GBP/JPY testing up into 182.50 in Monday relief bid for Pound Sterling

- The GBP/JPY is catching a Monday bid, rebounding from last week's dip.

- It's a heavy week on the economic calendar for the Pound Sterling, with wages, inflation, and Retail Sales inbound.

- Dovish comments from BoE officials are capping upside potential for the GBP.

The GBP/JPY is seeing gains for Monday, trading into 182.50 after Friday's dip into 181.27 on broad-market risk aversion. The Pound Sterling (GBP) is catching some early-week lift against the Japanese Yen (JPY) to kick off the new trading week as Guppy traders brace for a tense showing on the economic calendar this week.

BoE’s Pill: We have done a lot on interest rates

UK earnings figures are due on Tuesday, and investors are forecasting total Average Earnings (plus bonuses) to dip slightly from 8.5% to 8.3%, with Average Earnings (excluding bonuses) seen holding steady at 7.8% for the quarter into August.

UK Consumer Price Index (CPI) inflation figures are due on Wednesday, with markets expecting the monthly figure for September ticking up slightly from 0.3% to 0.4%, and the annualized figure for September is forecast to decline slightly from 6.7% to 6.5%.

Over the horizon, Friday has UK Retail Sales on the docket, where investors are forecasting a -0.1% decline in September after the previous month's 0.4%.

GBP/JPY Technical Outlook

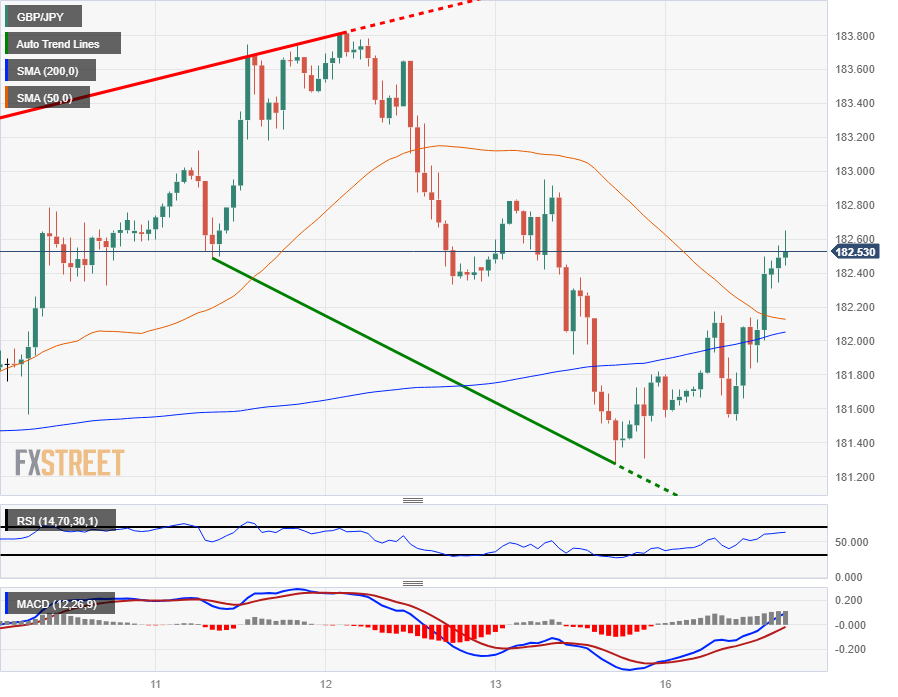

The GBP/JPY is still down 0.7% from last week's peak at 183.80, but the pair is seeing lift from last week's swing low after catching a rebound from the 200-hour Simple Moving Average (SMA). An extended bullish push could face difficulties in the near-term with the 50-hour SMA pulling down price action from below 182.20.

Longer-term, the Guppy sees constraining price action with the pair waffling just south of the 50-day SMA, and an upside break will need firm bidding support to lift the GBP/JPY back into the year's highs near 186.77 set back in August.

GBP/JPY Hourly Chart

GBP/JPY Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.