GBP/USD attempts a recovery near 1.2450 ahead of US debt-ceiling talks and UK Employment

- GBP/USD has attempted a recovery after building a cushion around 1.2450 as the USD Index has turned volatile.

- The release of the US Retail Sales data will prove more clarity on Federal Reserve’s monetary policy action.

- Bank of England policymakers agreed that they underestimated the strength and persistence of the United Kingdom’s inflation.

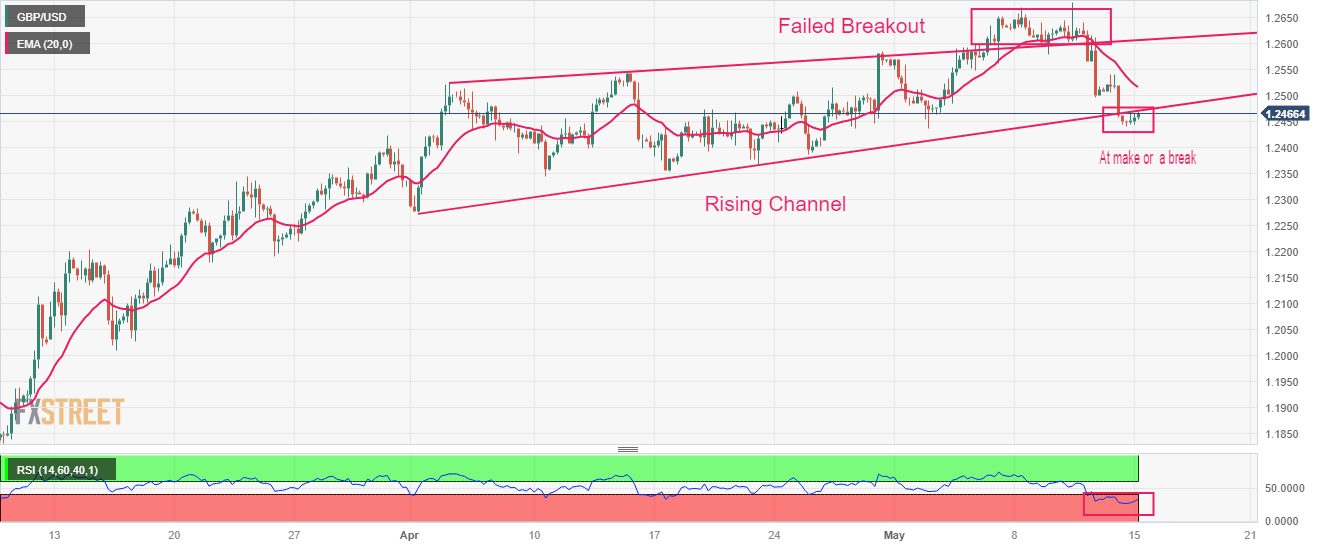

- GBP/USD is at a make or a break level below the Rising Channel pattern, therefore, sheer volatility is widely anticipated

GBP/USD is gathering strength for a recovery move from near the 1.2450 support as the US Dollar Index (DXY) has demonstrated a loss in the upside momentum after printing a high of 102.75 in the early European session. The Cable is expected to gain strength after surpassing the immediate resistance of 1.2480.

S&P500 futures have added nominal gains in the Asian session after a mild bearish Friday, portraying a recovery in the risk appetite of the market participants. The appeal for risk-perceived assets has improved as investors are shifting their focus towards solidifying expectations of a pause in the policy-tightening regime by the Federal Reserve (Fed).

The Pound Sterling is likely to remain active ahead of the United Kingdom’s Employment data, which is scheduled for Tuesday. Shortage of labor in the UK market has been a major reason behind its tight labor market conditions.

US debt-ceiling talks remain a key event

After the postponement of Friday’s US debt-ceiling negotiations, US President Joe Biden and Republican House of Representatives Joseph McCarthy are set to meet again on Tuesday. The former wants the approval of raising the Federal borrowing cap but not at the cost of the President’s initiatives and the latter is ready to approve an increment in debt-ceiling if US President Joe Biden agrees to cut spending initiatives to reduce the budget deficit.

The Congressional Budget Office warned on Friday that the United States faced a "significant risk" of defaulting on payment obligations within the first two weeks of June without raising the government's $31.4 trillion debt ceiling, adding that payment operations will remain uncertain throughout May.

Also, IMF has warned that a U.S. default would have "serious repercussions" for the U.S. economy.

US Retail Sales in spotlight

Investors’ expectations for a pause in the policy-tightening process by the Federal Reserve are skyrocketing amid support from major United States economic indicators. US inflation and prices offered by producers for goods and services at factory gates also known as Producer Price Index (PPI) have slowed down, and labor market conditions are softening due to tight credit conditions and a bleak economic outlook, which indicates that the Federal Reserve will halt its aggressive policy-tightening spree to safeguard the economy from collateral damage.

For further guidance, investors will keep an eye on the monthly Retail Sales data (April). The economic data is seen expanding by 0.7% vs. a contraction of 0.6%. A recovery in retail demand could ease expectations of a pause in the aggressive rate-hike spell by the Federal Reserve.

Bank of England lays down arms in front of stubborn UK inflation

After hiking interest rates for the 12th consecutive time, Bank of England policymakers agreed that they underestimated the strength and persistence of the United Kingdom’s inflation. Bank of England Governor Andrew Bailey pushed interest rates by 25 basis points (bps) to 4.5%. Regarding inflation guidance, Bank of England policymakers believe that UK’s inflation will come down to 2% by early 2025. The current UK inflation situation might result in the missing of UK Prime Minister Rishi Sunak’s pledge of halving UK inflation by the end of CY2023.

Going forward, UK’s Employment data (April) will be keenly watched. Three-month Unemployment Rate is seen unchanged at 3.8%. Average Earnings excluding bonuses are expected to accelerate to 6.8% from the former release of 6.6%. This could fuel inflationary pressures further. Claimant Count Change is seen declining by 10.8K.

GBP/USD technical outlook

GBP/USD has slipped below the Rising Channel chart pattern formed on a four-hour scale. The Cable is at a make or a break level, therefore, sheer volatility is widely anticipated. The 20-period Exponential Moving Average (EMA) at 1.2516 has acted as a major barricade for the Pound Sterling bulls.

The Relative Strength Index (RSI) (14) is oscillating in the bearish range of 20.00-40.00, advocating more weakness ahead.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.