Exxon Mobil (XOM Stock) gets closer to the 50 mark

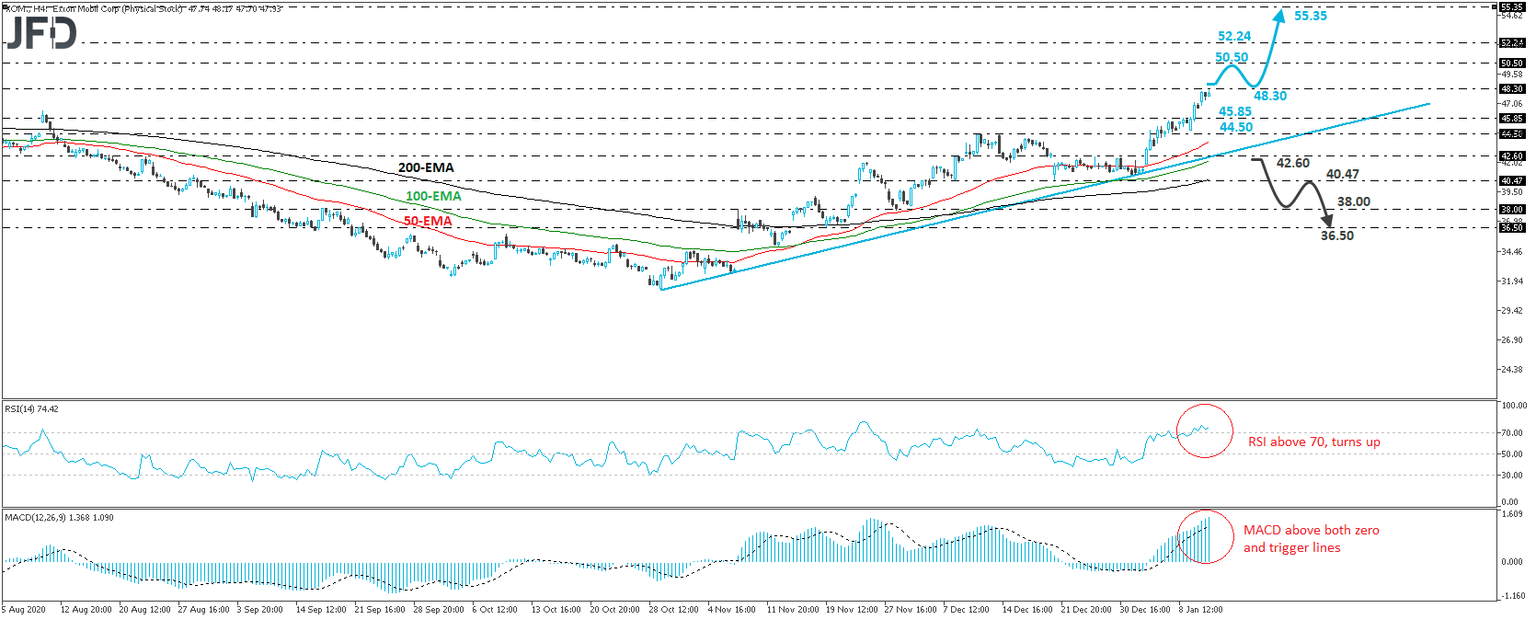

The Exxon Mobil Corp stock (NYSE: XOM) has been in a rally mode since January 5th, after hitting support on January 4th near the upside support line drawn from the low of October 29th. As long as the share continues to trade above that upside line, we would consider the near-term outlook to be positive.

Yesterday, the stock continued marching north, hitting resistance fractionally below the 48.30 barrier, which is marked by the high of June 19th. A break higher may carry more bullish implications and perhaps target the low of June 10th, at around 50.50, or even the 52.24 area, marked by an intraday swing high formed on the same day. If neither hurdle is able to halt the advance, then investors may put the 55.35 territory on their radars. That zone is defined as a resistance by the high of June 8th.

Shifting attention to our short-term oscillators, we see that the RSI, already above 70, has turned up again, while the MACD lies above both its zero and trigger lines, pointing up as well. Both indicators detect strong upside speed and corroborate our view for further advances in this stock.

In order to abandon the bullish case and start examining decent declines, we would like to see a clear dip below 42.60. This would also take the price below the aforementioned upside line and may initially target the 40.47 level, marked by the low of December 21st. Another break, below 40.47, may extent the slide towards the low of November 30th, at 38.00, or even the low of November 19th, at 36.50.

JFDBANK.com - One-stop Multi-asset Experience for Trading and Investment Services

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

JFD Team

JFD