GBP/JPY breaks above 188.50, hits its highest bids since August 2015

- GBP/JPY crosses 188.50, hits eight-year high as markets rally into the Friday close.

- The Pound Sterling is set for its fourth straight up day against the Yen.

- Risk appetite is catching a broad-market bid to cap off the trading week.

The GBP/JPY has broken into new eight-year highs above 188.50 as the Pound Sterling (GBP) catches a late-day Friday bid against the Japanese Yen (JPY), setting the Guppy up for a fourth consecutive green day.

Broad-market sentiment is seeing technical rallies across the board as investors make final adjustments heading into Friday's early close: US money markets are closing up shop early this week at 13:00 EST, and trading volumes will see a vacuum heading into the trading week's final hours.

The UK saw some upbeat data in the bottom half of the trading week, with UK Purchasing Managers' Index (PMI) data improving over previous releases and beating market expectations, and the GfK Consumer Confidence survey for November also showed the mood surrounding the UK domestic economy is improving slightly.

UK Preliminary Services PMI returns to expansion with 50.5 in November

Thursday saw the UK's S&P Global/CIPS November Composite PMI return to positive territory for the first time in over a quarter, printing at 50.1 against Wall Street's expected steady reading at 48.7.

Early Friday the UK's November GfK Consumer Confidence survey printed at -24, a firm bounce from the previous month's -30 and clearing the market's forecast of -28.

Next week is a thinner showing on the economic calendar, with a collection of Bank of England (BoE) speeches throughout the week as well as Japanese Retail Sales and trade figures due early Thursday.

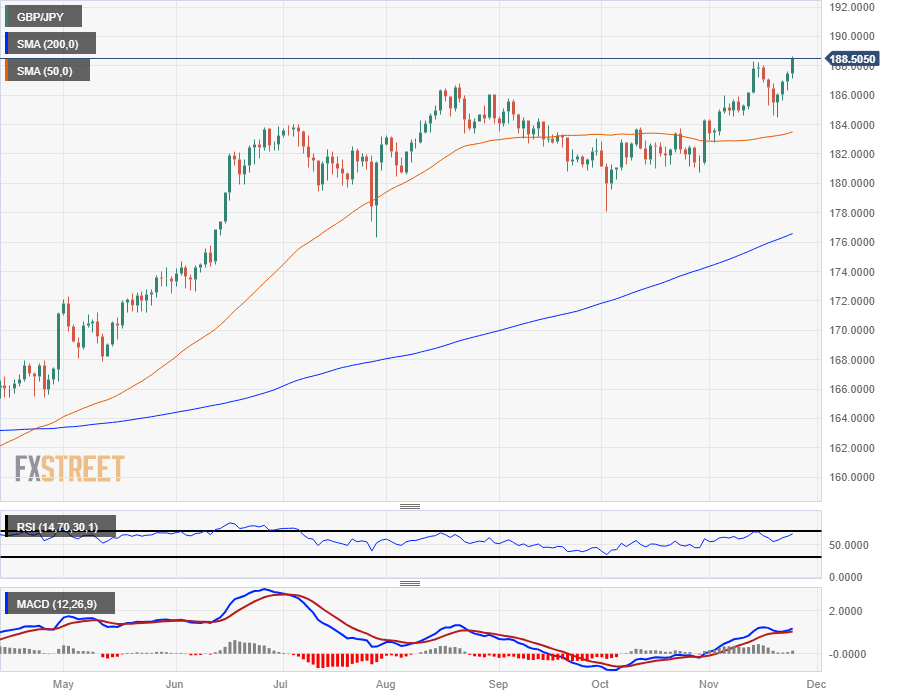

GBP/JPY Technical Outlook

With the GBP/JPY trading into eight-year highs, there is little in the way of technical resistance patterns weighing the pair down.

The Guppy is up over 2% from the week's lows of 184.47, and up almost a full percent overall from the week's opening bids near 186.44.

The GBP's climb against the JPY through 2023 has been extremely one-sided, with the GBP/JPY up over 20% from the year's lows at 155.36.

Near-term support is coming from the 50-day Simple Moving Average (SMA), which is drifting upwards into 184.00, while the last swing low sits at 184.47.

GBP/JPY Daily Chart

GBP/JPY Technical Levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.