FCOJ: Frozen concentrated orange juice is bullish

In the previous articles from March and November 2021, we have discussed the price action and the outlook for the Frozen Concentrated Orange Juice. As it has been expected, the soft commodities have advanced. In particular, we saw commodities like coffee, cocoa, cotton and sugar extending higher. Hereby, orange juice futures OJ #F have rallied as well. Now, we see a higher high in Weekly view confirming our bullish view. Short-term pullbacks should and will happen providing an opportunity both for investors and traders.

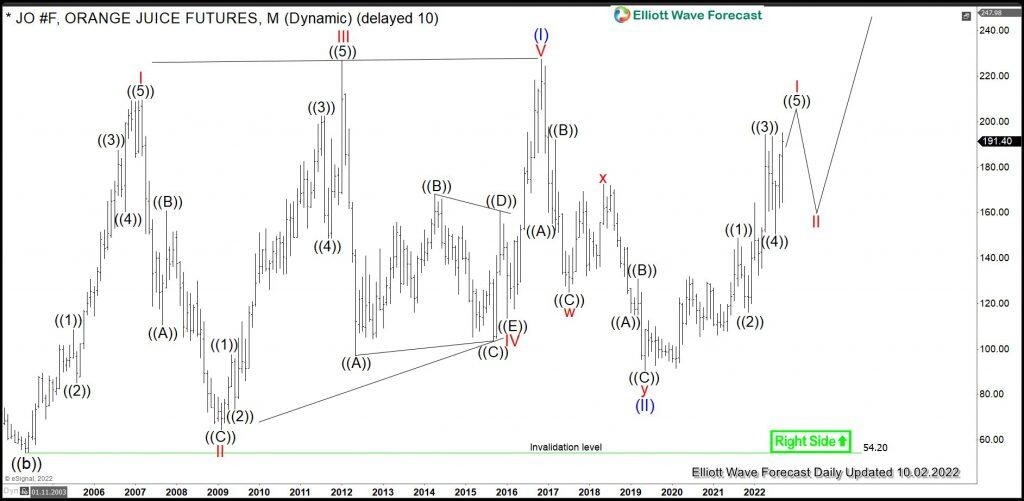

Orange juice monthly Elliott Wave analysis 10.02.2022

The monthly chart below shows the FCOJ front contract OJ #F at NYBOT (e-Signal ticker: JO). From the important low in May 2004, the prices have developed a cycle higher in blue wave (I) of a super cycle degree. Hereby, wave (I) has demonstrated a leading diagonal pattern and has ended in October 2016 at 227.50. From the all-time highs, a correction lower in wave (II) has unfolded as an Elliott Wave double three pattern. In 2.5 years, OJ #F has become cheaper by 60% reaching 90.60 level. It is the preferred view that an important bottom in May 2019 has been set and the correction has ended. From the lows, a new rally in prices within blue wave (III) may have already started. For 2023-2030, the expectations are to break to the new all-time highs. The target for wave (III) will be 264.00-371.20 area. From current levels, the orange juice can, therefore, double in price.

Orange juice weekly Elliott Wave analysis 10.02.2022

The weekly chart below shows in more detail the decline lower in wave (II) and the initial cycle within red wave I of the blue wave (III). From the 90.60 lows, we see the advance higher as a leading diagonal in wave I demonstrating a 3-3-3-3-3 structure. Recently, we saw a new high with a divergence. As a matter of fact, divergence does not mean that it should pullback. Orange juice can accelerate higher. Correlation with the entire market tells, however, that a pullback should happen. It can correct the cycle from May 2019 lows in 3, 7, 11 swings before upside resumes.

Investors and traders can be, therefore, looking to buy FCOJ in a pullback against 90.60 low targeting 264.00-371.20 area in medium to long term time perspective.

Author

Elliott Wave Forecast Team

ElliottWave-Forecast.com