GameStop Stock News and Forecast: GME aims for first 10-day gain streak in over a decade

- GME stock is back on its throne as king of the memes.

- GameStop shares rocketed with strong gains last week.

- GME seeing continued momentum on Monday on social media sites.

Update: GameStop stock is up 8.3% to $$164.50 one hour into the trading week. It appears last week's 67% gain was not enough for GME bulls. If GME remains up at the closes, which certainly seems likely, then it will be the first 10-day gaining streak since April 20, 2010, according to MarketWatch. Major indices are mixed at the moment. The Dow is down 0.3%, the S&P 500 is flat, and the Nasdaq is up 0.2%.

GameStop (GME) rocketed back to the top of the performance charts last week with a near 70% gain on the week. Shareholders were buoyed by Ryan Cohen increasing his stake through his investment firm RC Ventures and also by a strong performance and return of equity risk appetites. This may eventually fade, but gains of 70% will not be found in most other asset classes, so the volatility of meme stocks remains hard to beat. The gains available if you can manage to time your entries and exits are beyond compare. That as ever remains the secret sauce to trading profitably and consistently, but the power of retail traders remains in evidence as a force to be reckoned with.

GameStop Stock News

The company did not have a strong amount of newsflow itself, but rather its icon Ryan Cohen did. His RC Ventures investment company increased his stake in GameStop (GME) and so emboldened the retail army to once again follow him. Another retail favorite stock, Bed Bath & Beyond has also been the subject of interest from Ryan Cohen. RC Ventures and Ryan Cohen had purchased a stake of just under 10% in BBBY recently, and last Friday it was announced that Bed Bath & Beyond had named three new independent directors to the board. This is likely to appease Ryan Cohen as he seeks to take an activist role at the retailer. In particular, Ryan Cohen had looked for BBBY to extract more value from the Buy Buy Baby brand.

GameStop saw increased volume across regular shares and options trading in the past week as retail traders rushed in to capitalize on news of Ryan Cohen increasing his stake in the firm.

GameStop Stock Forecast

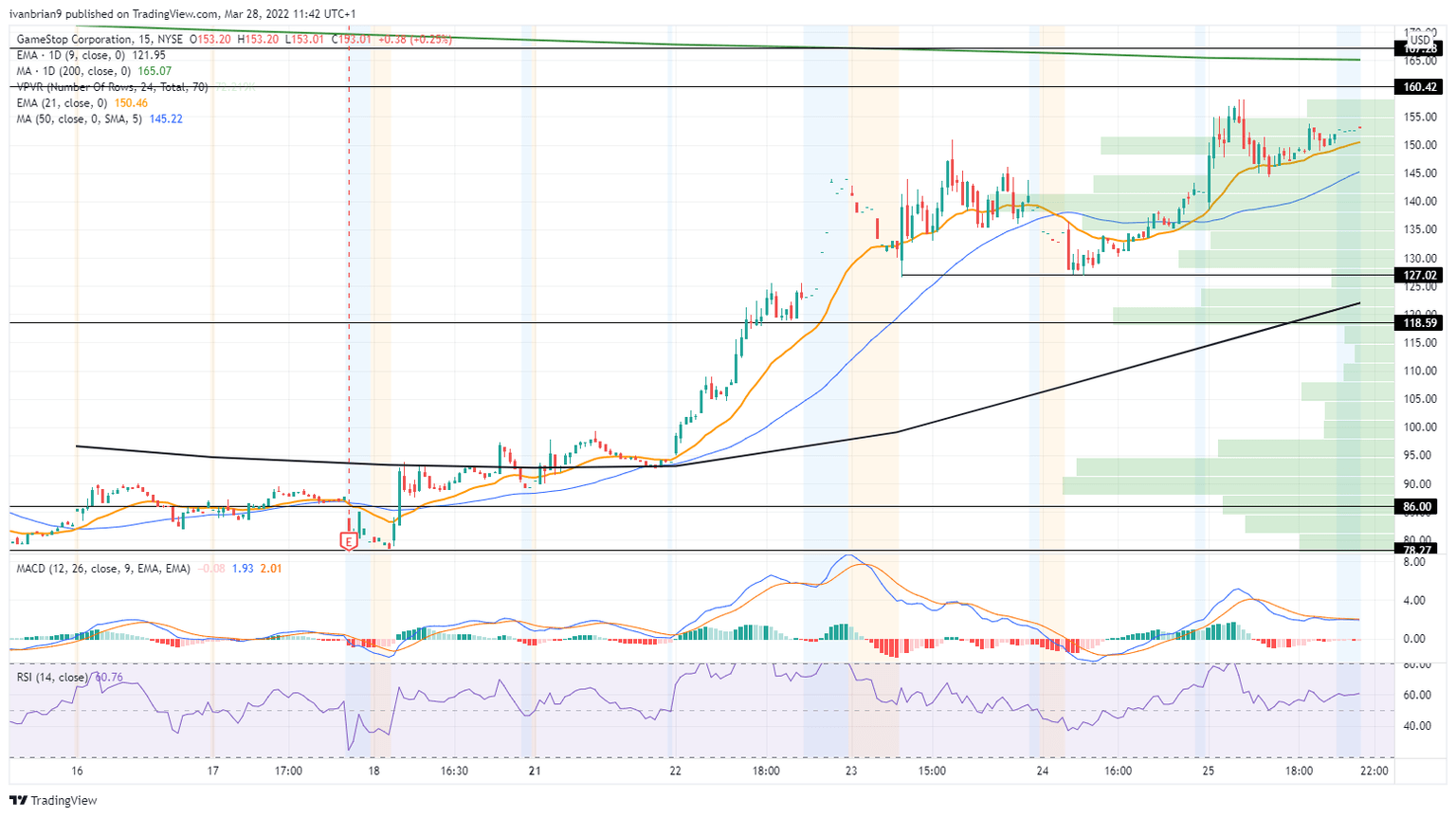

An impressive rally consumed last week, but so far failure at $160 to $167 resistance means the long-term trend is still negative. Break above here could take it back to test the double top at $250 that started the most recent decline. A double top is a powerful bearish indicator. $127 is key support as the breakout level successfully held on a retest on both Wednesday and Thursday of last week

GME stock chart, daily

The short-term 15-minute chart below shows the importance of $118.59 as support with a huge fall off in volume below. That could mean a sharp move lower to $95.

GME chart, 15-minute

A previous disclaimer stated in error the author was short GameStop when by unintended error the position was actually long. The author has since closed any position in GME.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.