GBP/USD stalls near 1.3500 as strong US data, risk-off mood bite

- GBP/USD hovers near 1.3495 as strong ISM Services PMI lifts the US Dollar despite mixed labor signals.

- Rising VIX reflects growing risk aversion, weighing on the Sterling due to its equity-linked correlation.

- Traders focus on Jobless Claims and NFPs as UK data remains scarce this week.

The Pound Sterling (GBP) is down 0.10% on Wednesday against the US Dollar (USD) amid a scarce economic docket in the United Kingdom (UK) and following a good employment report in the United States. At the time of writing, GBP/USD trades at 1.3486 after hitting a daily high of 1.3516.

Sterling trades flat as upbeat US services data and rising volatility support the Dollar, pressuring Cable

Market mood is mildly risk-off as the CBOE Volatility Index (VIX) shows traders are buying insurance against a reversal in US equities, with VIX posting nearly 2% gains.

The ISM Services PMI rose sharply in December, showing that business activity in the services sector is strengthening. The index improved from 52.6 to 54.4, exceeding estimates of 52.3. Insights of the survey showed that the Employment subcomponent improved from 48.9 to 52, while Prices Paid decreased from 65.4 to 64.3.

At the same time, the Department of Labor revealed the November JOLTS Job Openings report, which showed that vacancies dropped from October’s 7.449 million to 7.146 million.

Earlier, the ADP Employment Change report for December revealed that the economy added 41,000 jobs below estimates of 47,000 but an improvement compared with November’s print, which showed companies slashed 29,000 jobs.

Following the data releases, the Greenback bounced off daily lows, exerting pressure on Sterling. The US Dollar Index (DXY), which tracks the performance of the American currency versus other six, is up 0.06% to 98.65.

In the meantime, Cable is also pressured by investors turning risk-averse, as it has correlated positively with global equity markets. A scarce economic docket in the UK would keep traders focused on US economic developments and political woes.

Ahead, US Initial Jobless Claims for the week ending January 3 are expected to increase from 199K to 210K. Besides this, eyes are on the release of December’s Nonfarm Payroll figures on Friday, with economists projecting the creation of 60K jobs, beneath the previous reading of 64K.

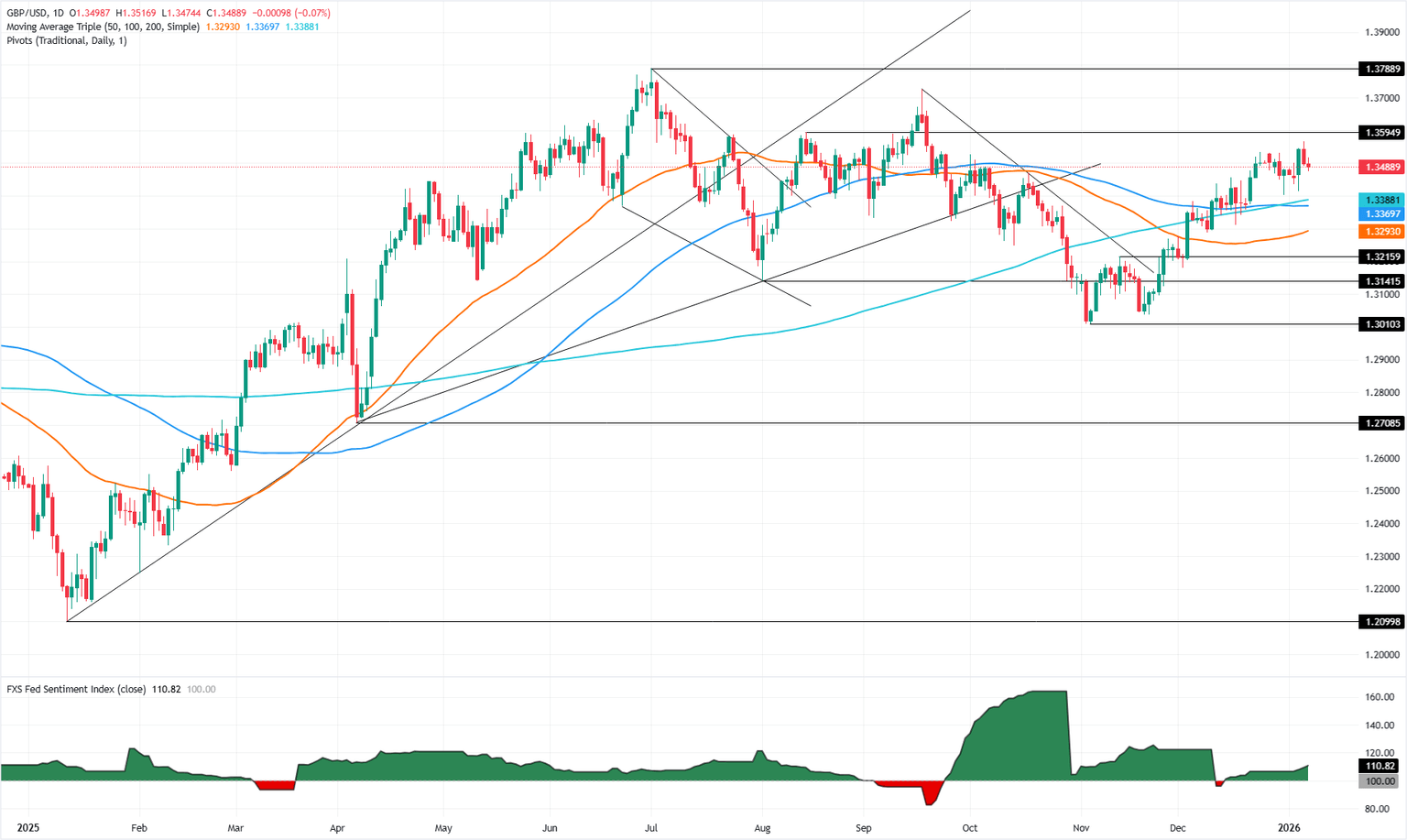

GBP/USD Price Analysis: Technical outlook

The GBP/USD pair is poised to print back-to-back daily bearish candles, an indication of US Dollar strength, but so far, the pair is far from shifting bearish bias. Momentum as measured by the Relative Strength Index (RSI) favors buyers, but recently dipped below the latest low, aiming toward its neutral line.

If GBP/USD tumbles below 1.3400, look for a test of the 200-day SMA at 1.3379. Once surpassed, bears could drive the exchange rate towards intermediate support at 1.3179, the December 2 low. Conversely, a daily close above 1.35 would keep buyers hopeful of re-testing the 1.36 mark.

(This story was corrected on January 7 at 15:54 GMT to day that the previous ADP Employment Change reading was -29K, not -32K.)

Pound Sterling Price This week

The table below shows the percentage change of British Pound (GBP) against listed major currencies this week. British Pound was the strongest against the Swiss Franc.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.31% | -0.17% | -0.13% | 0.50% | -0.77% | -0.35% | 0.53% | |

| EUR | -0.31% | -0.48% | -0.38% | 0.19% | -1.08% | -0.65% | 0.22% | |

| GBP | 0.17% | 0.48% | -0.04% | 0.68% | -0.60% | -0.17% | 0.71% | |

| JPY | 0.13% | 0.38% | 0.04% | 0.62% | -0.66% | -0.23% | 0.70% | |

| CAD | -0.50% | -0.19% | -0.68% | -0.62% | -1.11% | -0.84% | 0.04% | |

| AUD | 0.77% | 1.08% | 0.60% | 0.66% | 1.11% | 0.43% | 1.33% | |

| NZD | 0.35% | 0.65% | 0.17% | 0.23% | 0.84% | -0.43% | 0.88% | |

| CHF | -0.53% | -0.22% | -0.71% | -0.70% | -0.04% | -1.33% | -0.88% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.