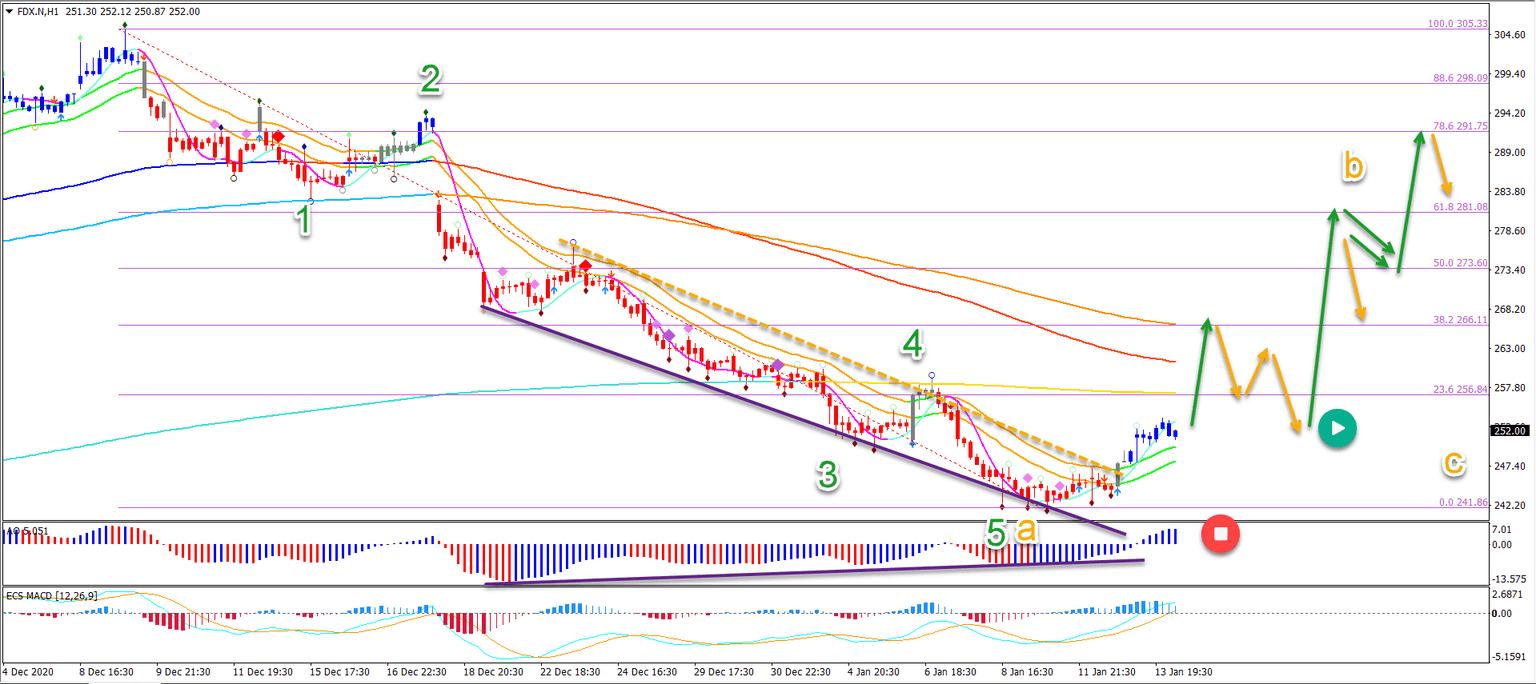

FedEx (FDX Stock) aims for +20% target despite strong decline

-

FedEx Corporation (FDX) has recently retraced to and bounced at the 38.2% Fibonacci retracement level.

-

This analysis reviews the potential wave and chart patterns connected to a 38.2% Fib bounce. We also pinpoint the best target for the upcoming few trading week.

Price Charts and Technical Analysis

The FDX daily chart has retraced down to the 38.2% Fibonacci and 144 ema zone. But the overall trend is strongly up. We can see this simply by adding long-term moving averages (blue box).

The quick pace of the decline, however, does indicate that the retracement is likely to be lengthy or deeper than usual for a wave 4 (grey). Here is what to expect, starting with the most likely:

-

An ABCDE triangle chart pattern (as shown in the image).

-

An ABC bull flag pattern.

-

An ABC zigzag pattern.

Although price action made a strong decline, a bullish bounce back towards the deep Fibonacci levels and previous top is likely to occur within a wave B (orange). The main target zone is therefore around $292-$305 for the short-term.

At the moment, a bearish bounce is expected at the target zone to create a wave C (orange). Eventually a new high is expected at around $350 once the triangle is completed (blue arrow).

On the 1 hour chart, we already see blue Elliott Wave candles emerge. This is indicating the potential start of the bullish run in wave B (orange).

The first target is the 38.2% Fib zone and long-term moving averages. Here we expect a bounce down and a higher low before a new bullish swing up again.

The analysis has been done with the ecs.SWAT method and ebook.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Chris Svorcik

Elite CurrenSea

Experience Chris Svorcik has co-founded Elite CurrenSea in 2014 together with Nenad Kerkez, aka Tarantula FX. Chris is a technical analyst, wave analyst, trader, writer, educator, webinar speaker, and seminar speaker of the financial markets.