GBP/JPY Price Analysis: Bulls keep the reins above 139.00 ahead of UK GDP

- GBP/JPY defies the previous day’s U-turn from 139.50 while bouncing off 138.85.

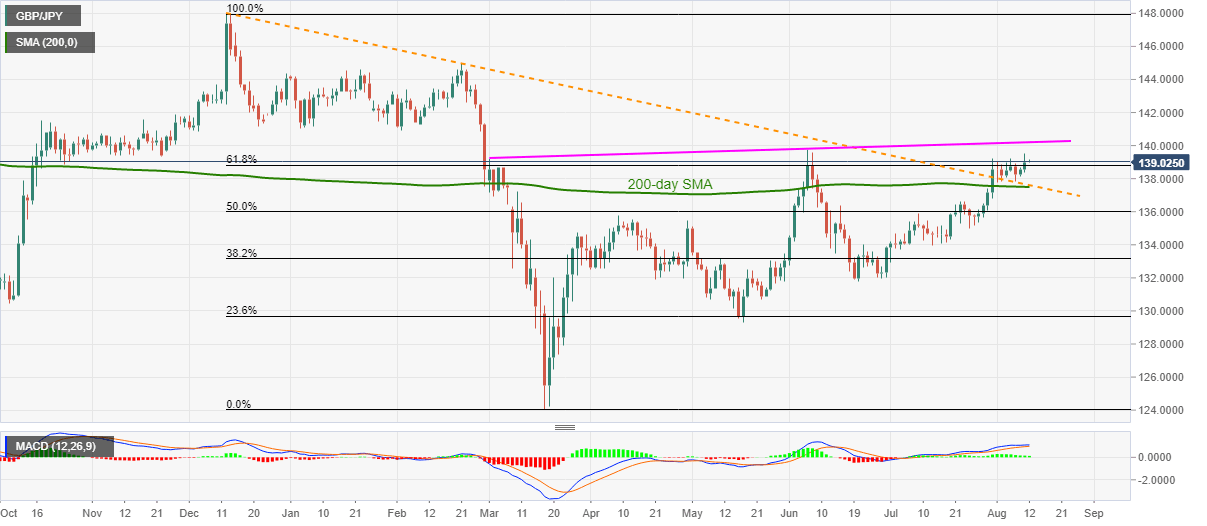

- Sustained trading beyond 61.8% Fibonacci retracement keeps bulls hopeful.

- Sellers will wait for a clear break below 200-day SMA, an eight-month-old falling trend line.

GBP/JPY picks up the bids near 139.10, up 0.10% on a day, during Wednesday’s Asian session. The pair surged to the fresh high since June on Tuesday before retracing a bit. However, the quote’s successful trading above 61.8% Fibonacci retracement level of December 2019 to March 2020 fall justifies the previous break of a falling trend line from December 12, 2019.

While the said technical catalysts are likely to support the pair’s upside momentum, also signaled by bullish MACD, bulls seem cautious ahead of the preliminary UK GDP for the second quarter (Q2).

Read: UK GDP Preview: Three reasons why 20% contraction estimates are too low, GBP/USD may rise

Even so, the pair remain on the bull’s radar unless it slips below 138.80 comprising the key Fibonacci retracement level, a break of which could drag it to 137.65/60 support confluence including 200-day SMA and the said resistance-turned-support line.

On the contrary, the pair’s further upside eyes June month’s high of 139.75 as immediate resistance ahead of the 140.00 threshold and a five-month-old ascending trend line near 140.30.

GBP/JPY daily chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.