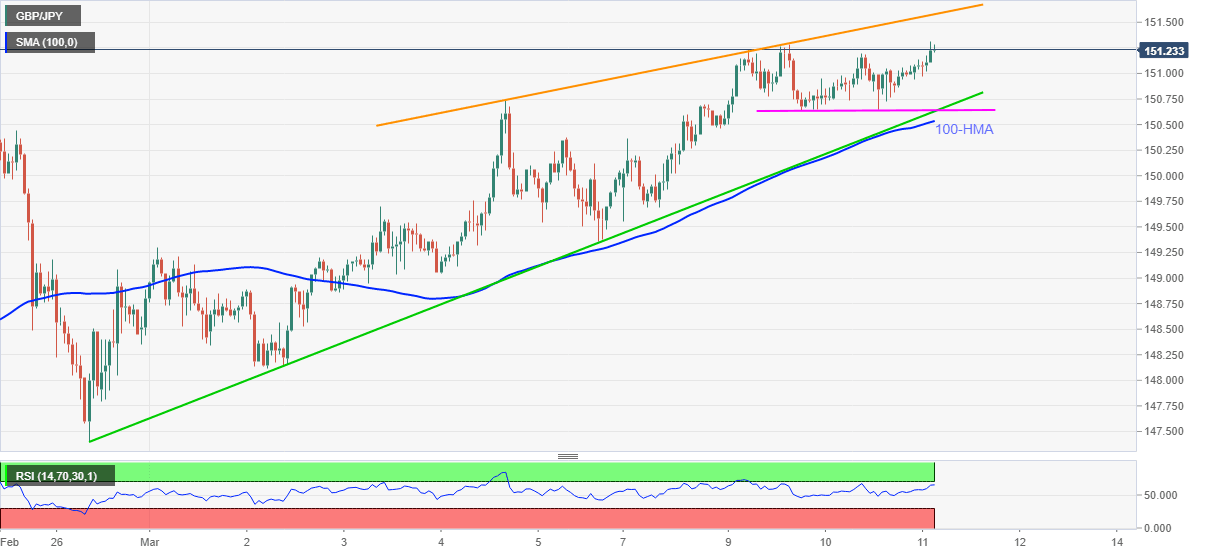

GBP/JPY Price Analysis: Refreshes multi-month high above 151.00, further upside expected

- GBP/JPY stays firm after rising to the fresh high since April 2018.

- RSI has room for further upside, one-week-old resistance line in focus.

- 100-HMA, rising trend line from February 26 adds to the downside filters.

GBP/JPY extends upward trajectory to the fresh high in 34.5 months, up 0.17% intraday near 151.31, during early Thursday. Although the pair rises for the ninth consecutive day, the RSI still has room to the north before hitting the overbought signal.

This suggests an extension of the run-up towards an ascending trend line from last Thursday, at 151.58 now, before scaling back some of the gains.

Should the GBP/JPY bulls refrain from respecting the stated trend line hurdle around 151.60, the 152.00 threshold and the late April 2018 peak surrounding 152.75 will be in the spotlight.

Alternatively, the quote’s pullback moves will be tested by 150.65-50 support confluence comprising multiple trend lines and 100-HMA, a break of which may recall short-term sellers targeting the 150.00 round-figure.

In a case where the GBP/JPY prices remain weak below 150.00, the monthly low near 148.10 should gain the bears’ attention.

GBP/JPY hourly chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.