GBP/CAD Price Forecast: Breaks back above legacy trendline as trend turns higher

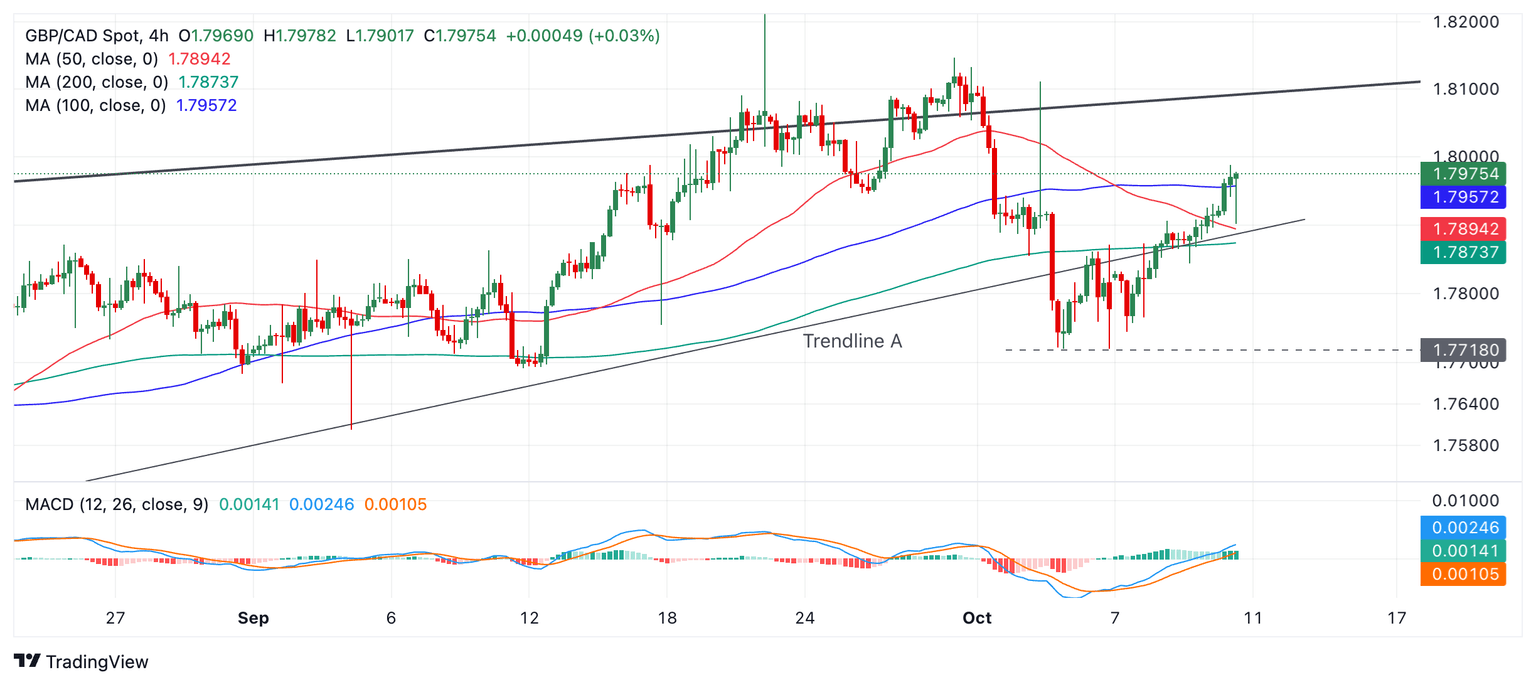

- GBP/CAD rises back above an old trendline and extends its rally.

- The pair extends its rally within a medium and long-term rising channel.

GBP/CAD looks like it has bottomed out and is once more rising within a broader rising channel.

The pair was falling in a down leg, however, it has probably reversed and started a new uptrend. Given the principle that “the trend is your friend” the odds favor more upside to come.

GBP/CAD 4-hour Chart

Although the pair broke below an important trendline (“Trendline A” on chart) on October 3. It quickly bottomed out and has since recovered. Now it has also broken back above the same trendline, reversing the short-term downtrend in the process.

The Moving Average Convergence Divergence (MACD) indicator is now above the zero line adding further bullish evidence to the chart.

GBP/CAD is further supported by the fact that it is in medium and longer-term uptrending cycles.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.