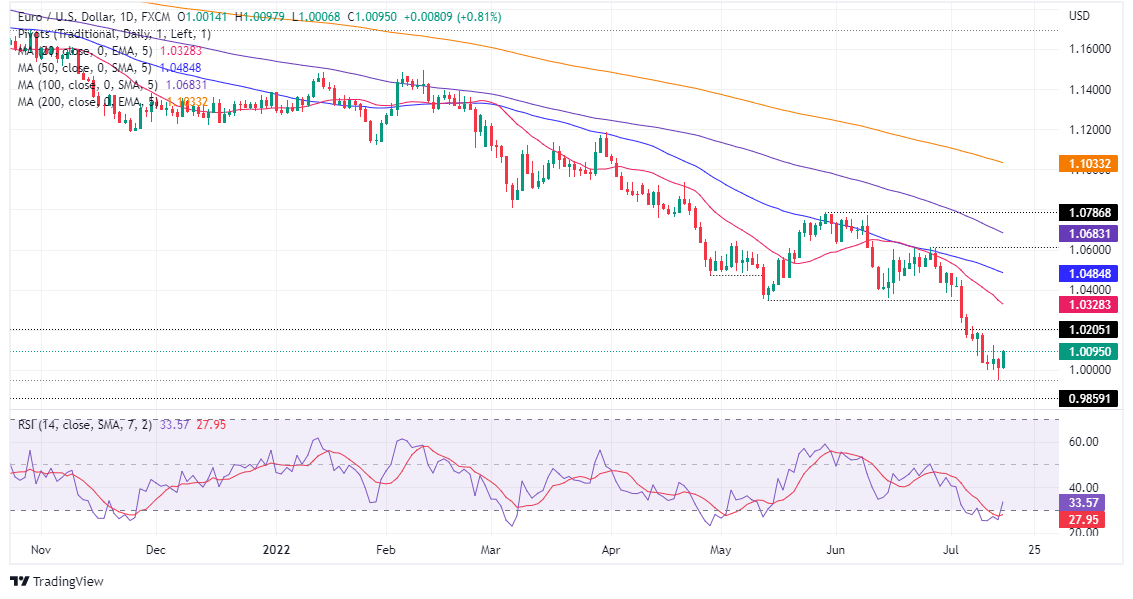

EURUSD buyers take a breather after upbeat US data, eyeing 1.0100

- EURUSD trades above 1.0060 and trims its weekly losses, down 1.03% in the week.

- US Retail Sales and UoM Consumer sentiment exceed estimations, easing prospects of a 100 bps Fed hike.

- Interest rate differentials between the Fed and the ECB boost the EURUSD fall.

EURUSD buyers stepped in vigorously, defending the euro from falling below parity, with the major trading above the July 14 high 1.0058, though before dipped towards 1.0006, at the brink of the €1/$1 mark, but bounced off daily lows, and climbed towards current price levels. At the time of writing, the EURUSD is trading at 1.0095.

The financial markets narrative remains unchanged. Worries of higher inflation, central banks tightening, and recession jitters linger on investors’ minds. Nevertheless, global equities edge up in positive US economic data related to consumers, which would further cement the Fed’s case for a 75 bps hike. That said, the EURUSD will be at the mercy of interest rate differentials between the ECB and the Fed, which could favor the shared currency. However, the greenback recoils 0.52%, as shown by the US Dollar Index falling towards 108.070, a tailwind for the euro.

Also read: EUR/USD Forecast: Euro remains vulnerable despite reclaiming parity

US Inflation remains high

US Retail sales and UoM Consumer sentiment beat forecasts.

In the meantime, upbeat economic data give traders a respite, but not to USD buyers, which are booking profits ahead of the weekend. The US Department of Commerce reported that US Retail Sales rose by 1% YoY, exceeding expectations of 0.8%, and also left behind May’s dismal reading of -0.3%. Of late, the University of Michigan Consumer Sentiment came better than expected, with the index toping 51.1 vs. 49.9 estimated. The positive in the report is that inflation expectations tempered, with consumers seeing inflation at 2.8% over a 5-year horizon, lower than 3.1% in June. Although data is positive, that could boost the EURUSD because the data may ease Fed officials from hiking more than 75 bps.

US inflation remains high; additional Fed hikes ahead

Given that US inflation readings in the week remained higher, with the CPI and the PPI hitting 9.1% and 11.3% in year-over-year readings, EURUSD traders need to be aware of that. Further rate hikes from the Fed are expected, with money market futures STIRs portraying the Federal funds rate (FFR) at 3.55% by December, meaning that market participants expect at least 225 bps of tightening by the year’s end. Consequently, this would be a headwind for the EURUSD, despite the ECB’s guidance that it would begin raising rates for the first time in 11 years.

Fed speakers began to be vocal about rate hikes and emphasized that inflation is high

Elsewhere, Fed speakers have been entertaining EURUSD traders throughout the week. On Friday, the St. Louis Fed President James Bullard said it would not make any difference to hike 100 or 75 bps while adding that the pace could be adjusted for the rest of the year. Earlier in the week, Atlanta’s Fed President Raphael Bostic said everything is in play when asked about raising rates 100 bps in the July meeting. Later, the Cleveland Fed President Loretta Mester said they don’t need to decide on rates today but emphasized that inflation is “too high,” and the CPI report was uniformly negative. In the meantime, backing 75 bps is San Francisco’s Fed Mary Daly, but she also said that 100 bps is within the range of possibilities.

Recession fears remain as the US 2s-10s yield curve remains inverted

The US 2s-10-yield curve is still inverted for nine consecutive days, though less profound than in previous days- At the time of writing, the spread reduced to -0.189%, as traders’ fears about recession easied a tone. However, unless Fed officials express worries about economic growth, that would not deter them from aggressive tightening, which is negative news for EURUSD longs in the future.

ECB vs. Fed differentials, a headwind for the EURUSD

In July, both banks, the ECB and the Federal Reserve will host their monetary policy meetings. Currently, the ECB’s deposit rate lies at minus 0.50%, while the US Federal Reserve’s Federal funds rate (FFR) is at 1.75%, bolstering the appetite for the greenback. With expectations of the ECB hiking 25 bps and the Fed to move at least by 75 bps, differentials would widen further, to -0.25% (ECB) vs. 2.50% (Fed), meaning that the greenback would keep the upper hand, opening the door for further selling pressure on the EURUSD.

EURUSD Price Technical outlook

EURUSD remains heavy, as shown by the daily chart, with the daily moving averages (DMAs) residing well above the exchange rate. Wednesday’s correction offered EURUSD shorts a better entry price after hitting a daily high around 1.0122, but on Thursday, the major extended its losses, pushing below the parity. However, on Friday, the EURUSD buyers stepped in and kept the price above the July 14 high of 1.0058, meaning that achieving a daily close above it might open the door for a correction.

In the near term, the EURUSD is headed upwards. That said, the major’s first resistance would be 1.0100. Break above will expose the July 13 high at 1.0122, followed by July 11 daily high at 1.0183.

On the flip side, the EURUSD first support would be 1.0000. A breach of the latter will expose the fresh 20-year low at 0.9952. Once cleared, EURUSD sellers’ next challenge will be December 2002 lows around 0.9859.

EURUSD: Weekly forex analysis video: EUR/USD, GBP/USD, AUD/USD and more [Video]

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.