GBP/JPY searching for 195.00 as pair tests high side

- GBP/JPY holding above 194.50 as markets continue to sell Yen.

- BoE still stands pat on interest rates, but officials are slowly changing camps.

- Trading week to wrap up with Friday’s UK GDP print.

GBP/JPY is holding steady, churning above 194.50 as the Japanese Yen continues to soften across the board in the wake of “Yenterventions” from the Bank of Japan (BoJ). The UK’s Bank of England (BoE) held rates as markets broadly expected, but Monetary Policy Committee (MPC) votes shifted one more towards a rate cut vote.

The BoE voted 7-to-2 to keep rates in place early Thursday. Two members of the MPC voted for a rate cut, with Sir David Ramsden, Deputy Governor for Markets and Banking, joining Dr. Swati Dhingra, an external MPC member of the BoE, in voting for a 25-basis-point cut. Markets initially expected an 8-to-1 vote outcome, with Dr. Dhingra expected to be the singular rate dove.

Friday’s UK Gross Domestic Product (GDP) will round out the trading week, with markets forecasting a rebound in quarterly UK growth figures. Q1 UK GDP is expected to climb 0.4% QoQ, compared to the previous quarter’s -0.3% contraction.

Further public appearances on Friday from BoE policymakers, including BoE Chief Economist Huw Pill and Dr. Dhingra, are expected throughout the day.

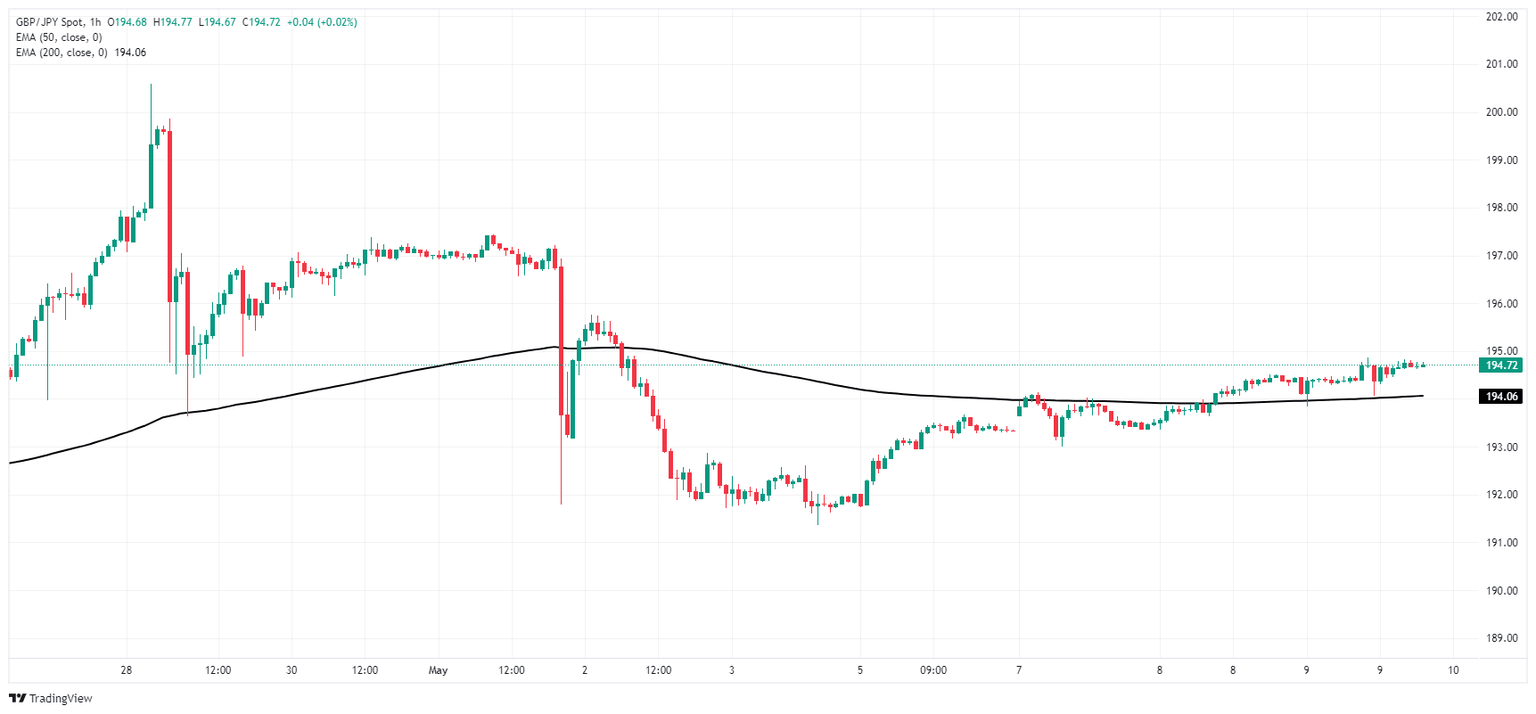

GBP/JPY technical outlook

The Guppy is slowly churning further into bullish territory above the 200-hour Exponential Moving Average (EMA) near the 194.00 handle. The pair is building up a short-term price floor from 194.50 as the pair makes a break for 195.00. GBP/JPY is up around 1.8% since hitting a near-term price floor below 191.50 following last week’s 3% tumble from the 197.50 region.

GBP/JPY hourly chart

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.