EUR/USD slumps as French political turmoil weighs on Euro

- Euro weakens after French PM’s resignation fuels fiscal instability fears.

- US Dollar rebounds as investors eye shutdown uncertainty and higher inflation expectations from NY Fed survey.

- Fed’s Kashkari warns of stagflation risks, while Miran highlights weaker growth and urges a forward-looking policy stance.

EUR/USD falls on Tuesday amid the political turmoil in France along with the US government shutdown. The Dollar which previously depreciated is posting a surprising recovery up 0.52% in the day, according to the US Dollar Index (DXY). The pair trades at 1.1654, down 0.46%.

Shared currency retreats below 1.17 as France’s budget crisis, renewed Fed hawkishness

The situation in France has kept the Euro from clearing key resistance levels and aim towards the yearly peak of 1.1918. The resignation of France’s Prime Minister Lecom puts the country’s 2026 fiscal budge tin danger, as difficulties amongst politics prevented France from stabilizing its public finances.

If there is no budget, the French assembly could pass a special law that allows the government to rollover spending from 2025, avoiding a shutdown like the one in the United States. Nevertheless, the law is “transitory” as the assembly needs to approve a budget.

In the meantime, the US economic docket features the NY Fed Survey of Consumer Expectations (SCE), which showed that consumers expect higher prices for a one-year period. Recently, the RealClearMarkets/TIPP Economic Optimism Index dipped in October

Fed’s Kashkari flags stagflation risks, Miran urges forward-looking policy

Minneapolis Fed President Neel Kashkari was moderately hawkish as he said it is too early to determine whether tariffs will make inflation sticky. He added that recent data show signs of stagflation, though he remains optimistic about the labor market.

Fed Governor Stephen Miran noted that economic growth in the first half of the year was weaker than expected and stressed that monetary policy should remain forward-looking, given the lagged effects of prior tightening.

Data in the Eurozone featured Germany’s Factory Orders, which despite improving, contractd in August, revealed the Deustche Bundesbank.

Daily digest market movers: Broad US Dollar strength weighs on the Euro

- Minneapolis Fed President Kashkari also cautioned that he’s unconvinced a few rate cuts would significantly lower mortgage rates, warning that if they did, the economy could face a burst of high inflation.

- The New York Fed SCE showed that the median inflation expectations for one year increased from 3.2% to 3.4% and for a five-year period from 2.9% to 3%. For a three-year horizon, it remained steady at 3%.

- The same survey revealed that earnings growth expectations fell by 0.1% to 2.4%.

- The RCB/TIPP Economic Optimism Index slipped from 48.7 in September to 48.3, a modest 0.4-point (0.8%) decline. This marks the second consecutive month the index has remained below the neutral 50 benchmark, signaling continued pessimism.

- Money markets indicate that the Fed will cut interest rates by 25 basis points (bps) at the upcoming October 29 meeting. The odds stand at 94%, according to the Prime Market Terminal interest rate probability tool.

- European Central Bank President Christine Lagarde said that she hopes France will produce a budget in time. She added that the Euro should play a greater global role. She argued that the Euro Area acts as an “innocent bystander,” exposed to economic and financial shocks originating from Washington.

- German Factory Orders in August plunged to -0.8% MoM, better than July’s -2.7% contraction but missed estimates for a 0.2% expansion. On a yearly basis, orders rose from -3.3% to 1.5% YoY for the same period.

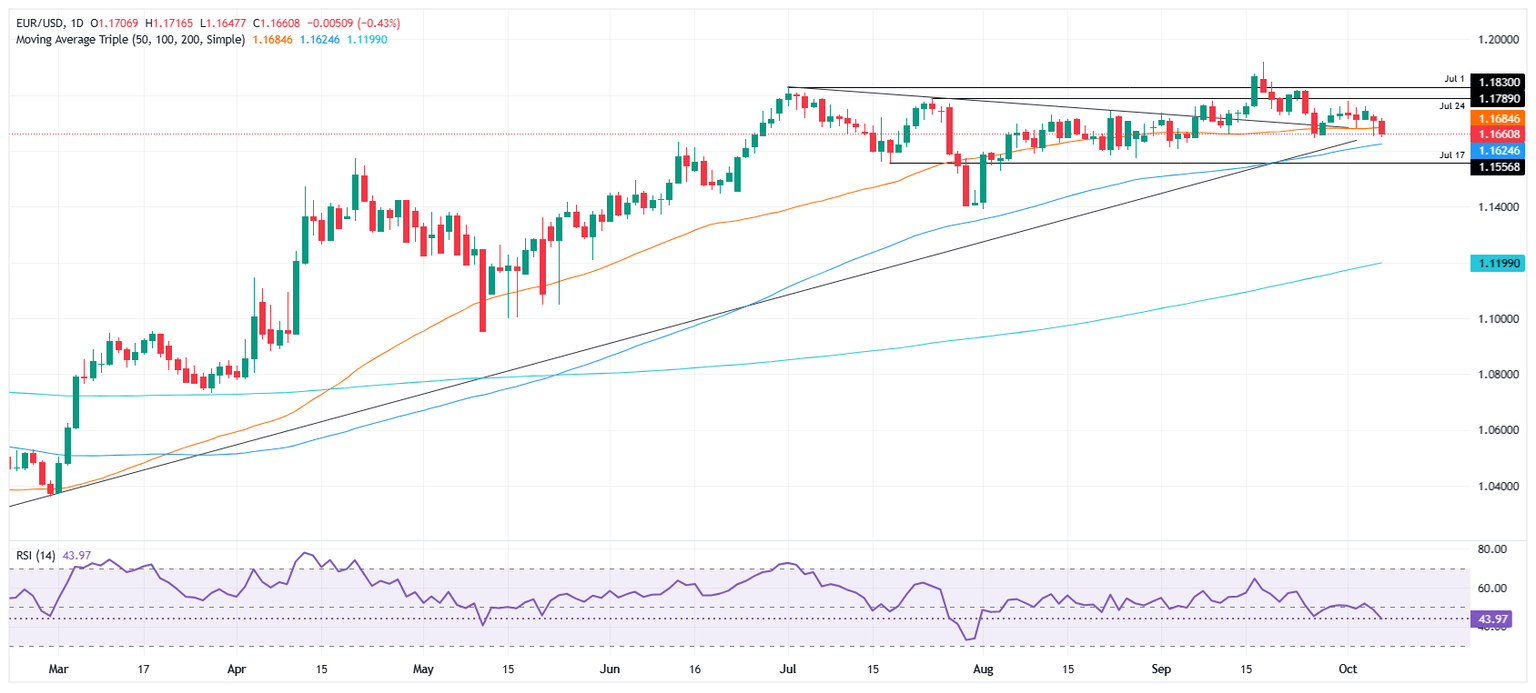

Technical outlook: EUR/USD tumbles below 1.1700

EUR/USD ended Tuesday’s session below the 1.1700 figure, which has opened the door for further downside. The Relative Strength Index (RSI) shows that sellers are in charge, as it turned bearish.

Therefore, the EUR/USD first support would be the 100-day Simple Moving Average (SMA) at 1.1628. If surpassed, the next demand zone would be 1.1600, ahead of extending losses towards 1.1574, the August 27 swing low. Below this, the August 1 cycle low at 1.1391 would be up next.

Conversely, the EUR/USD first resistance would be 1.1700. The next key resistance areas would be 1.1760, 1.1800 and the July 1 high of 1.1830.

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.