GBP/JPY Price Forecast: Looks set for fresh rally above 212.20

- GBP/JPY strengthens on the Japanese Yen's continued underperformance.

- BoJ’s Ueda has kept the door open for further interest rate hikes.

- The Pound Sterling is expected to remain on the sidelines in a light UK economic calendar week.

The GBP/JPY pair posts a fresh multi-year high at 212.15 during the Asian trading session on Tuesday. The pair trades firmly as the Japanese Yen (JPY) underperforms across the board, even as Bank of Japan (BoJ) Governor Kazuo Ueda has signaled that there will be more interest rate hikes in the near term.

Japanese Yen Price Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the weakest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.06% | -0.05% | 0.05% | 0.02% | -0.17% | -0.18% | -0.03% | |

| EUR | 0.06% | 0.02% | 0.09% | 0.08% | -0.10% | -0.12% | 0.03% | |

| GBP | 0.05% | -0.02% | 0.08% | 0.07% | -0.12% | -0.13% | 0.01% | |

| JPY | -0.05% | -0.09% | -0.08% | -0.03% | -0.21% | -0.23% | -0.08% | |

| CAD | -0.02% | -0.08% | -0.07% | 0.03% | -0.18% | -0.20% | -0.05% | |

| AUD | 0.17% | 0.10% | 0.12% | 0.21% | 0.18% | -0.01% | 0.13% | |

| NZD | 0.18% | 0.12% | 0.13% | 0.23% | 0.20% | 0.01% | 0.14% | |

| CHF | 0.03% | -0.03% | -0.01% | 0.08% | 0.05% | -0.13% | -0.14% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

“BoJ expected to continue raising interest rates if economy and prices move in line with our forecast,” Governor Ueda said on Monday, and added that adjusting the degree of monetary support will help achieve “sustained growth and stable inflation”.

This week, investors will focus on the Overall Household Spending data for November, which will be published on Friday. The data is expected to have declined at a moderate pace of 1% against a 3% contraction in October.

Meanwhile, the Pound Sterling (GBP) trades higher against its peers, except antipodeans, as the market sentiment turns positive after the risks of a United States (US)-Venezuela clash subsiding. The British currency is expected to be majorly driven by market expectations for the Bank of England’s (BoE)monetary policy outlook amid a light United Kingdom (UK) economic calendar week.

GBP/JPY technical analysis

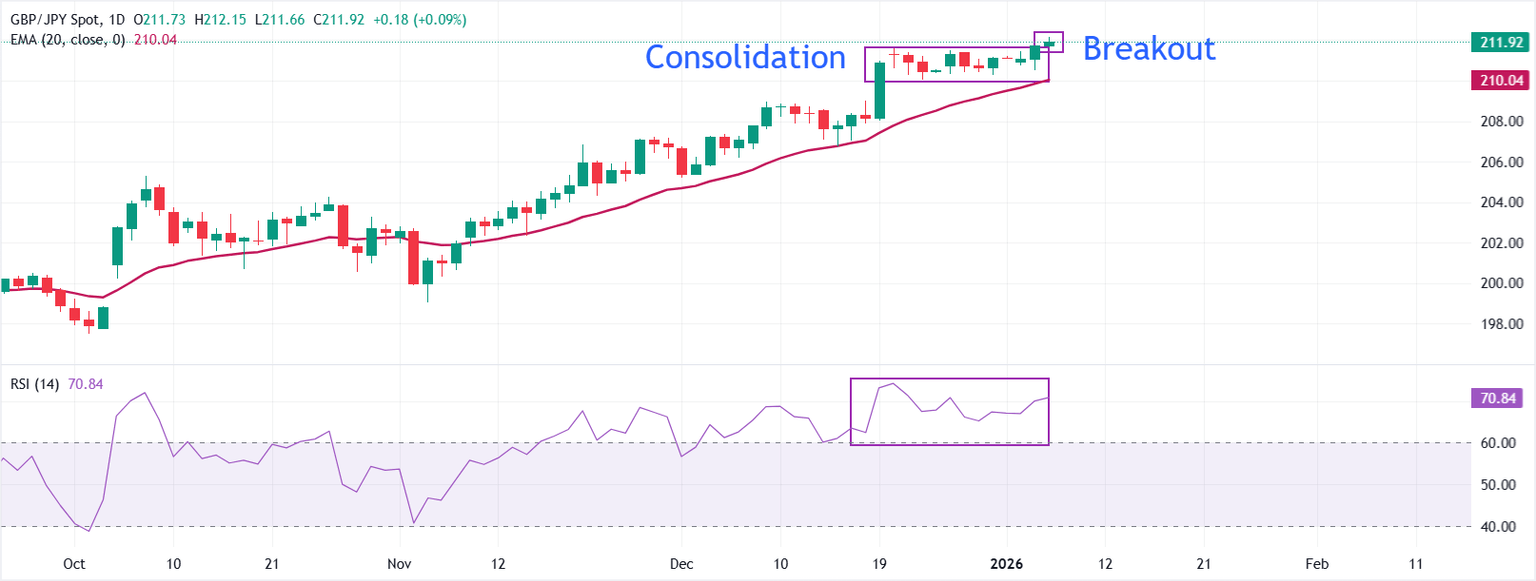

In the daily chart, GBP/JPY trades at 211.92 as of writing. The 20-day Exponential Moving Average (EMA) rises and provides support at 210.04. Price holds above this rising gauge, preserving the bullish bias.

The 14-day Relative Strength Index (RSI) at 70.84 is positive but carries risks of stretched momentum.

As long as the pair remains above the ascending 20-day EMA, the trend is positive and could extend towards 215.00. While a close below 210.04 could invite a corrective pullback towards the December 19 low of 208.00.

(The technical analysis of this story was written with the help of an AI tool.)

Bank of Japan FAQs

The Bank of Japan (BoJ) is the Japanese central bank, which sets monetary policy in the country. Its mandate is to issue banknotes and carry out currency and monetary control to ensure price stability, which means an inflation target of around 2%.

The Bank of Japan embarked in an ultra-loose monetary policy in 2013 in order to stimulate the economy and fuel inflation amid a low-inflationary environment. The bank’s policy is based on Quantitative and Qualitative Easing (QQE), or printing notes to buy assets such as government or corporate bonds to provide liquidity. In 2016, the bank doubled down on its strategy and further loosened policy by first introducing negative interest rates and then directly controlling the yield of its 10-year government bonds. In March 2024, the BoJ lifted interest rates, effectively retreating from the ultra-loose monetary policy stance.

The Bank’s massive stimulus caused the Yen to depreciate against its main currency peers. This process exacerbated in 2022 and 2023 due to an increasing policy divergence between the Bank of Japan and other main central banks, which opted to increase interest rates sharply to fight decades-high levels of inflation. The BoJ’s policy led to a widening differential with other currencies, dragging down the value of the Yen. This trend partly reversed in 2024, when the BoJ decided to abandon its ultra-loose policy stance.

A weaker Yen and the spike in global energy prices led to an increase in Japanese inflation, which exceeded the BoJ’s 2% target. The prospect of rising salaries in the country – a key element fuelling inflation – also contributed to the move.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.