FB Stock News: Meta Platforms Inc soars as Instagram adds NFTs to site

- NASDAQ:FB gained 6.04% during Wednesday’s trading session.

- CEO Mark Zuckerberg announces Instagram will be adding NFTs to its platform.

- Ex-Meta staff have created a crypto unicorn after receiving more funding.

NASDAQ:FB had its best session in weeks, as the beaten-down tech giant continues to roll out new content on its platforms. Shares of FB jumped by 6.04% and closed the trading day at $203.63. On Wednesday, stocks rallied for the second straight session ahead of the Federal Reserve announcing its first interest rate hike since 2018. Big tech stocks surged as the NASDAQ index jumped by 3.77%, while the S&P 500 gained 2.24% during the session. The Dow Jones also continued to rebound as the blue-chip index added back a further 518 basis points, as crude oil futures fell for a third straight session.

Stay up to speed with hot stocks' news!

CEO Mark Zuckerberg made a big announcement at the SXSW festival in Austin, Texas. Zuck announced that the Instagram platform will be adding NFTs for users to both mint and sell in the near future. The move comes as Meta Platforms gears up for the Metaverse and the transition to Web3.0, where artists and content creators can earn payment via things like NFTs. This has the potential to further boost Instagram’s eCommerce segment and will continue to support independent entrepreneurs in making a living off of the platform.

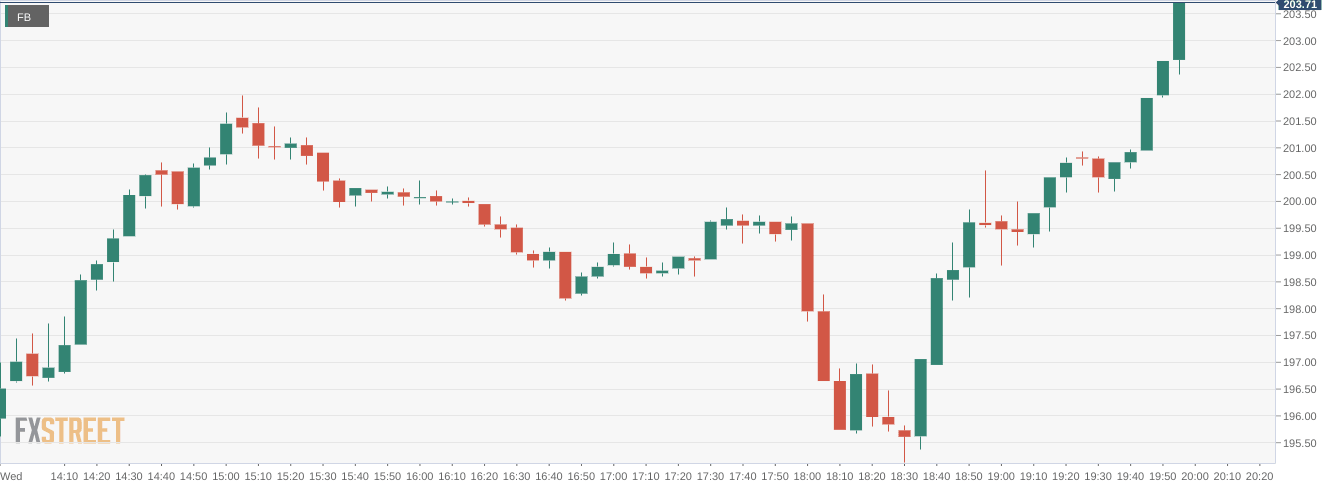

Facebook stock price

In other blockchain-related news, ex-Meta employees which created the crypto project, Aptos, received over $200 million in funding in the latest round, and are now valued at over $1 billion. The group left Meta after working on its Diem project, and are now working towards providing a scalable solution that will eliminate high gas fees like the ones that are seen on the Ethereum network.

Like this article? Help us with some feedback by answering this survey:

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet