FX daily: Trade and tax story weigh on the Dollar

A shift to a more confrontational stance on trade between the US and China, plus a focus on a potential US 'revenge tax' on foreign investors, are weighing on the dollar. Softer jobs data this week could also see the dollar explore the downside. Elsewhere, we should see rate cuts in the eurozone and Canada.

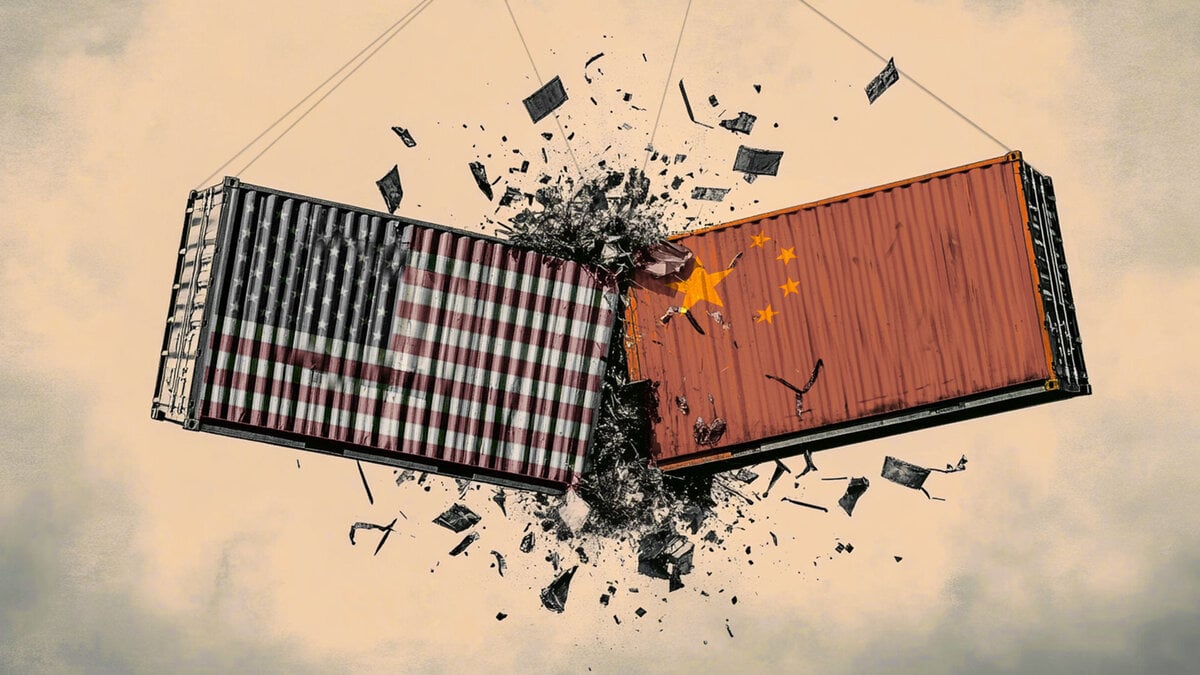

USD: Risk environment softens on trade confrontation

Global equity markets and the dollar start the week a little softer as trade tensions between the US and China start to reappear. It's not quite fair to say that the US-China trade deal reached in Geneva last month is unravelling, but both sides clearly seem frustrated. Social media posts from US President Donald Trump on Friday and comments made in the Chinese state media today both express frustration that trade commitments have not been adhered to. Any early end to the deal, which lasts until 12 August, would hit risk assets and the dollar again. At the same time, the tariff story took a more aggressive turn at the weekend with Washington choosing to double the 25% sectoral tariff in the steel and aluminium sectors. We're still waiting to hear back from the US Commerce Department on findings in the likes of the pharma, chip and aerospace sectors. 25-50% sectoral tariffs could potentially be unveiled there too.

Another, more indirect factor that may be keeping the dollar soft is the threat of a Section 899 'revenge tax', which is currently in President Trump's tax bill working its way through Congress. The idea here is that the US can employ a retaliatory tax of up to 20% on any country's residents (both the private and public sectors) employing 'discriminatory' taxes. There is a lot of legalese here in terms of definitions of these taxes, but one of these is the Digital Services Tax, currently employed in much of Europe and places like India and Taiwan, too.

In theory, if these countries do not remove these discriminatory taxes in time, a new withholding tax on gross income (interest, dividends and royalties) could be applied from the start of next year should the bill go through Congress. The Senate looks at this this week. This all adds to the narrative of the potential divestment of US assets – something we'll be tracking closely as the data emerges.

In terms of data this week, there's a big focus on jobs (job openings on Tuesday and payrolls Friday), plus business surveys starting with ISM manufacturing today. We'll also have quite a few Federal Reserve speakers and get the Fed's Beige Book on Wednesday. In terms of the latest Fed views, Christopher Waller gave a speech in Asia earlier today, once again as a proponent of rate cuts later this year. In terms of current market pricing, 53bp of Fed rate cuts are expected this year.

Even though the speculative market is quite short dollars already, the bearish overhang suggests DXY can edge down towards the 98.70 area, barring a big positive spike in the ISM today.

EUR: Staying bid despite another ECB rate cut

Dollar problems are keeping EUR/USD bid. This despite the fact that the European Central Bank will very likely be cutting rates on Thursday, and this week's inflation data in the eurozone should come in on the soft side. Here, the flash May eurozone CPI is released tomorrow, where core is expected to drop back to 2.5% year-on-year.

Also on Thursday will be a meeting of NATO defence ministers in Brussels. The European representatives should be better prepared for further excoriating remarks from the US, and may refocus market attention on the planned big pick-up in defence spending. Additionally, some further colour on German fiscal expansion in late June should also prove euro supportive.

EUR/USD has some intra-day resistance at 1.1425, above which a short-term run-up to 1.1500 beckons.

GBP: Staying supported

Sterling is staying relatively supported, particularly against the dollar. In terms of the local sterling story this week, we are due to hear from quite a few Bank of England policymakers, especially at tomorrow's Treasury Committee meeting. Also this morning, we've just seen some better house price data for May – potentially an area of support for the UK economy as interest rates get cut. We look for two further 25bp rate cuts this year.

Above 1.3525 opens up 1.3600 for Cable.

CEE: Opposition candidate wins Poland's presidential election

In Poland, the second round of the presidential election was won by the opposition candidate Karol Nawrocki. The market is taking a bearish side at the open. Overnight PLN trading saw levels above 4.260 per euro, which we believe was already indicated by Friday's move in rates following weaker inflation numbers. In our view, this is only the starting point for EUR/PLN, and we are likely to see a push to higher levels above 4.280.

We believe the market will mainly be watching the election result to measure its impact on the government's next steps and potential consolidation of public finances. An opposition win may therefore be seen by the market as less likely to prompt changes on the fiscal policy side, leading to renewed pressure on government bonds and widening asset spreads.

With the start of a new month, the calendar in the CEE region is usually very busy. PMIs across the region will be released today, which could show some slight improvement in sentiment.

Tomorrow, we will see May inflation in Turkey, which should slow again after a stronger April. On Wednesday, May inflation and first-quarter wage data will be released in the Czech Republic. We expect a small pick-up from 1.8% to 2.1% for headline inflation, in line with expectations. The National Bank of Poland also meets on Wednesday; we expect it to leave rates unchanged at 5.25% following May's 50bp cut, instead opting to wait for the new July forecast. Industrial production in the Czech Republic will be published on Friday.

Read the original analysis: FX daily: Trade and tax story weigh on the Dollar

Author

ING Global Economics Team

ING Economic and Financial Analysis

From Trump to trade, FX to Brexit, ING’s global economists have it covered. Go to ING.com/THINK to stay a step ahead.