Forex Today: The BoJ is widely anticipated to keep rates unchanged

Renewed buying interest prompted the US Dollar to add to Tuesday’s gains, always on the back of alleviating concerns over US-China trade effervescence and investors’ assessment of weaker-than-expected US data releases. Most markets will be closed on May 1 due to the Labour Day holiday.

Here is what you need to know on Thursday, May 1:

The US Dollar Index (DXY) advanced further and reached two-day highs in the 99.60-99.70 band amid mixed yields and following poor US data releases. The usual weekly Initial Jobless Claims are due, seconded by Challenger Job Cuts, the final S&P Global Manufacturing PMI, the ISM Manufacturing Index, and Construction Spending.

EUR/USD added to the weekly leg lower and retested the ow-1.1300s in response to the Dollar’s firm tone. The final HCOB Manufacturing PMI for both Germany and the euro bloc is next on tap along with the preliminary Inflation Rate and the Unemployment Rate in the euro bloc.

GBP/USD dropped to two-day troughs near the 1.3300 neighbourhood along with the widespread pullback in the risk complex on Wednesday. Next on the UK calendar will be Mortgage Approvals, Mortgage Lending, the final S&P Global Manufacturing PMI, and the BoE’s M4 Money Supply and Consumer Credit figures.

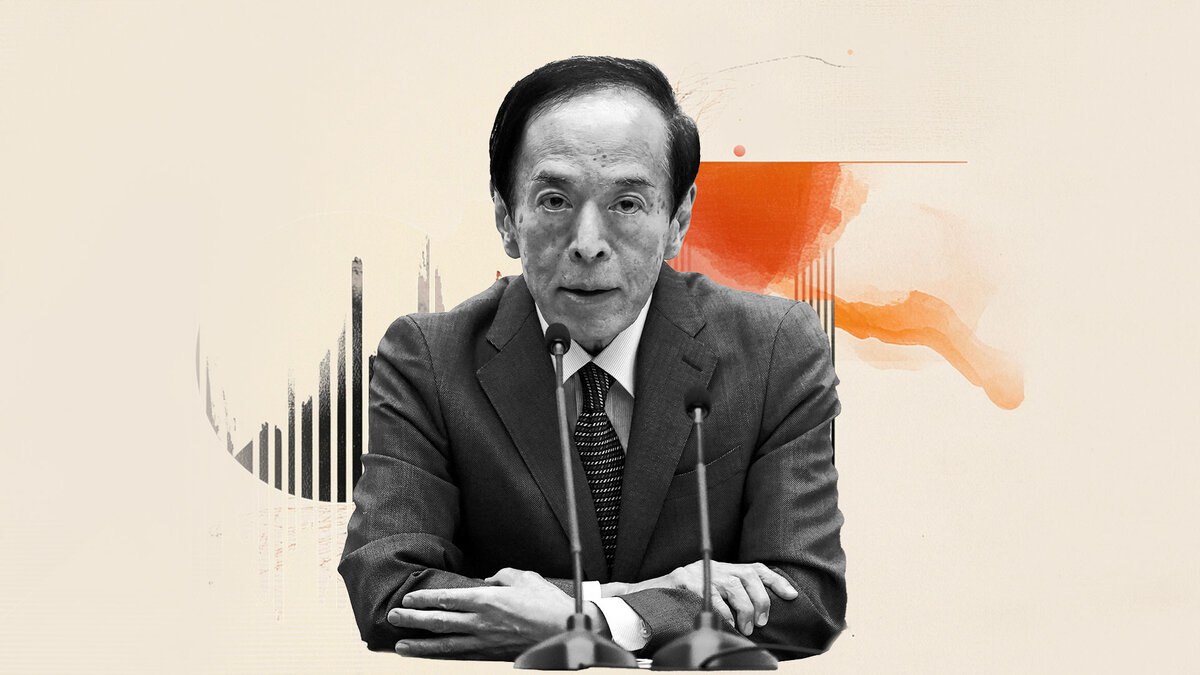

USD/JPY rose past the 143.00 hurdle and reached two-day highs on the back of further loss of momentum in the Japanese Yen. The BoJ is expected to keep its interest rate unchanged, followed by the final Jibun Bank Manufacturing PMI and the Consumer Confidence survey.

AUD/USD has embarked on a consolidative range around the 0.6400 zone, always closely following US-China trade developments. Attention is expected to shift to the release of the final S&P Global Manufacturing PMI, Balance of Trade data, Commodity Prices, and Q1 Import and Export Prices.

Prices of WTI sold off to the $58.00 region per barrel on the back of prospects of supply boost and despite a larger-than-expected drop in the weekly US inventories, as reported by the EIA.

Gold prices retested the $3,270 area once again on Wednesday, adding to the previous day’s pullback following the stronger US Dollar and mitigating trade concerns. Silver prices also traded on the back foot, adding to Tuesday’s drop and hitting multi-day lows near the $32.00 mark per ounce.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.