GBP/JPY retreats as safe-haven demand rises ahead of Trump's tariff deadline

- GBP/JPY edges lower as safe-haven demand rises ahead of President Trump's July 9 tariff deadline.

- UK Prime Minister Keir Starmer faces political pressure from the Labour Party, limiting upside potential for Sterling.

- GBP/JPY retreats as technical resistance firms around 198.00

The Japanese Yen (JPY) is strengthening against the British Pound (GBP) on Friday as markets turn cautious ahead of the weekend.

With GBP/JPY retreating after failing to gain traction above the psychologically significant 198.00 level on Thursday, Friday's price action has been driven by an increase in the demand for safe havens ahead of US President Donald Trump's tariff deadline on July 9.

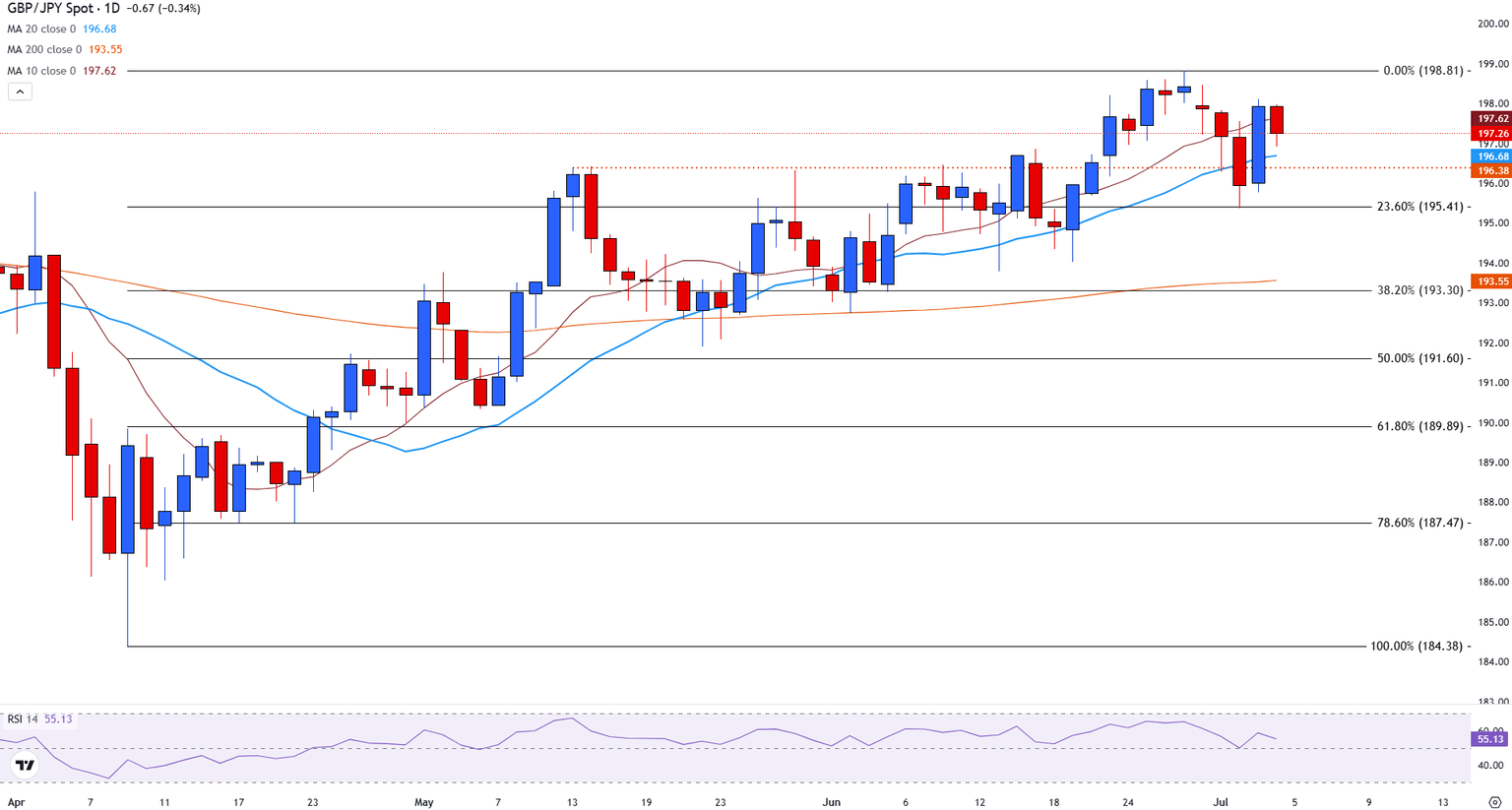

At the time of writing, GBP/JPY is trading below the 10-day Simple Moving Average (SMA), providing near-term resistance at 197.61. Immediate support is found at the 197.00 psychological round number, a break of which could trigger a deeper correction toward the 23.6% Fibonacci retracement level of the April-July uptrend at 195.41.

GBP/JPY remains vulnerable to the broader macro-fundamental backdrop

UK Prime Minister Keir Starmer is under increasing scrutiny after recent compromises on welfare and growing disagreements within the Labour Party over budget strategy and proposed spending cuts.

These internal challenges, coupled with concerns about ballooning deficits and the lack of a well-defined tax plan, have been hindering momentum in the GBP/JPY exchange rate.

Meanwhile, in Japan, the Yen remains under pressure due to the Bank of Japan’s (BoJ) ongoing commitment to an ultra-loose monetary policy. This approach stands in contrast to the tightening measures seen in other major economies.

Furthermore, renewed trade tensions with the United States resulting from Japan's reluctance to import rice from the US have triggered a trade war between the two nations. With concerns about potential tariff hikes and export restrictions related to technology and automobiles ahead of the July 9 tariff deadline, capping Yen's gains.

GBP/JPY retreats as technical resistance firms around 198.00

On the daily chart below, GBP/JPY remains in a generally bullish structure. Price action currently remains above its 200-day SMA, offering longer-term support at 193.55.

However, a clear break of the 198.00 handle is required before the pair can confidently continue along its upward trajectory. The ability to do so would then bring the recent June swing high back into play at 198.81.

GBP/JPY daily chart

Meanwhile, the Relative Strength Index (RSI) sits near 55, indicating neutral momentum with a slight bullish tilt.

If the pair manages to clear resistance around 198.00–198.81, it could resume its uptrend, while a drop below 195.41 might expose deeper Fibonacci supports, particularly near 193.30 and the 200-day MA.

Risk sentiment FAQs

In the world of financial jargon the two widely used terms “risk-on” and “risk off'' refer to the level of risk that investors are willing to stomach during the period referenced. In a “risk-on” market, investors are optimistic about the future and more willing to buy risky assets. In a “risk-off” market investors start to ‘play it safe’ because they are worried about the future, and therefore buy less risky assets that are more certain of bringing a return, even if it is relatively modest.

Typically, during periods of “risk-on”, stock markets will rise, most commodities – except Gold – will also gain in value, since they benefit from a positive growth outlook. The currencies of nations that are heavy commodity exporters strengthen because of increased demand, and Cryptocurrencies rise. In a “risk-off” market, Bonds go up – especially major government Bonds – Gold shines, and safe-haven currencies such as the Japanese Yen, Swiss Franc and US Dollar all benefit.

The Australian Dollar (AUD), the Canadian Dollar (CAD), the New Zealand Dollar (NZD) and minor FX like the Ruble (RUB) and the South African Rand (ZAR), all tend to rise in markets that are “risk-on”. This is because the economies of these currencies are heavily reliant on commodity exports for growth, and commodities tend to rise in price during risk-on periods. This is because investors foresee greater demand for raw materials in the future due to heightened economic activity.

The major currencies that tend to rise during periods of “risk-off” are the US Dollar (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Dollar, because it is the world’s reserve currency, and because in times of crisis investors buy US government debt, which is seen as safe because the largest economy in the world is unlikely to default. The Yen, from increased demand for Japanese government bonds, because a high proportion are held by domestic investors who are unlikely to dump them – even in a crisis. The Swiss Franc, because strict Swiss banking laws offer investors enhanced capital protection.

Author

Tammy Da Costa, CFTe®

FXStreet

Tammy is an economist and market analyst with a deep passion for financial markets, particularly commodities and geopolitics.