GBP/JPY retreats from near one-year highs as Yen regains ground

- GBP/JPY eases from near one-year highs, retreating after rising to 199.83 — the highest level since July 2024.

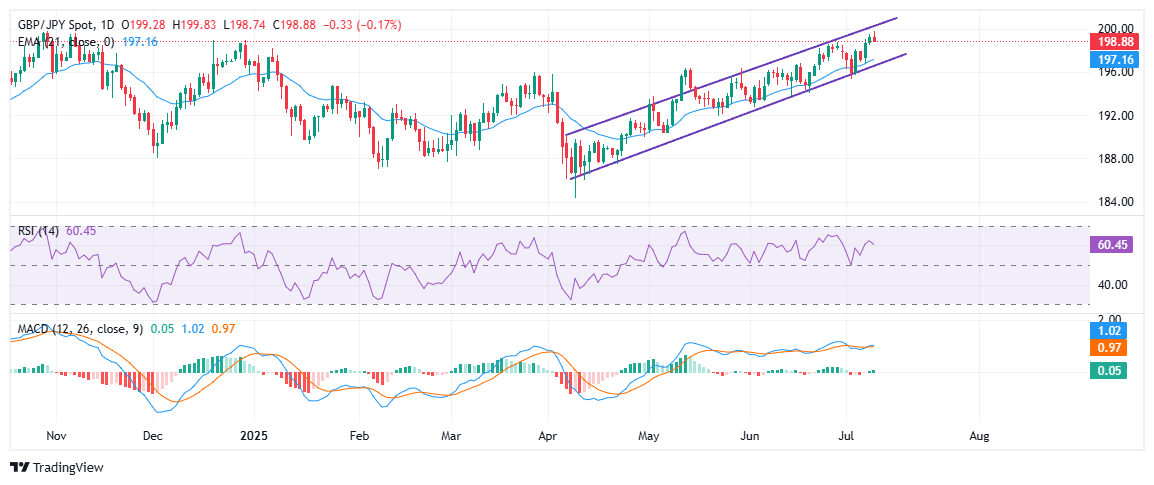

- The technical picture remains bullish, with GBP/JPY holding above the 21-day EMA at 197.15.

- RSI hovers near 60, indicating sustained bullish momentum, while the MACD maintains a positive crossover.

The British Pound (GBP) eases slightly against the Japanese Yen (JPY) on Wednesday, retreating after rising to 199.83 — its highest level since late July 2024. The mild pullback appears to be driven by profit-taking and a technical correction, while the Japanese Yen regains some strength across the board after being pressured earlier this week by renewed US tariff threats and weak wage data.

The GBP/JPY is drifting lower during the American trading hours. At the time of writing, the cross is trading around 198.90, down 0.17% on the day, as bulls take a breather following the pair’s strong rally to near one-year highs.

On the trade front, Japan is navigating heightened pressure from Washington’s aggressive tariff campaign. US President Trump has announced sweeping 25% tariffs on all Japanese imports, set to take effect on August 1. In contrast, the UK has emerged as one of the few early movers to secure a deal with the US, having finalized an Economic Prosperity Agreement that lowers tariffs on key exports like steel, aluminum, and automobiles. The deal has helped cushion the British Pound against broader trade-related volatility, while the Japanese Yen remains under pressure as Tokyo races to negotiate similar exemptions before the August deadline.

From a technical perspective, the GBP/JPY pair remains in a well-defined ascending channel, with prices currently pulling back after testing the upper boundary, just shy of the psychological 200.00 level. The modest decline appears to be part of a technical correction following the pair’s extended bullish run.

The broader uptrend remains intact, as the pair continues to trade above the 21-day Exponential Moving Average (EMA) at 197.16, which closely aligns with the lower boundary of the ascending channel and has consistently served as dynamic support since early May. A decisive break below this level could open the door for a deeper correction toward the June 19 low near 194.00, with further downside risk if that level fails to hold. Until then, the overall bullish structure remains in place.

Momentum indicators offer a mixed-to-positive bias. The Relative Strength Index (RSI) is hovering around 60, suggesting bullish momentum remains but is not yet in overbought territory. Meanwhile, the MACD indicator shows a positive crossover, with the MACD line (blue) holding just above the signal line (orange), reflecting continued bullish momentum. However, the narrowing gap between the lines suggests a slowing of upside momentum in the short term. Traders should watch for a daily close above 200.00 for potential breakout confirmation, while a close below 197.00 may open the door for a deeper pullback toward 194.50–195.00 support.

Japanese Yen PRICE Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the Canadian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.09% | -0.04% | -0.22% | 0.20% | -0.17% | -0.01% | -0.25% | |

| EUR | -0.09% | -0.11% | -0.31% | 0.12% | -0.22% | -0.10% | -0.22% | |

| GBP | 0.04% | 0.11% | -0.14% | 0.23% | -0.19% | -0.05% | -0.20% | |

| JPY | 0.22% | 0.31% | 0.14% | 0.38% | 0.04% | 0.19% | -0.02% | |

| CAD | -0.20% | -0.12% | -0.23% | -0.38% | -0.31% | -0.21% | -0.33% | |

| AUD | 0.17% | 0.22% | 0.19% | -0.04% | 0.31% | 0.12% | 0.00% | |

| NZD | 0.01% | 0.10% | 0.05% | -0.19% | 0.21% | -0.12% | -0.15% | |

| CHF | 0.25% | 0.22% | 0.20% | 0.02% | 0.33% | -0.01% | 0.15% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

Author

Vishal Chaturvedi

FXStreet

I am a macro-focused research analyst with over four years of experience covering forex and commodities market. I enjoy breaking down complex economic trends and turning them into clear, actionable insights that help traders stay ahead of the curve.