GameStop Stock News and Forecast: GME jumps over 10% as robust sales offset net loss

- GameStop shrugged off a big net loss, adds 10% on Thursday.

- GME reported EPS of -$2.08 and revenue of $1.38 billion.

- GME stock initially ran higher before quickly reversing after earnings.

Update: GameStop (GME) snapped a three-day corrective downtrend and jumped 10.38% on Thursday, closing the day at $134. The meme stocks rallied as high as $136.50 at one point during the day but failed to hold at higher levels after the company reported its quarterly results. “GameStop reported $1.38 billion in revenue in its fiscal first quarter, up slightly from the $1.27 billion it reported in the year-ago quarter. But it also reported a $157.9 million net loss, which is worse than the $66 million net loss in the year-ago quarter,” per CNBC News. Investors cheered solid sales figures, shrugging off the big net loss. The Wall Street turnaround also aided the upside in the GME stock price.

GameStop (GME) reported its Q1 earnings after the close on Wednesday, and the stock exhibited textbook volatility around the release. GameStop initially rallied nearly 10% on the report before settling back and trading more or less flat from the regular session close.

GameStop stock news: Bigger loss than expected

GameStop reported a loss of $154 million versus $41 million a year earlier. This was partially due to investors hoarding in anticipation of consumer demand and higher prices. However, it can be viewed as a negative in the context of sluggish growth, but with sales beating estimates it would appear that it is a case of genuine front-loading to reduce cost and supply chain issues. Inventory rose from $571 million at the end of 2021 to the currently reported $918 million. However, SG&A (selling, general, administrative) expenses rose as a percentage of revenues from 29% to 33%. Cash levels increased to $1 billion with no major debt. The balance sheet then is in a healthy position, but there are question marks over profitability. We also highlight net cash outflows for the quarter at a significant $304 million versus $19 million a year earlier. This can be partially explained away by rising inventories.

Overall, it was a very mixed bag. No guidance and no Q&A session on the conference call were a worrying sign. We take both as negatives. Ryan Cohen has been in situ now for some time, so it would be interesting to hear more from him about his turnaround plans. The lack of guidance is also concerning given the build-up of inventory.

GameStop stock forecast: Valuation remains too high

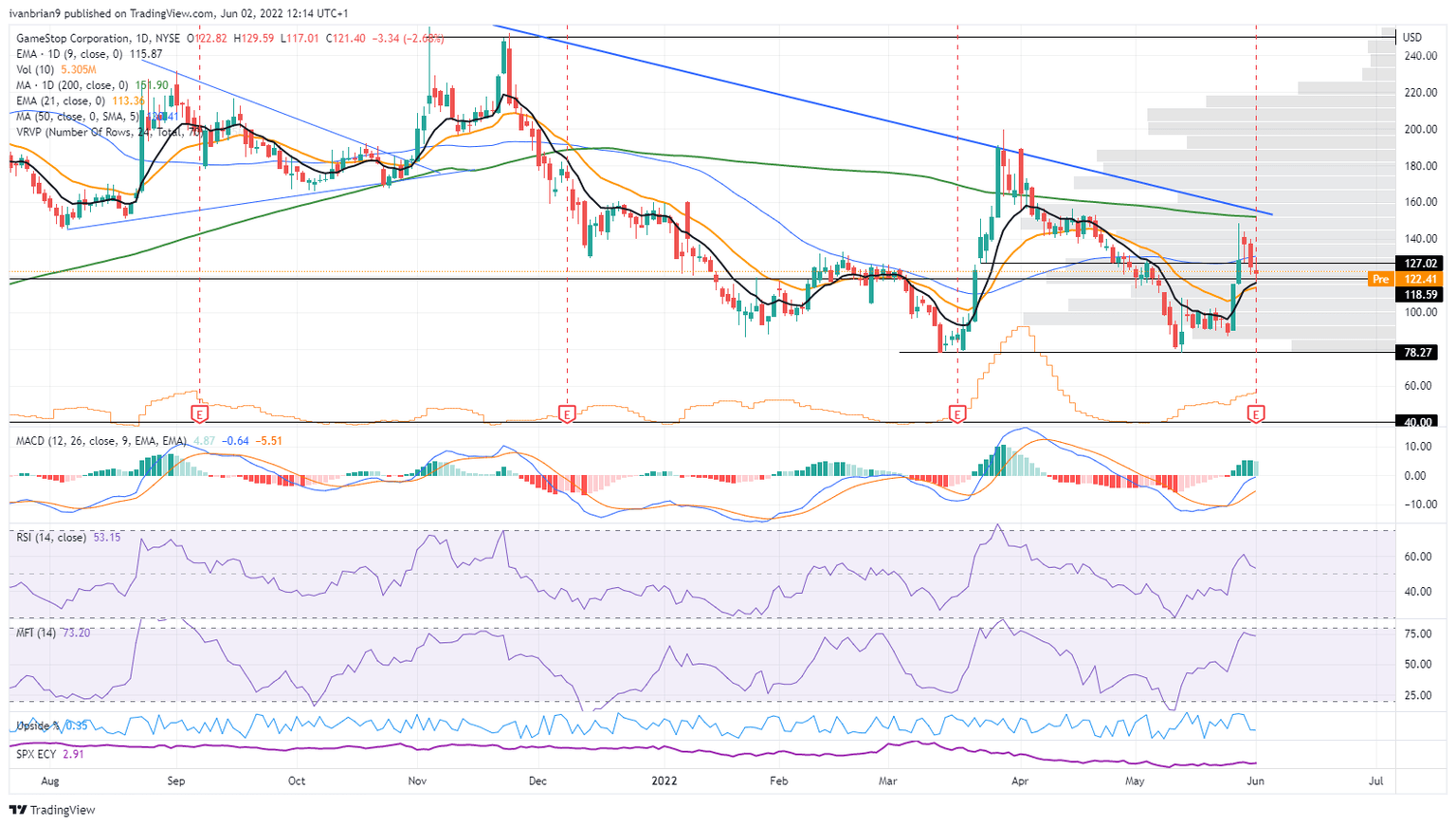

GameStop is currently valued at over $10 billion with a price-to-sales ratio of 1.5 and cash of $1 billion. GameStop is in a stronger position than many meme stocks but is still unprofitable. From a technical standpoint, the strong rally from $90 to nearly $150 looks to have now completely ended. The anticipation of earnings was a catalyst, as was the overall recovery in stock market performance. Both tailwinds appear to be struggling for momentum. This latest earnings report does little to comfort us. The inverted hammer candle from May 26 was already a sign of reduced momentum with the high $148 nearing the 200-day moving average and seeing a significant late sell-off to close at $128. This was followed by further falls to current levels at $121. Key short-term support is at $115, the high from the May 25 breakout, which was retested as the low the following day. If this breaks, then GME has a target of $78.

GME chart, daily

Previous updates

Úpdate: GameStop (GME) quickly overcame disappointing earnings results, ending Thursday up by 10.38% at $134.00 per share. Wall Street posted gains despite lingering turmoil and downbeat US employment data. The ADP survey showed the private sector added just 128,000 new jobs in May, the slowest pace of growth since the pandemic hit the world. Nevertheless, the Dow Jones Industrial Average gained 435 points, while the S&P 500 surged 1.63%. The best performer was the Nasdaq Composite, as it ended at 12,316.90, up 322 points or 2.69%.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.