GBP/JPY consolidates around 153.00 amid strong US dollar

- GBP/JPY stays around a multi-week low 153.00 amid risk-averse sentiment.

- Japan’s PPI rose to 0.3%, rising past market expectations.

- The pairs look for impetus from UK GDP data for momentum.

GBP/JPY snaps its downtrend, trading around 153.00 during the Asian session on Thursday. The cross takes a cue from US inflation data over the domestic issues in the UK and Japan.

The pair managed to stop its erosion from November 4 highs, attempting a tepid bounce amid a cautious market mood, The preliminary estimate of Q3 UK GDP data due later this Wednesday can provide the impetus to the pair.

Meanwhile, the Brexit drama and the subsequent trade war still brew, with the UK on the cusp of escalating tensions with the EU and even putting the post-Brexit trade deal at risk if it opts to trigger Article 16 of the Northern Ireland Protocol (which allows either side to unilaterally suspend parts of the agreement if it is causing significant societal damage).

Traders digest Japan’s Producer Price Index (PPI) for October, which rose past 0.3% market forecast to arrive 1.2% on MoM in the reported month. The US inflation worked in favor of the US dollar, which has put pressure on the yen.

GBP/JPY Technical Levels

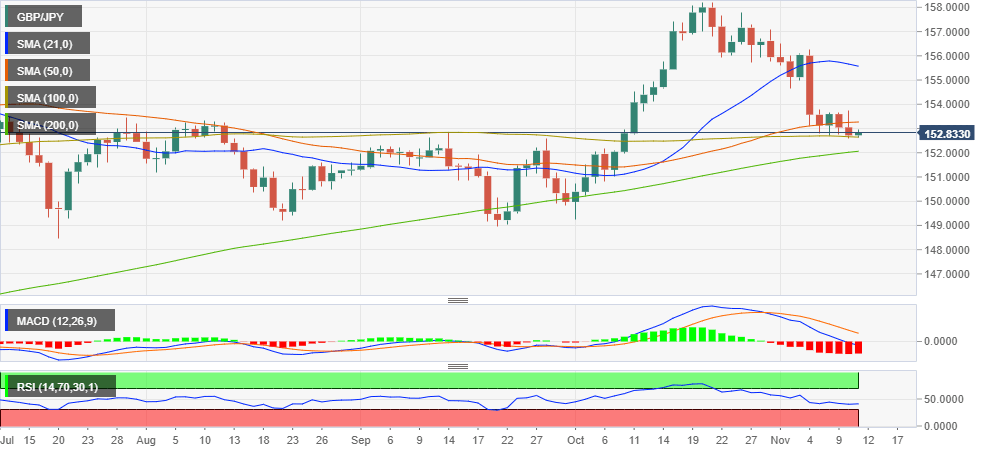

The GBP/JPY daily chart indicates that it is facing an upside barrier from 50-day Simple Moving Average (SMA) and 21-day SMA 153.28 and 155.57. The next resistance in the bulls way that can be tested is 158.22, it's one month high.

The price may reverse and breach its first support 152.06 (100-day SMA) and continue the downtrend towards the support level 152.64, 200-day SMAs. If it continues further south, its one-month low can be tested at 149.23.

GBP/JPY Additional levels

Author

Sounava Ray Sarkar

Independent Analyst

Sounava has been working as a Journalist since 2012. He has worked with several reputed media organizations in various capacities before settling as a writer and news editor for business and technology segments.