GBP/JPY Price Analysis: Hovers around 188.00 on BoJ rate cut speculation

- GBP/JPY down, near 188.04, on BoJ policy change rumors.

- Sterling's future uncertain without UK data; employment figures crucial.

- Technical signs suggest more drops; key support levels watched.

The GBP/JPY clings to the 188.00 figure and prints losses of 0.51% in the mid-North American session. The pair exchanges hands at 188.04 after dropping from a daily high of 189.17.

Rumors about a sudden end of negative interest rates by the Bank of Japan (BoJ) sponsored a leg up in the Yen against most G7 currencies. An absent UK economic docket keeps Sterling pressured, though employment figures could favor Cable on Tuesday.

GBP/JPY Price Analysis: Technical outlook

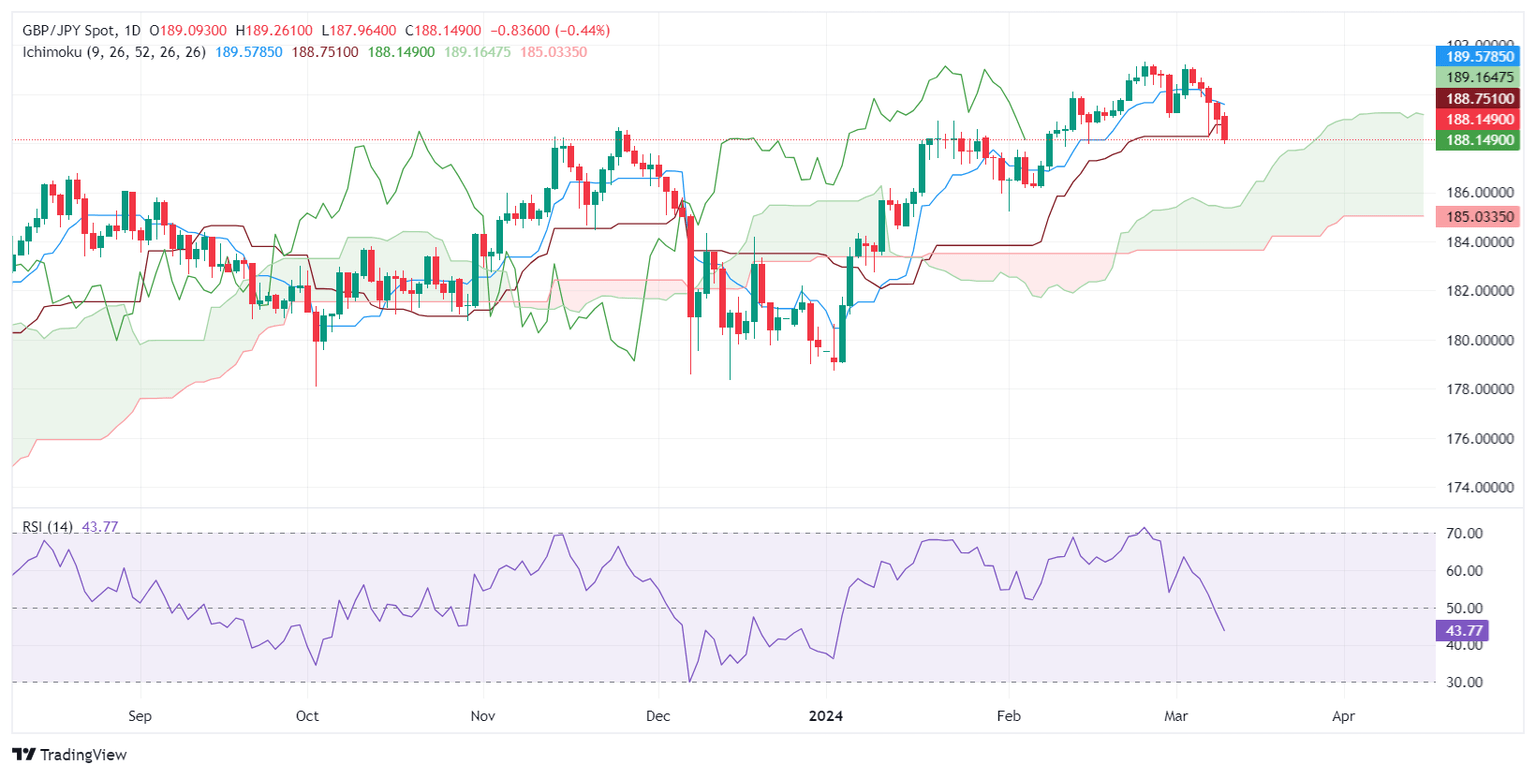

The GBP/JPY has extended its losses below the Tenkan and Kijun-Sen levels, which exacerbated a drop to a four-week low of 187.95. However, buyers lifted the exchange rate, and the pair has bottomed out around the 188.00 mark as of writing. A daily close above the latter and a leg-up could be on the cards.

Otherwise, the downtrend could extend towards the 50-day moving average (DMA) at 187.64, followed by the 187.00 mark. Once cleared, the next support would be the 100-DMA at 185.77.

GBP/JPY Price Action – Daily Chart

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.