessive inflation are not well supported by the evidence.” He added that it was “difficult to see these additional deposits as the principal cause of the inflation that’s followed” and that “very large jumps” in import prices such as energy, “seem the more likely cause.” We concur. Massive waves of QE in the wake of the financial crisis and then the eurozone crisis did not spark inflation.´´

The analysts anticipate another 25 bp hike June 22 is around 80% priced, while odds of one last 25 bp hike top out near 75% for September 21 and so the peak policy rate is seen near 5.0% vs. 4.75% at the start of last week and between 4.50-4.75% at the start of the week before that.

GBP/USD technical analysis

The price is correcting back into what would be a potential resistance area before what could evolve into a downward continuation.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.