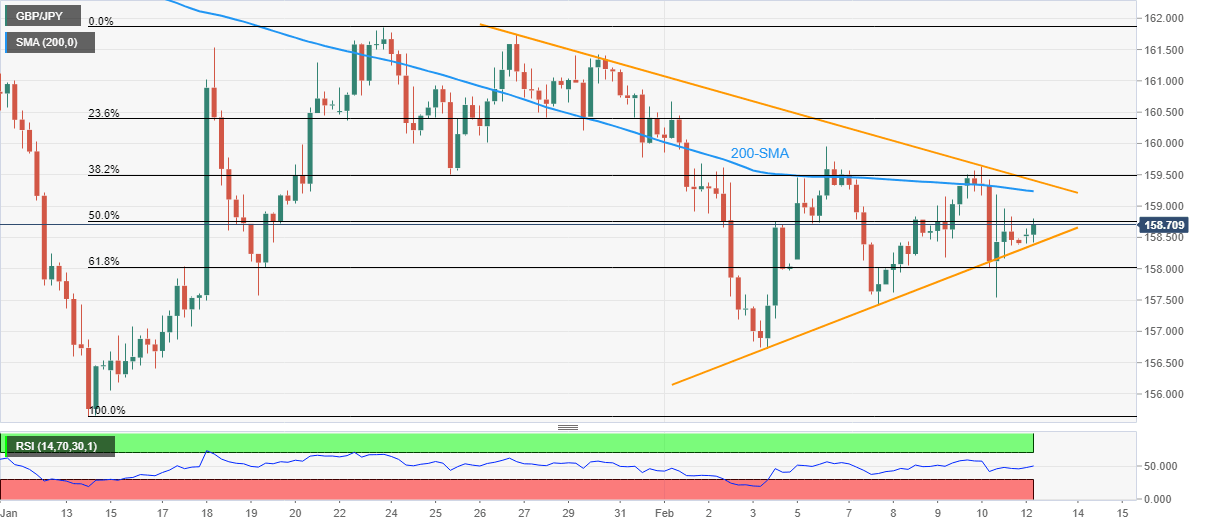

GBP/JPY Price Analysis: Mildly bid below 159.00 inside symmetrical triangle

- GBP/JPY pares the previous day’s losses inside fortnight-long symmetrical triangle.

- Steady RSI backs recent recovery, 200-SMA challenges immediate upside.

- Multiple supports to test bears on their return.

GBP/JPY picks up bids to 158.70 as it grinds inside a two-wee-old triangle formation during Monday’s Asian session.

The cross-currency pair prints mild gains after a consecutive two-week downtrend. That said, the recently steady RSI (14) backs the quote’s recovery moves inside the symmetrical triangle.

It’s worth noting, however, that the 200-SMA hurdle surrounding 159.30 acts as an immediate upside hurdle for the GBP/JPY buyers to watch before the stated triangle’s top line, close to 159.45 by the press time.

In a case where the pair remains firmer past 159.45, the 160.00 psychological magnet holds the key for the GBP/JPY run-up targeting the previous monthly high surrounding 161.85 and then to the last defense of sellers, namely the late December 2022 high near 162.35.

Alternatively, a downside break of the 158.30 level will defy the triangle formation and theoretically suggest a slump toward the 143.00 mark. However, multiple hurdles do challenge the GBP/JPY bears before allowing them to cheer the multi-month low.

Among them, lows marked during February and January 2023, respectively near 156.75 and 155.35, will precede the September 2022 bottom surrounding 148.80 are the key. Also important to watch is the 150.00 round figure.

To sum up, GBP/JPY remains sidelined as it consolidates recent losses.

GBP/JPY: Four-hour chart

Trend: Upside remains more appealing

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.