GBP/JPY strengthens ahead of UK CPI as diverging monetary policies and Yen weakness supports gains

- GBP/JPY trades near 199.30 on Tuesday, supported by diverging central bank policies and broader Yen weakness.

- Focus shifts to UK CPI data on Wednesday, as the BoE monitors for signs of tariff-driven inflation pressure.

- GBP/JPY eyes psychological resistance at 200 amid tariff uncertainty ahead of US-Japan trade talks on Friday.

The British Pound (GBP) continues to appreciate against the Japanese Yen (JPY) on Tuesday, as diverging central bank policies and rising geopolitical tensions support bullish momentum.

At the time of writing, GBP/JPY is trading near 199.30 as focus shifts to UK inflation data on Wednesday.

The Bank of England (BoE) is closely monitoring the June release of the Consumer Price Index (CPI) report in search of signs that tariff-related cost pressures are contributing to persistent inflation.

With the BoE holding interest rates at 4.25% and the Bank of Japan (BoJ) maintaining its ultra-dovish stance at 0.5%, the widening interest rate differential continues to favor the Pound over the Yen.

Adding to yen weakness, Japanese Prime Minister Shigeru Ishiba is scheduled to meet with US Treasury Secretary Scott Bessent on Friday, in a last-minute attempt to revive trade talks ahead of the August tariff deadline.

While the UK currently faces a 10% blanket tariff on exports to the US, President Donald Trump has threatened to raise tariffs on Japanese imports to 25%, covering nearly all categories not already affected by sector-specific duties. At present, US tariffs on steel and aluminum from Japan stand at 50%, while auto parts face a 25% levy.

As an export-reliant economy, Japan remains especially vulnerable to trade friction. The threat of escalating tariffs has compelled the BoJ to maintain a dovish policy stance, diminishing prospects for a rate hike and reinforcing the structural headwinds facing the Yen.

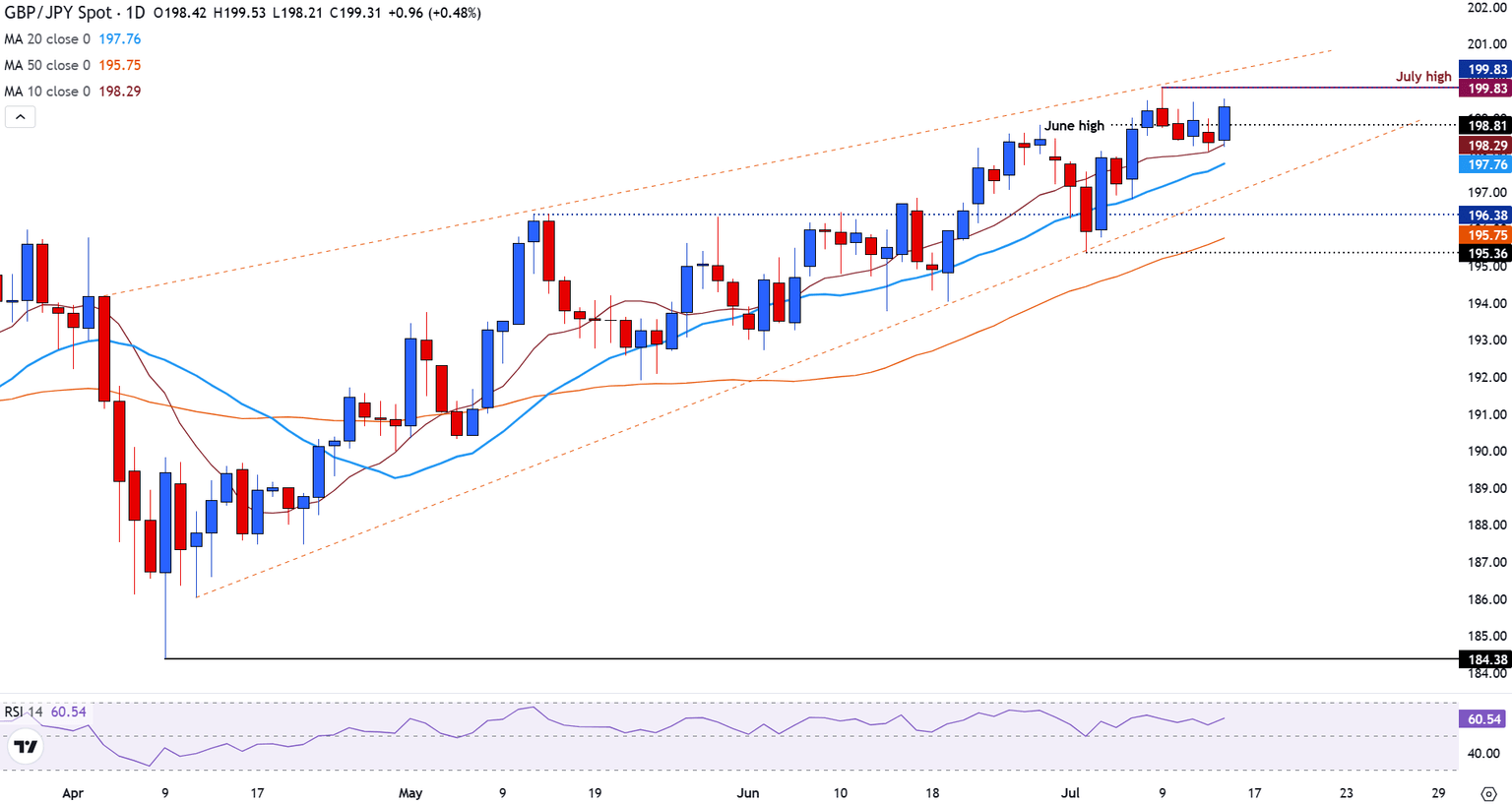

GBP/JPY technical analysis

GBP/JPY is rising toward the upper boundary of its ascending channel near 199.80, just above the June high at 198.81, suggesting continued bullish interest.

The channel that has been forming since April has continued to provide resistance for recent price action and may remain a catalyst for the near-term move.

With the 200 psychological level in sight, the pair remains well-supported above key moving averages, providing additional support for GBP/JPY. Immediate support is found at the 10-day Simple Moving Average (SMA) at 198.29, while the 20-day SMA sits at 197.77. A move lower could bring the 50-day SMA at 195.75 into play, with the potential to push prices back toward the 195.00 psychological level.

GBP/JPY daily chart

Economic Indicator

Core Consumer Price Index (YoY)

The United Kingdom (UK) Core Consumer Price Index (CPI), released by the Office for National Statistics on a monthly basis, is a measure of consumer price inflation – the rate at which the prices of goods and services bought by households rise or fall – produced to international standards. The YoY reading compares prices in the reference month to a year earlier. Core CPI excludes the volatile components of food, energy, alcohol and tobacco. The Core CPI is a key indicator to measure inflation and changes in purchasing trends. Generally, a high reading is seen as bullish for the Pound Sterling (GBP), while a low reading is seen as bearish.

Read more.Next release: Wed Jul 16, 2025 06:00

Frequency: Monthly

Consensus: 3.5%

Previous: 3.5%

Source: Office for National Statistics

The Bank of England is tasked with keeping inflation, as measured by the headline Consumer Price Index (CPI) at around 2%, giving the monthly release its importance. An increase in inflation implies a quicker and sooner increase of interest rates or the reduction of bond-buying by the BOE, which means squeezing the supply of pounds. Conversely, a drop in the pace of price rises indicates looser monetary policy. A higher-than-expected result tends to be GBP bullish.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, also known as ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Tammy Da Costa, CFTe®

FXStreet

Tammy is an economist and market analyst with a deep passion for financial markets, particularly commodities and geopolitics.