GBP/JPY flounders near 192.00 after suspected BoJ interventions flatten markets

- GBP/JPY lethargic near 192.00 handle.

- Overactive BoJ financing reports tips hat towards FX intervention.

- Coming up next week: BoE rate call, UK GDP.

GBP/JPY is trading flat near the 192.00 handle after the Bank of Japan (BoJ) is suspected of directly intervening in FX markets to prop up the battered Japanese Yen (JPY) twice in two days earlier this week. According to disclosure reporting from the BoJ, the Japanese central bank overspent on uncategorized financing operations by around 9 trillion Yen. The massive overshoot in BoJ financing operations strongly implies direct market intervention on behalf of the Yen, though no official statements have been made in either direction.

Coming up next week, The Bank of England (BoE) delivers its latest rate call and economic outlook statement, with late next week seeing a fresh update on UK economic growth with a quarterly Gross Domestic Product (GDP) update. UK QoQ GDP is currently forecast to rebound to 0.4% versus the previous quarter.

Japanese markets return to the fold after a raft of holiday observations this week, but Japanese data releases remain limited to low-tier prints. Investors will be keeping an eye out for any official statements from the BoJ on market operations in the days to come.

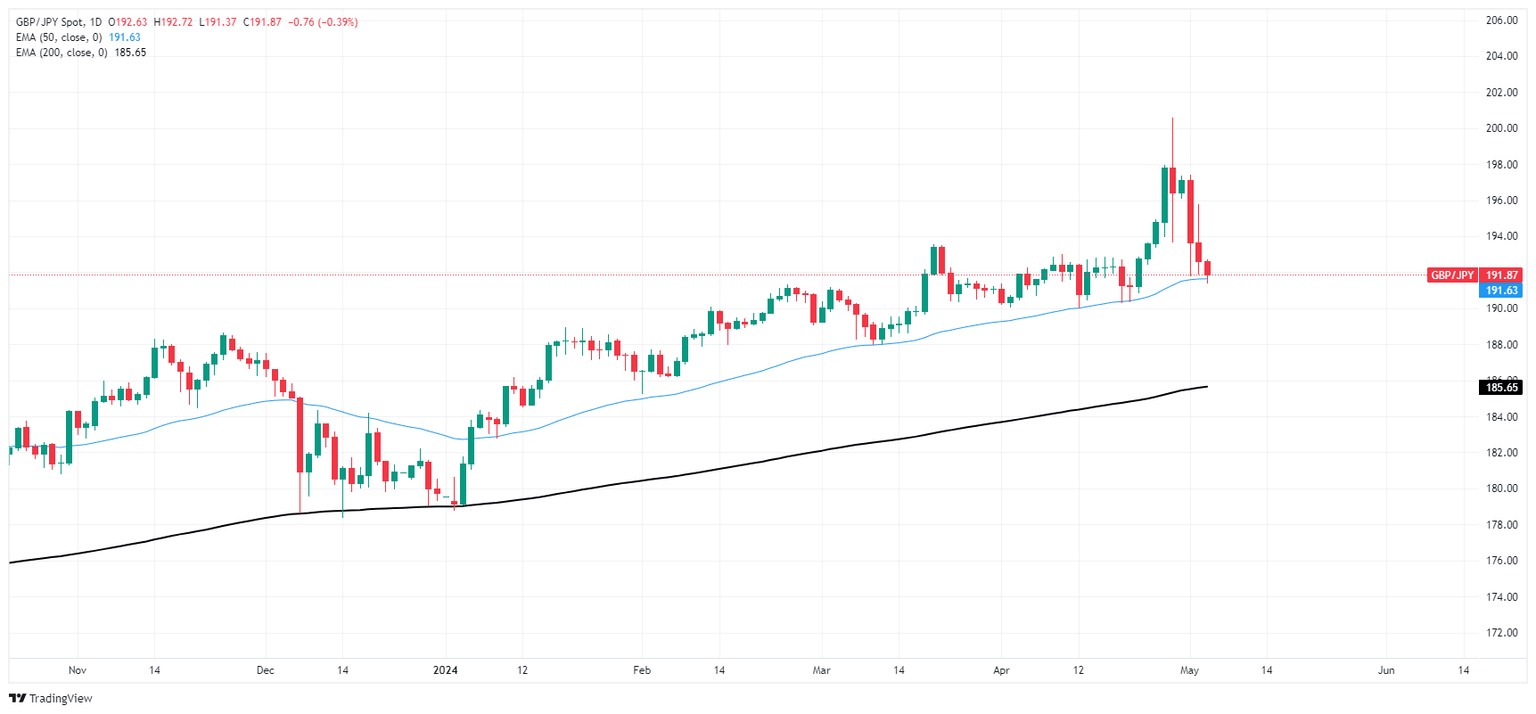

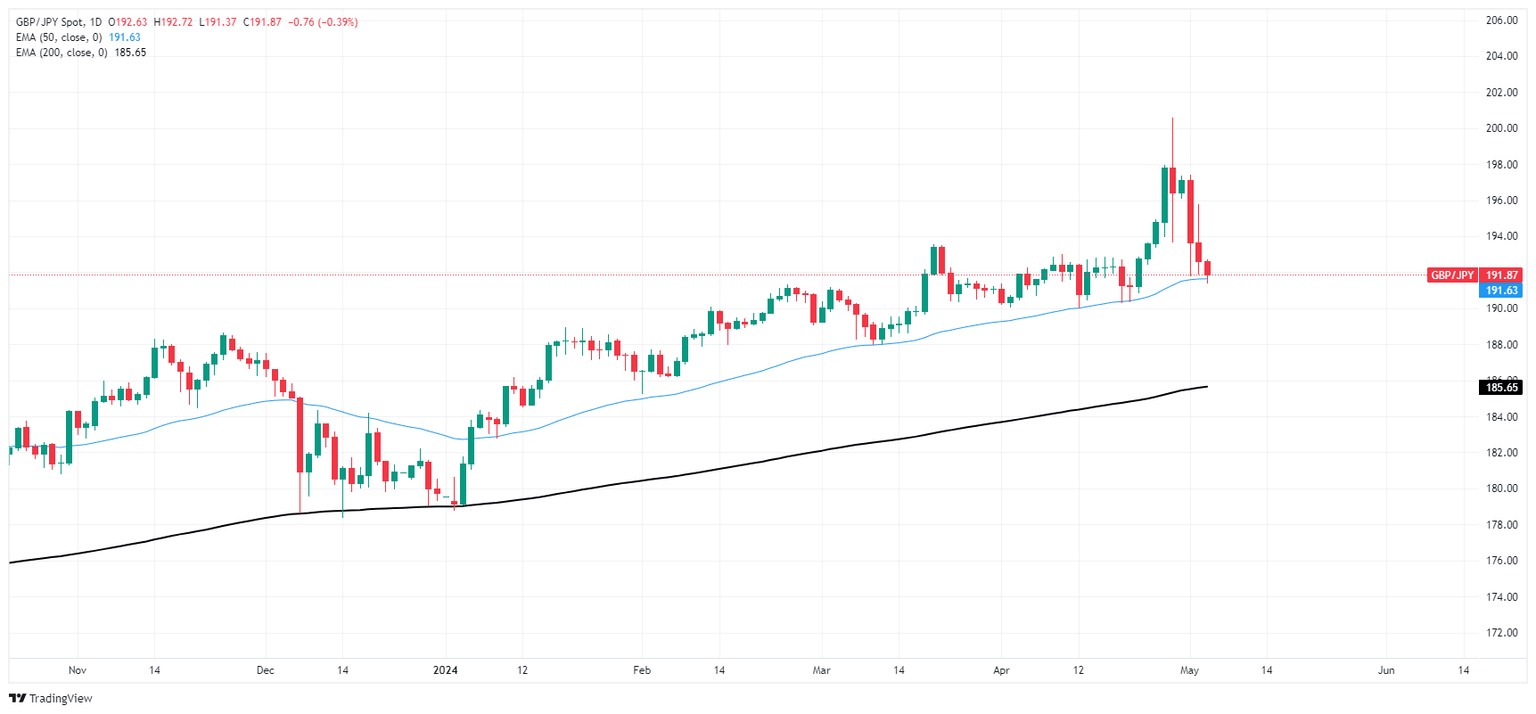

GBP/JPY technical outlook

The GBP/JPY kicked off the trading week hitting a 34-year peak bid of 200.60 before strong JPY activity dragged the pair down nearly 900 pips, or -4.4%, peak-to-trough, hitting a bottom bid near 191.80, and the pair has settled into a holding pattern near that level.

Despite a recent knockdown from multi-decade highs, the Guppy remains firmly planted in bull country, with the pair still trading well above the 200-day Exponential Moving Average (EMA) at 185.70. The pair is still up nearly 7% since the start of 2024, and is still a scorching 54% from the 2020 low near 124.00.

GBP/JPY hourly chart

GBP/JPY daily chart

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.