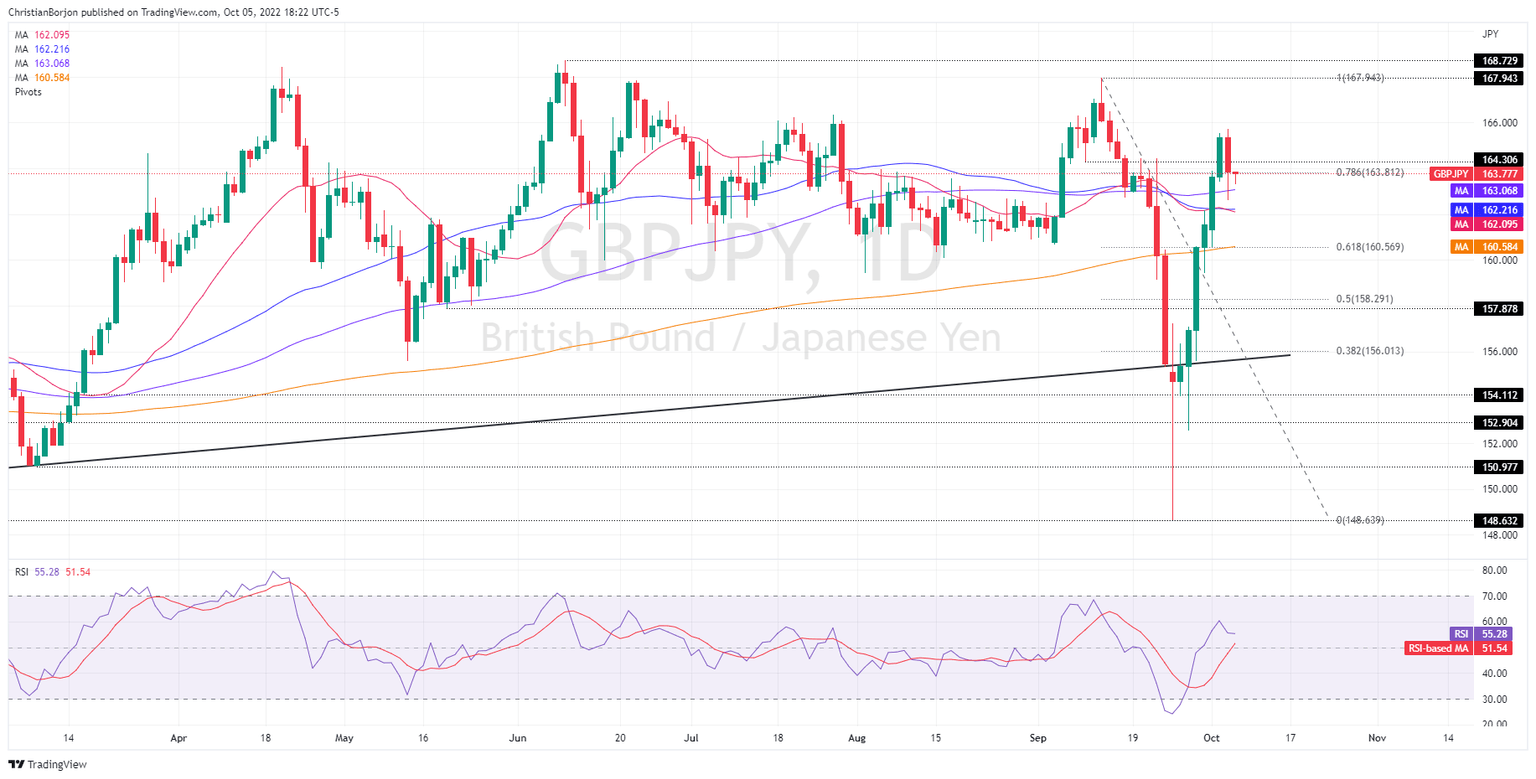

GBP/JPY Price Analysis: Subdued below the 78.6% Fibonacci, as sellers gain momentum

- The GBP/JPY daily chart delineates the pair as neutral-biased from a technical perspective.

- However, the pair meanders around the 78.6% Fibonacci retracement, which, once broken, will resume the GBP/JPY downtrend.

- Contrarily, a break above 164.00 could open the door for a re-test of the weekly high.

The GBP/JPY reached a fresh weekly high on Wednesday at 165.71 but plunged towards its daily low at 162.60 before retracing to current exchange rates for some reasons. Firstly, expectations of a possible Fed pivot extended the GBP/JPY uptrend since Monday. Nevertheless, Fed officials’ rhetoric emphasized the need for higher rates for longer, spurring a risk-off impulse. Therefore, as the Asian session begins, the GBP/JPY is trading at 163.77, below its opening price.

The GBP/JPY is neutral-biased from a daily chart perspective, even though the pair managed to stay above the 100, 50, and 20-day EMAs. Nevertheless, it’s meandering around the 78.6% Fibonacci level, drawn from the September 13-26 high at 167.94/low at 148.63, which, if broken to the downside, might pave the way for further losses.

If that scenario plays out, the GBP/JPY first support would be the 100-day EMA at 163.07, which, once cleared, will expose the confluence of the 50 and 20-day EMAs, around 162.10/20. A decisive break might send the pair plummeting to the junction of the 200-day EMA and the 61.8% Fibonacci retracement at 160.57.

On the other hand, if GBP/JPY buyers hold the price above 163.81, it could open the door for further gains. The GBP/JPY’s first resistance would be the 164.00 figure, followed by 165, and then the October 5 daily high at 165.71.

GBP/JPY Daily Chart

GBP/JPY Key Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.