Freeport-McMoRan (FCX) Elliott Wave analysis: Copper giant poised for a powerful long-term rally

Elliott Wave structure of Freeport-McMoRan (NYSE: FCX) suggests the completion of a major correction and the beginning of a new bullish cycle, supported by rising global copper demand and strong market momentum.

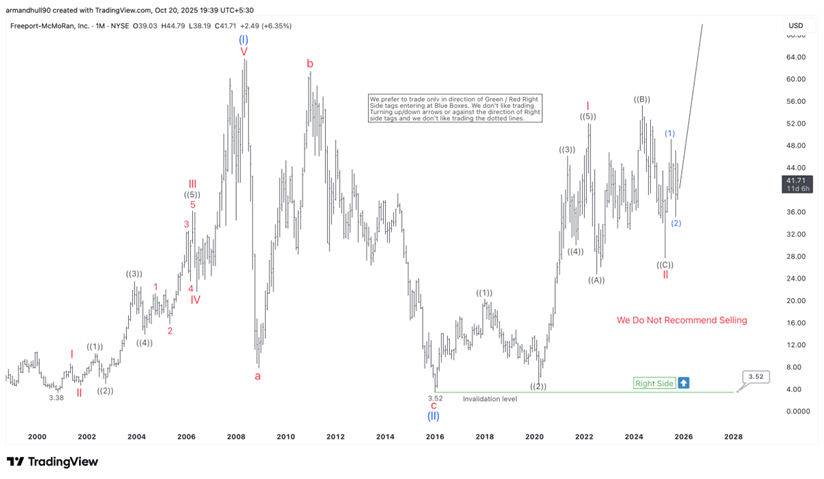

Freeport-McMoRan Inc. (NYSE: FCX), one of the world’s leading copper producers, continues to display a strong bullish structure in the long term. According to the Elliott Wave analysis, the stock has likely completed a major correction and started a new upward impulse within wave III.

The long-term Elliott Wave structure

The first significant rally began from the 2000 low near $3.38. It unfolded in a clear five-wave impulse, completing wave (I) at the 2008 peak. The 2008–2009 financial crisis then triggered a steep drop, forming wave (II). From there, FCX entered a strong recovery that ended around $61.34 in early 2022, marking the end of a higher-degree wave I in blue.

Following this rally, the decline from 2022 to 2025 unfolded in a corrective pattern ((A))–((B))–((C)), which bottomed near $30. This decline completed wave II in red. The strong rebound that followed suggests the beginning of wave (3) of III, often the most powerful part of an Elliott Wave sequence.

The invalidation level for this bullish structure stands at $3.52, the 2016 low where wave (II) ended. As long as FCX remains above that level, the right side of the market stays bullish. Additionally, rising global demand for copper, driven by electrification and renewable energy, supports the long-term outlook.

From an Elliott Wave perspective, wave (3) could extend to new highs and beyond the $60–$65 zone in the coming years. The stock is positioned well for potential gains if the bullish momentum continues.

Summary

In summary, Freeport-McMoRan (FCX) maintains a strong bullish structure above $3.52. Traders and investors may continue to favor the upside as the commodity supercycle and copper demand expansion remain supportive.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com