GBP/JPY climbs past 200.00, BoE and BoJ monetary policy meetings in focus

- GBP/JPY extends gains for the fourth consecutive day, breaking firmly above the 200.00 psychological level.

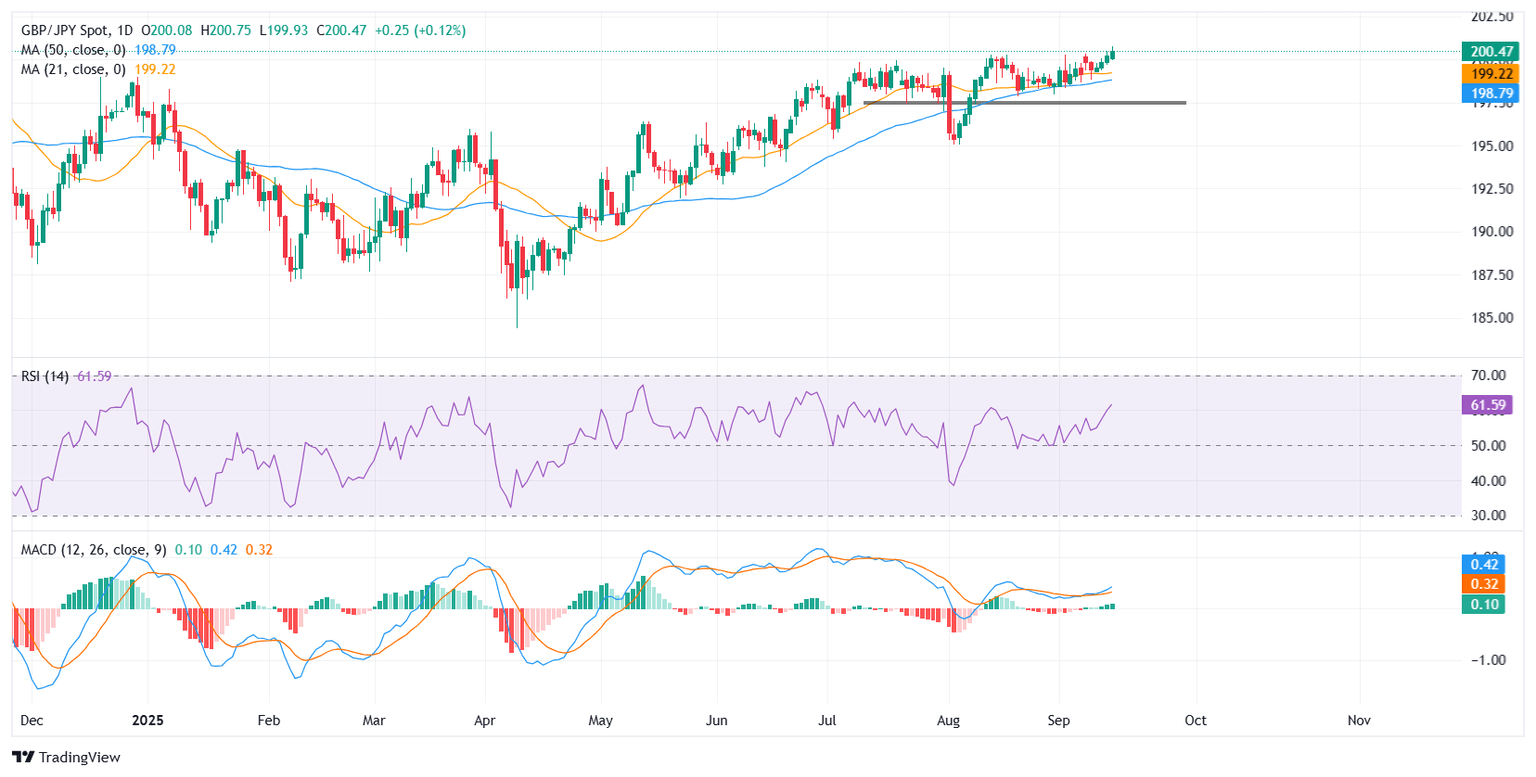

- Technicals remain constructive with RSI at 62.7 and a fresh MACD bullish crossover.

- Traders eye key risk events this week, including UK jobs and CPI data ahead of the BoE decision on Thursday, and Japan’s CPI release before the BoJ meeting on Friday.

The British Pound (GBP) is extending its winning streak against the Japanese Yen (JPY) for the fourth consecutive day on Monday, with the cross trading near its strongest level in more than a year. At the time of writing, GBP/JPY is trading around 200.50, up nearly 0.15% on the day, marking its highest level since July 24, 2024.

The British Pound is strong across the board at the start of the week, while the Yen remains on the defensive as traders position ahead of the Bank of England’s (BoE) monetary policy decision on Thursday and the Bank of Japan’s (BoJ) policy announcement on Friday.

From a technical perspective, the cross continues to trade with a clear bullish bias, comfortably holding above both the 21-day Simple Moving Average (SMA) at 199.23 and the 50-day SMA at 198.80. The sustained break and consolidation above the 200.00 psychological level reinforces the positive momentum, with the Relative Strength Index (RSI) at 62.7 pointing to strong upside pressure without reaching overbought territory.

The Moving Average Convergence Divergence (MACD) indicator is also reinforcing the bullish structure, with the MACD line crossing above the signal line and the histogram printing green bars. This crossover is a fresh bullish signal, suggesting that upside momentum is regaining strength after a period of consolidation.

On the upside, immediate resistance is located at the July 24, 2024 peak around 201.18, which if cleared would open the door toward the July 23, 2024 high at 203.16. A decisive break above this zone could pave the way for a broader extension of the uptrend.

On the downside, the first line of defense is the 200.00 psychological level, with additional support near the 21-day SMA, followed by the 50-day SMA. A break below these zones could trigger a deeper correction toward 197.50, though the broader structure remains constructive while price holds above 200.00.

Looking ahead, UK labour market data on Tuesday and inflation figures on Wednesday will be closely watched for fresh cues on the BoE’s policy stance, while in Japan, CPI figures due Friday ahead of the BoJ decision could provide additional volatility for the Yen.

Pound Sterling Price Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.31% | -0.44% | -0.28% | -0.11% | -0.35% | -0.25% | -0.20% | |

| EUR | 0.31% | -0.12% | -0.02% | 0.20% | -0.01% | 0.00% | 0.10% | |

| GBP | 0.44% | 0.12% | 0.18% | 0.31% | 0.11% | 0.12% | 0.10% | |

| JPY | 0.28% | 0.02% | -0.18% | 0.13% | -0.04% | -0.00% | 0.07% | |

| CAD | 0.11% | -0.20% | -0.31% | -0.13% | -0.13% | -0.18% | -0.21% | |

| AUD | 0.35% | 0.00% | -0.11% | 0.04% | 0.13% | 0.02% | 0.07% | |

| NZD | 0.25% | -0.00% | -0.12% | 0.00% | 0.18% | -0.02% | -0.02% | |

| CHF | 0.20% | -0.10% | -0.10% | -0.07% | 0.21% | -0.07% | 0.02% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Author

Vishal Chaturvedi

FXStreet

I am a macro-focused research analyst with over four years of experience covering forex and commodities market. I enjoy breaking down complex economic trends and turning them into clear, actionable insights that help traders stay ahead of the curve.