Fed's Bullard: Could raise interest rates as soon as March

St. Louis Fed President James Bullard said on Thursday that the Federal Reserve could raise interest rates as soon as March.

The official, known as an uber hawk and aligned with the market sentiment, explained that the Fed is now in a "good position" to take even more aggressive steps against inflation, as needed after a policy reset last month.

How comments follow yesterday's hawkish minutes and the spike in US yields and the greenback as a consequence.

In December, the Fed agreed to end its asset purchases in March and laid the groundwork for the start of rate increases that all policymakers, even the most dovish, now feel will be appropriate in 2022.

Today, Bullard explained that the Fed "is in good position to take additional steps as necessary to control inflation, including allowing passive balance sheet runoff, increasing the policy rate, and adjusting the timing and pace of subsequent policy rate increases," Bullard said in prepared remarks to the CFA Society of St. Louis.

''Subsequent rate increases during 2022 could be pulled forward or pushed back depending on inflation developments," Bullard said.

The tone reinforces the idea that an initial rate increase could be approved "as early as the March meeting.

Reuters explained in a note following Bullard's comments that ''projections issued in December showed half of the Fed policymakers expect three quarter-percentage-point rate increases will be needed this year.''

''Inflation is now running at more than twice the Fed's 2% target, and Bullard said that the inflation 'shock' experienced by the country means the central bank should be able to satisfy its inflation targeting goals now for several years to come.''

Covid will not throw Fed of course

Additionally, Bullard said he did not think the current wave of cases would throw the US economy or the Fed off course.

He explained that Infections in the United States "are projected to follow the pattern where the variant was first identified," while citing projections that daily case counts may peak late this month.

Key notes

St. Louis Fed's Bullard says the first interest rate hike could come in March.

Bullard says the Fed is now in a 'good position' to address inflation with rate increases, balance sheet runoff if needed.

Bullard says expects omicron infections to peak late this month, following a path similar to that seen in South Africa.

Bullard says the recent inflation shock means Fed's average 2% target should be met for next several years.

Bullard says focus on returning US labour force participation to pre-pandemic levels ignores trend decline.

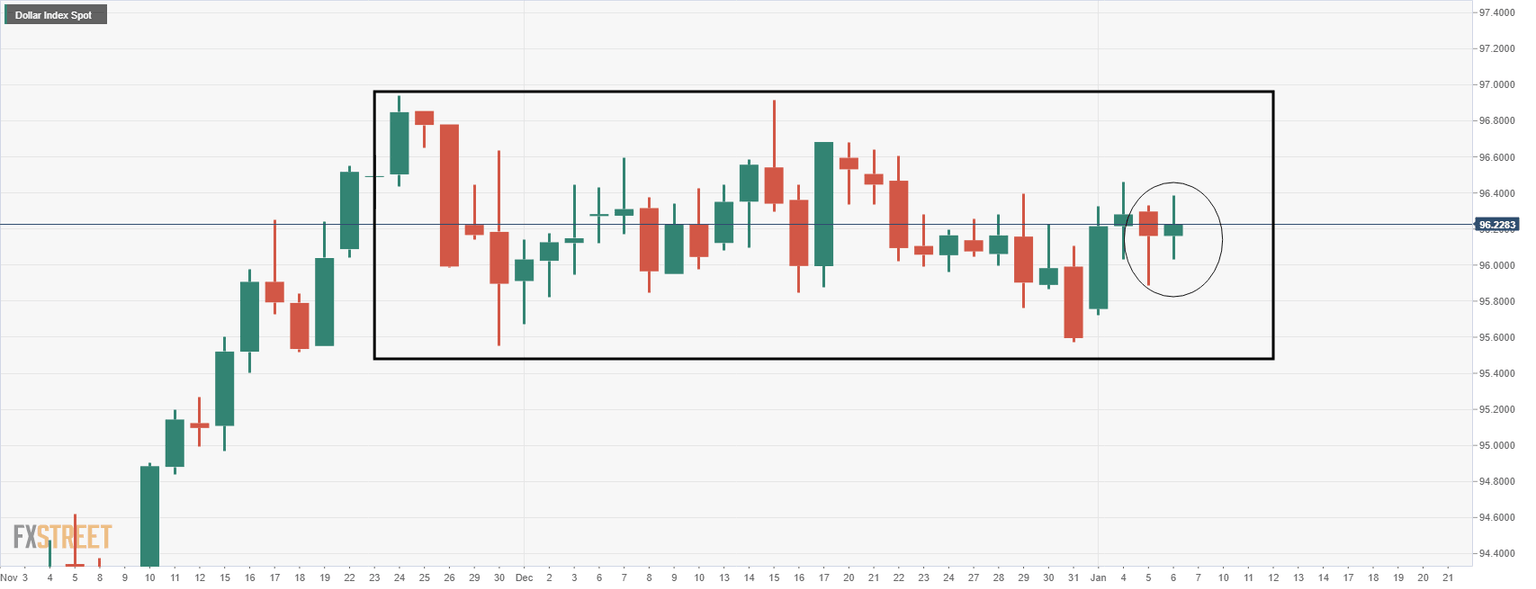

US dollar remains in a familiar consolidated range

Despite the hawkishness, the greenback remains in the familiar consolidation on the daily chart.

However, if this is a phase of reaccumulation, then 98 the figure and then 99 the figure would be expected to be revisited in due course:

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.