GBP/JPY recovering from Tuesday's lows, eyes on 184.00 handle

- The GBP/JPY is pushing higher after getting knocked lower in Tuesday trading, looking to chalk in a green day.

- UK GDP figures around the corner for Wednesday, investors are looking to position ahead of industrial production figures.

- BoJ comments are bolstering JPY traders eager for hawkish policy changes.

The GBP/JPY pair is recovering into the green for Tuesday, testing the 183.70 region after slipping to the 183.00 handle earlier in the session.

The Guppy kicked off the trading day near 183.45, briefly clambering above the 183.90 level before getting knocked lower in European trading. The Pound Sterling (GBP) faces headwinds on the back of a dovish Bank of England (BoE), and a firming Yen (JPY) on the back of recent hawkish Bank of Japan (BoJ) comments is complicating matters.

The BoE has struck a notably softer tone recently, highlighted by the BoE’s Governor Andrew Bailey noting recently that the UK central bank is quickly approaching the peak of the rate hike cycle. Inflation remains a stubbornly sticky complication for the UK, but the BoE is caught between a rock and a hard place, as too much action on interest rate hikes could pose a threat to the British economy.

On the Yen side, the BoJ’s Governor Kazuo Ueda hit news wires recently alluding to the eventual end of the Japanese central bank’s negative interest rate policy if data continues to improve into the end of the year. Before major policy adjustments can be made, however, the BoJ needs to be confident that it has successfully attained its 2% inflation target alongside rising wages. While Japanese inflation has been above the 2% target for some time, inflation is expected to undershoot BoJ targets in the coming months, and market expectations of rate adjustments may be premature.

UK GDP, industrial production figures in the pipe

Investors are jostling for position ahead of a smattering of mid-tier UK economic data due on Wednesday. Gross Domestic Product (GDP) figures for the month of July are expected to decline 0.2% versus the previous month’s 0.5% increase, and Industrial Production for July is likewise forecast to decline 0.6% versus the previous month’s growth of 1.6%.

UK Manufacturing Production for July is also anticipated to decline by 1% after climbing 2.4% in June, while the annualized figure is expected to slide from 3.1% to 2.7%.

GBP/JPY technical outlook

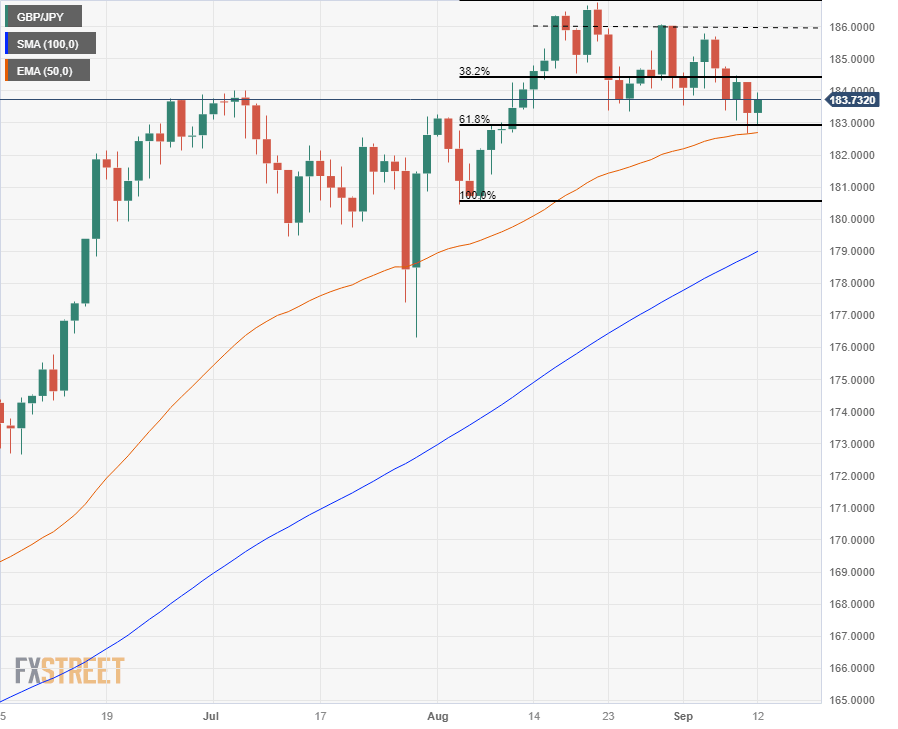

The Guppy is pushing upwards for Tuesday, testing 183.70 while a descending 100-hour Simple Moving Average (SMA) is providing resistance as it punches into 183.80.

The Pound Sterling slipped against the Yen from August’s peak just beneath the 187.00 major handle and is currently trapped between the 38.2% and 61.8% Fibonacci retracement levels from August’s swing low into 180.60, at 184.40 and 183.00 respectively, while the 50-day Exponential Moving Average (EMA) is lifting to provide dynamic support as the indicator consolidates with the 61.8% Fibonacci level.

GBP/JPY daily chart

GBP/JPY technical levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.